The bill makes transferring a farm to a family member easier

By Diego Flammini

Staff Writer

Farms.com

The House of Commons passed a piece of legislation designed to help family farmers pass their operations down to the next generation.

Bill C-208, introduced by Manitoba Conservative MP Larry Maguire, passed its third reading in the House on May 12. The bill now moves to the Senate for consideration.

The bill calls for amendments to section 84.1 of the Income Tax Act to ensure farm families have the same tax treatment as non-family members when a farm operation is transferred.

“It’s a catch-up bill,” said Grant Compton, a potato grower from Morell, P.E.I. who spent about five years working as a chartered accountant. “There are no additional benefits, it just puts everyone on a level playing field.”

“It will make that farm or ranch more viable to pass to the next generation. And we need that to keep those businesses productive and to not fragment them into less competitive sizes,” Ryder Lee, CEO of the Saskatchewan Cattlemen’s Association, told CTV.

Canada’s federal income tax law received royal assent in 1917 and was worded in a way that unintentionally put farm family members at a disadvantage compared to strangers.

“It’s an antiquated law and it’s worded so the transfer is going to be taxed as a dividend versus the family member being able to maximize their lifetime capital gains exemptions,” he told Farms.com. “It would impose more tax on a farm selling to the next generation than it would selling to a third party. So, it would cost you more money to sell the farm to your family.”

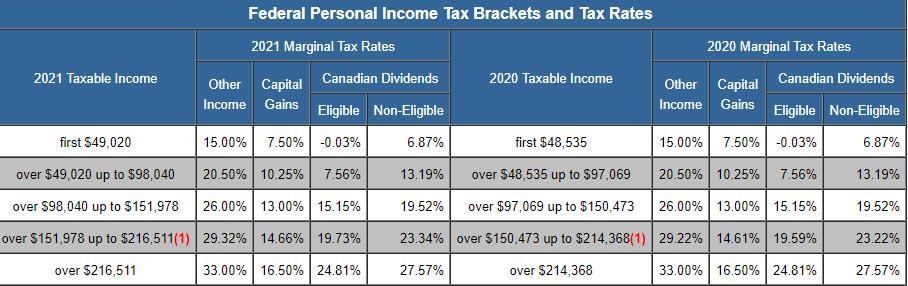

Dividends are taxed at higher rates than capital gains exemptions.

Taxtips.ca photo

When dealing with family farm transfers, the tax implications are “in the hundreds of thousands of dollars,” Compton said.

Having those dollars available is critical to helping the next generation of a farm family succeed, he added.

“If you’ve got to part with $100,000 that really puts you behind the eight ball, he said. “That money is important to have if a producer wants to invest in the farm.”

Industry organizations are pleased the bill has moved to the Senate.

With more than 90 per cent of Canada’s farms family owned, Bill C-208 will help ensure this remains the case, said Keith Currie, first vice-president of the Canadian Federation of Agriculture.

“We’re very happy to see these amendments,” he told Farms.com. “This is something the Canadian Federation of Agriculture and farmers in general have wanted for a while now to keep farms family owned and operated. If you’re selling the farm to a non-family member, they likely have deep pockets and may not be concerned with some of the other costs associated with farm transfers.”