Uncertainties in trade and hog supply may be the factors shaping the markets this year

By Jennifer Jackson

From a new U.S. president to record high production numbers, 2017 may be a memorable year for pork producers.

Factors such as trade uncertainties and consumer demands are all market drivers that pork producers should be aware of, says Abhinesh Gopal, commodity analyst for Farms.com Risk Management.

Farms.com had the opportunity to interview Gopal on his speculations for the 2017 hog markets.

Farms.com (Farms): What is happening now in terms of price for hogs/pork? What are production levels like currently?

Abhinesh Gopal (AG): The current U.S. scenario of huge hog supply at elevated prices is a very unusual combination which is being driven by strong domestic and export demands for pork. This demand momentum could continue further into 2017 but we may need to buy some time.

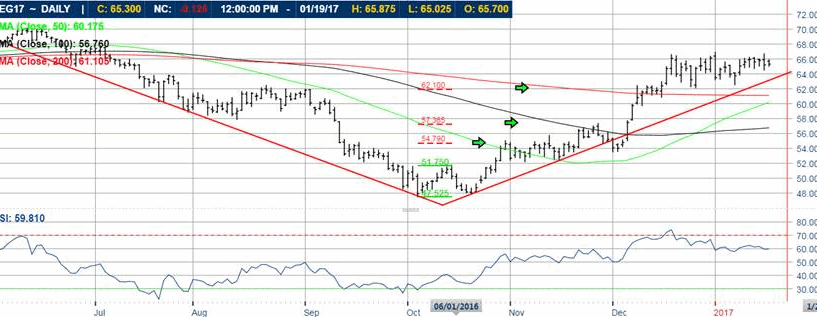

While hogs and pork production in the U.S. continues to expand, slaughter and pork consumption has expanded at an even faster pace since 2014 due to pork's relative attractiveness versus beef. The latest USDA estimate calls for a 5 per cent increase in U.S. pork production in 2017. But, lean hog futures have been able to climb that wall of worry, creating a V-shaped bottom (as seen in the following figure) in October 2016. (This trend is) due to better than expected U.S. domestic and export demands, which are expected to be even higher in 2017.

Source: www.qtmarketcenter.com

Farms: What can we perhaps expect to drive market changes?

AG: With the new Trump administration in the U.S., initial financial market euphoria since the Nov. 8, 2016 U.S. election day has given way to cautionary optimism and some nervousness. Thanks to the “Trump rally,” the U.S. stock market had added about US $ 1 billion to U.S. consumers’ balance sheets since then. This, coupled with higher incomes and wages, and good U.S. economic prospects, historically leads to consumers spending more money by eating more meat at restaurants.

The key in 2017 will be exports and higher domestic demand. Even with U.S. pork production reaching record levels, exports are accounting for a larger share. November 2016 export volume equated to 28 per cent of total production and 23 per cent for muscle cuts only – substantial increases over the November 2015 ratios of 24 per cent and 21 per cent. For January through November (2016), exports accounted for 25.5 per cent of total production and 21.4 per cent for muscle cuts – up from 24.2 per cent and 20.9 per cent, respectively, in 2015. If this trend continues in 2017, hog futures could outperform and surprise the market to the upside.

Farms: Is the outlook bearish or bullish for hog prices?

AG: We remain bullish on hog futures for 2017 but we may be ahead ourselves near-term. Producers may need to wait until the second quarter of 2017 to see solid gains in hog prices, as we may need to consolidate before moving higher.

In early-high years (like 2017) for hog futures, (prices) historically tend to peak early and this may last through end of January to mid-February. For hog producers, now is the time to start managing risk and think about placing hanging orders above the futures.

Farms: Are there any trade/international affairs that pork producers should be aware of?

AG: Keep an eye on Chinese exports (which nearly doubled in 2016) and the position of the new U.S. Trump administration on trade issues, and how (these factors) might impact agriculture.

Mexico became the number one destination for U.S. pork in 2015 and 2016 – trade relations with Mexico will need to be watched carefully for potential impacts on the hog market.

President Trump said this week that he will begin renegotiating the North American Free Trade Agreement (NAFTA) when he meets with the leaders of Canada and Mexico. A central promise of Trump's campaign was that he would revamp the 23-year-old trade pact.

Also, (President Trump) signed an order this week withdrawing from the Trans-Pacific Partnership, whose other members are Brunei, Chile, New Zealand, Singapore, Australia, Canada, Japan, Malaysia, Mexico, Peru and Vietnam.

A potential risk could be a trade war between China and the U.S. as President Trump looks to renegotiate the trade arrangement there as well. China does buy a lot of commodities from the US.

Farms: What does this all mean to producers on-farm – how will they see these changes mentioned above?

AG: We remain cautiously optimistic on pork prices and futures but we would not be surprised to see a pull back or correction after the recent rally. As long as cash is leading futures (which is the case currently), futures can move much higher. The CME Cash Hogs Index seasonally has been moving higher since futures hit the low in October. In down markets cash follows but in up markets cash leads and futures follow.

Speculative money in the form of managed money funds has been a key factor in the current rise of hog futures and they would be key again as we go further into 2017. They have been increasing their buy position in lean hogs and could be leading it to their record level from 2013.

More detailed market analysis is available through Farms.com’s Risk Management Hog Marketing Program. The program includes daily commodity reports, hog marketing recommendations, monthly WASDE interactive webinars and more. For more information, visit the Risk Management website.