Bad news for North American farmers who had hoped that adverse weather would lead to reduced global crop yields and increased prices

By Devin Lashley

Farms.com Risk Management Intern

Photo Credit: Nutrien Ag Solutions

The summer of 2024 has been a rollercoaster for farmers worldwide, with the fear of disastrous weather events looming over the agricultural sector. However, as the season progresses, it has become evident that these anticipated weather-related catastrophes have largely failed to materialize or significantly impact crop yields.

This realization brings some bad news to North American farmers, who had hoped that adverse weather would lead to reduced global crop yields, thereby raising prices and boosting their profits.

In April/May U.S. wheat futures jumped 30 percent as there were worries that 2010 was going to repeat with the Russian wheat crop that fell over 30 percent followed by a wheat export ban, but that worst case scenario never unfolded, and prices came back down to earth.

The rally in wheat futures spilled over into higher grain prices overall, causing shorts to be chased out for a moment, but the funds never went long which is very rare for the month of June. The highs typically do not happen in May, 2024 has become an outlier and was the high thus far this year.

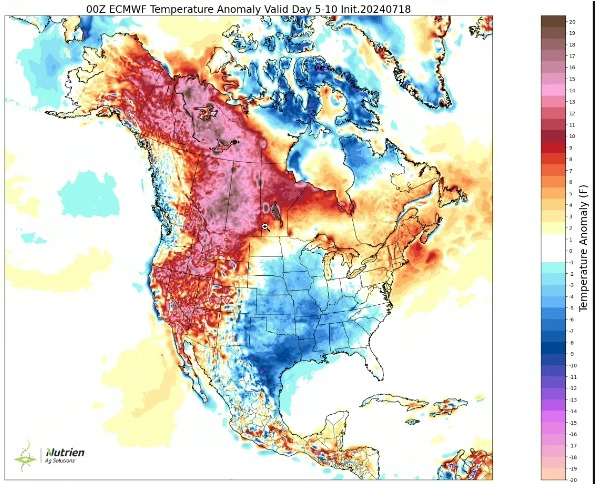

Weather forecasters were calling for a “heat dome” to occur over the U.S. midwest in early July, coinciding with the critical pollination period for 50 percent of the U.S. corn crop, but they kept pushing it out. This heat dome has yet to materialize but the forecasters are still calling for a dry period for the 1st half of August.

The heat was concentrated in the east and southeast where crops were burning up, but in U.S. states like Texas, Oklahoma and Georgia, where only 2.2 million corn and 2.7 million soybeans are grown, it is too small to matter in the grand picture. Talk of records crop in Illinoi and Indiana will more than offset these smaller producing states.

Then came Hurricane Beryl that added to this year's weather narrative. The hurricane brought much-needed timely rains to the drier eastern parts of the U.S. midwest while avoiding the already oversaturated western regions. This balance allowed the previously wet areas to dry out and provided near-perfect growing conditions for crops in the heart of the U.S. Corn Belt. The moisture only added to a favorable growing environment as “rain makes grain.”

In China, droughts that were expected to severely reduce yields are also beginning to abate. Forecasted rains are anticipated to mitigate the drought conditions, thereby preserving Chinese crop yields and possibly reducing their projected imports. This reduction in demand for crops from other countries is expected to help keep global prices low. Additionally, the southern parts of China, previously plagued by flooding, are now experiencing a respite, further stabilizing the situation.

Currently, there are no significant weather forecasts indicating potential yield reductions that could impact the global marketplace and provide farmers the opportunity to sell their crops at higher prices. The only notable concern is the dryness in Russia's southern growing regions. However, this issue is not expected to cause significant market disruptions, at least in the short term.

As a result, corn, soy, and wheat prices continue to face downward pressure with little indication of an imminent change. This persistent decline in crop prices has left many farmers in a difficult financial position, with the hope for a market rebound becoming increasingly distant.

For the most part the summer 2024 weather scare appears to be over but there is a late weather scare in the Western Canadian Prairies with heat stress showing up in the next 7-14 days that will stress crops and its coverage is wide. Reports of late planted canola flowering into the heat and it can be more sensitive than wheat a dryland crop.

With the funds record short any corrective short covering rally as we chase some shorts out will be magnified in both canola and spring wheat futures and provide farmers one last opportunity to hedge 2024 bushels at higher prices. Weather headlines do not have the same impact anymore like they did 8 years ago, and any future rallies tend to fizzle out quicker because of larger ending stocks.

For daily information and updates on agriculture commodity marketing and price risk management for North American farmers, producers, and agribusiness visit the Farms.com Risk Management Website to subscribe to the program.