Farmland prices among the reasons for the move

By Diego Flammini

Assistant Editor, North American Content

Farms.com

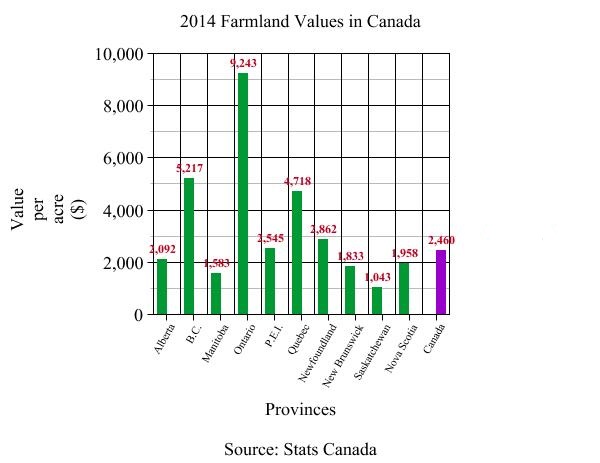

According to some Amish families, Ontario farmland is too expensive and is a main factor in their decision to move to Prince Edward Island.

Brad Oliver, a realtor based in Montague, Prince Edward Island, told CTV News that some of the families are on Ontario farmland that can be worth more than $20,000 per acre. Conversely, some farmland in P.E.I. is worth about $2,000 to $3,000 per acre.

Oliver said it’s easier to make those prices work when farmers own the land, but the next generation of farmers are looking to buy farms and may not be able to afford it.

Tony Wallbank’s is among the nearly 10 families making the moves to the east coast.

He began looking for new opportunities in Ontario’s north and in the United States but found land prices were too expensive or the land itself was unusable.

Wallbank visited P.E.I. in 2014 and was encouraged by the sight of fields and landowners who used traditional methods to produce crops.

Some families will make their new homes in P.E.I. in March, while some others will wait until June when the school year is done.

Oliver said towards the end of May, people could see some farmers using horse-drawn equipment to perform farming duties.

According to a 2014 report by Farm Credit Canada, farmland values in the country increased by about 14.3 per cent in 2014.