Groups say Canada’s actions are in violation of NAFTA

By Diego Flammini

Assistant Editor, North American Content

Farms.com

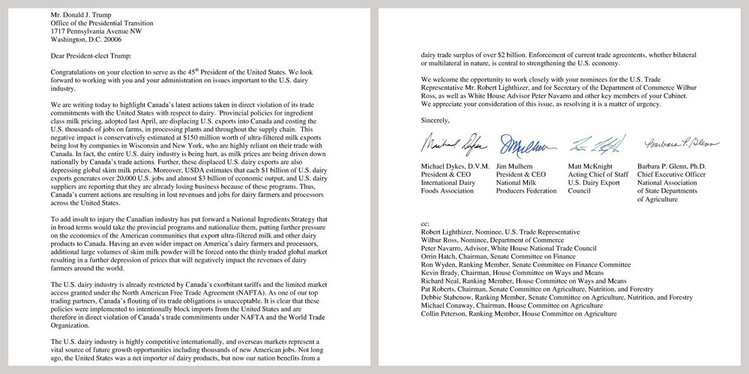

The International Dairy Foods Association, National Milk Producers Federation, U.S. Dairy Export Council and National Association of State Departments of Agriculture wrote a letter to President-elect Donald Trump urging him to address dairy trade with Canada.

Last April, Dairy Farmers of Ontario implemented a strategy to create a new milk ingedient class, allowing Canadian ingredients to be more competitive domestically.

The letter to Trump suggests it’s costing companies in New York and Wisconsin about $150 million and that jobs are being lost on farms and in processing plants.

“In fact, the entire U.S. dairy industry is being hurt, as milk prices are being driven down nationally by Canada’s trade actions,” the letter says.

The groups say if Canada adopts a national ingredients strategy it could hurt the American dairy industry further and be in violation of NAFTA.

“The U.S. dairy industry is already restricted by Canada’s exorbitant tariffs and the limited market access granted under the North American Free Trade Agreement (NAFTA),” the letter said. “As one of our top trading partners, Canada’s flouting of its trade obligations is unacceptable.

“It is clear that these policies were implemented to intentionally block imports from the United States and are therefore in direct violation of Canada’s trade commitments under NAFTA and the World Trade Organization.”

In an email to Farms.com, Dairy Farmers of Canada said it continues to monitor the situation.

"We remain confident that our government supports the Canadian dairy sector," the email said. "The dairy ingredients strategy is a Canadian domestic initiative that is part of an effort by the sector to continuously respond to a changing market environment. Of course, the food processing industry in Canada will continue to be able to source its inputs domestically or through imports."