Ontario and Saskatchewan appear to be the most expensive

By Diego Flammini

Assistant Editor, North American Content

Farms.com

With cold weather arriving in parts of Canada, farmers are turning up the heat in their barns to keep produce, livestock and other investments safe.

On Monday, Mucci Farms, greenhouse growers from Kingsville, Ont., said it’s looking to build a new greenhouse in Ohio because the hydro rates are much lower.

In Ontario, hydro can cost up to 18 cents per kilowatt hour, while in Ohio rates are as low as six cents per kilowatt, according to CBC.

"We are paying one of the highest rates in North America," grower Bert Mucci told CBC. "It's causing us to move out of Ontario right now."

Farms.com has compiled some hydro rates from many of Canada’s provinces.

British Columbia (Farm Rate)

Basic charge of $0.1957 per day.

Energy charge of $0.0993 per kWh (kilowatt hour).

5 per cent Rate Rider applied to all charges before taxes and levies. The Rate Rider covers additional and unpredictable energy costs resulting from things including low water inflows or higher-than-forecast market prices.

Saskatchewan (Farm Rate)

For farms with “normal household and agricultural use, up to and including 3,000 kVA."

Basic monthly charge of $32.61.

Demand charge of $0 for the first 50 kVA (kilovolt ampere), and $11.981 per kVA afterwards.

Energy charge of 11.803¢ for the first 16,000 kWh and 5.118¢ per kWh afterwards.

Alberta

Farmers in Alberta can choose from different companies.

Direct Energy Regulated Services – Farm rate of 3.880¢ per kWh as of November 2016.

ENMAX Energy Corporation – 3.8114¢ per kWh for residential and commercial use.

EPCOR Energy Alberta GP – 3.736¢ per kWh for residential and small commercial use.

EPCOR Energy Alberta GP (Fortis service area) – Farm rate of 3.709¢ per kWh.

On November 22, the Government of Alberta announced changes to hydro pricing. In June 2017, when the changes are implemented, Albertans can sign a contract to pay no more than 6.8¢ per kWh for four years.

Manitoba

Monthly basic charge (not exceeding 200 Amp) - $7.82.

Monthly basic charge (exceeding 200 Amp) - $15.64.

Energy charge of 7.930¢ kWh.

Ontario

For customers with Smart Meters, different rates apply at different times of the year. Ontario Hydro is currently in its Winter Rate.

7:00 a.m. to 11:00 a.m. – On peak rate of 18¢ per kWh

11:00 a.m. to 5:00 p.m. – Mid peak rate of 13.2¢ per kWh

5:00 p.m. To 7:00 p.m. – On peak rate of 18¢ per kWh

7:00 p.m. to 7:00 a.m., weekends and holidays – Off peak rate of 8.7¢ per kWh

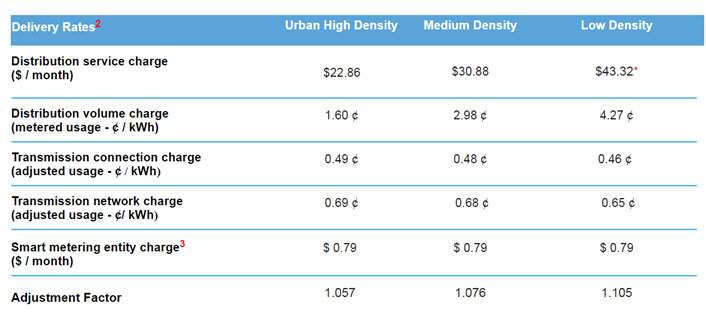

According to Hydro One, there appear to be three main residential delivery rates in Ontario:

Urban High Density - contains 3,000 io more customers, with at least 60 customers for every kilometer of power line used to supply energy to the zone.

Medium Density - contains 100 or more customers, with at least 15 customers for every kilometer of power line used to supply energy to the zone.

Low Density - the remaining area not covered by Urban or Medium Density areas.

Many farmers in Ontario fall under the low density delivery rate; and different delivery rates mean different charges.

Producers with farms as a primary residence can apply for a year-round residential rate.

Photo: Hydro One

Ontario NDP leader Andrea Horwath met with dairy farmers in Windsor at the beginning of November to address concerns.