U.S. and Canadian reports show differences in sales of tractors over 100hp

By Diego Flammini

Assistant Editor, North American Content

Farms.com

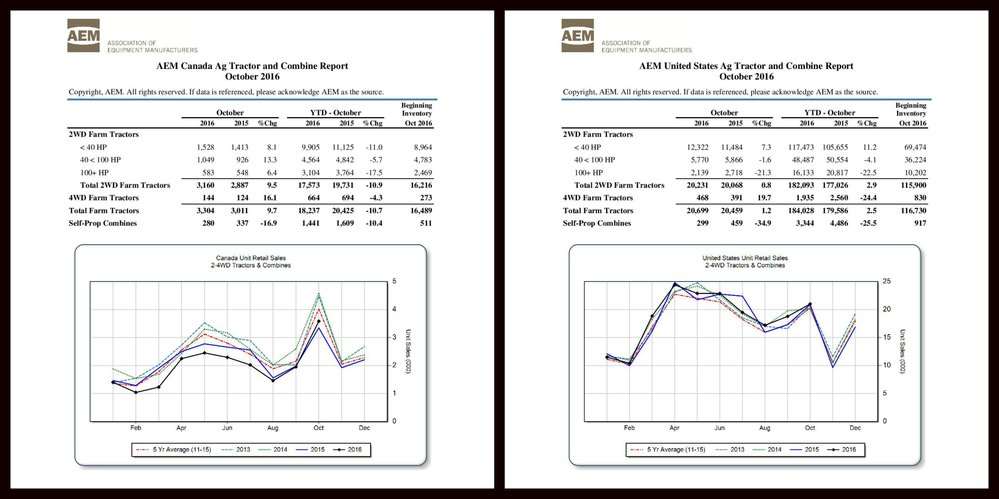

The Association of Equipment Manufacturers (AEM) released its October Ag Tractor and Combine Reports for Canada and the United States, and both reports show interesting trends among equipment sales.

In Canada, between October 2015 and 2016, sales of tractors between 40 and 100hp, as well as tractors with more than 100hp, experienced sales increases.

Tractors between 40 and 100hp saw the largest sales increase in the 2WD tractor category with a 13.3 per cent increase.

But 4WD tractors in Canada experienced an even higher increase of 16.1 per cent.

Total farm tractor sales in Canada saw a 9.7 per cent increase between October 2015 and 2016.

However, combines have not fared so well in the last year.

Between October 2015 and 2016, combine sales dropped by 16.9 per cent.

When compared to the Canadian market, American equipment seemed to follow a different pattern.

According to the AEM report, tractors in the 40 to 100hp range saw a 1.6 per cent decrease in sales in the past year.

Sales of tractors with 100hp or more suffered a 21.3 per cent decrease.

The sales of 4WD tractors in the United States saw nearly a 20 per cent increase in sales, but AEM says it probably isn’t an indicator of the overall market.

“While we saw a significant bump in the sales of 4WD farm tractors this month, the uptick is unlikely to signal a change in the overall trends. The increase in sales during the October period is quite seasonal and while this year was no exception, the 4WD tractor October numbers are still far below pre-downturn years,” Charlie O’Brien, AEM senior vice president, said in a release.

When including 2WD tractors, total tractor sales were up by 1.2 per cent.

Combine sales in the U.S dropped by nearly 35 per cent in the year.