An analysis of Canada’s livestock census comparing the Canada Census of Agriculture data from 2016 with 2020.

By Andrew Joseph, Farms.com

One-two-three-ha-ha-ha, said Sesame Street’s The Count.

Released on May 11, 2022, the 2021 Census of Agriculture published by Statistics Canada noted that while industry consolidation and aging of farm operators has continued from the last ag census done in 2016, the Canadian agriculture industry is adapting and modernizing, with higher rates of technology adoption, renewable energy production, use of direct marketing solutions, and sustainable farming practices.

The 2021 Census of Agriculture also showed that livestock inventories and acreage for prominent crops have remained stable with some increase since 2016 which suggests that Canadian farmers have been resilient in the face of Covid-19 challenges.

The census counted 189,874 farms in Canada, a 1.9 percent decrease from 2016.

Farms in Canada reported a 3.2 percent drop in total farm area from 2016, but total area for hay and field crops increased by 0.3 percent to 92.9 million acres in 2021.

Looking for more drought-tolerant crops, perhaps, there was a 24.3 percent increase in barley acreage from 2016 to 2021. We’re not sure if that means more barley-related breakfast cereals are in the mix—Barl-abix?—but we still love Weetabix. Of course, barley is also one of the four key ingredients in the manufacture of beer (hops, yeast and water being the others). Maybe Canadians are consuming more beer.

To be open, Stats Canada is not suggesting anything other than barley crops have increased over the two census periods.

LIVESTOCK

The number of head reported for major livestock categories has also increased modestly since 2016.

The Canadian livestock sector was challenged because of the pandemic, as meat processing facilities were shut down early to contain outbreaks of Covid-19. This in turn was exasperated by a labour shortage that challenged the meat processing industry—actually most industries in Canada and the world.

Swine:

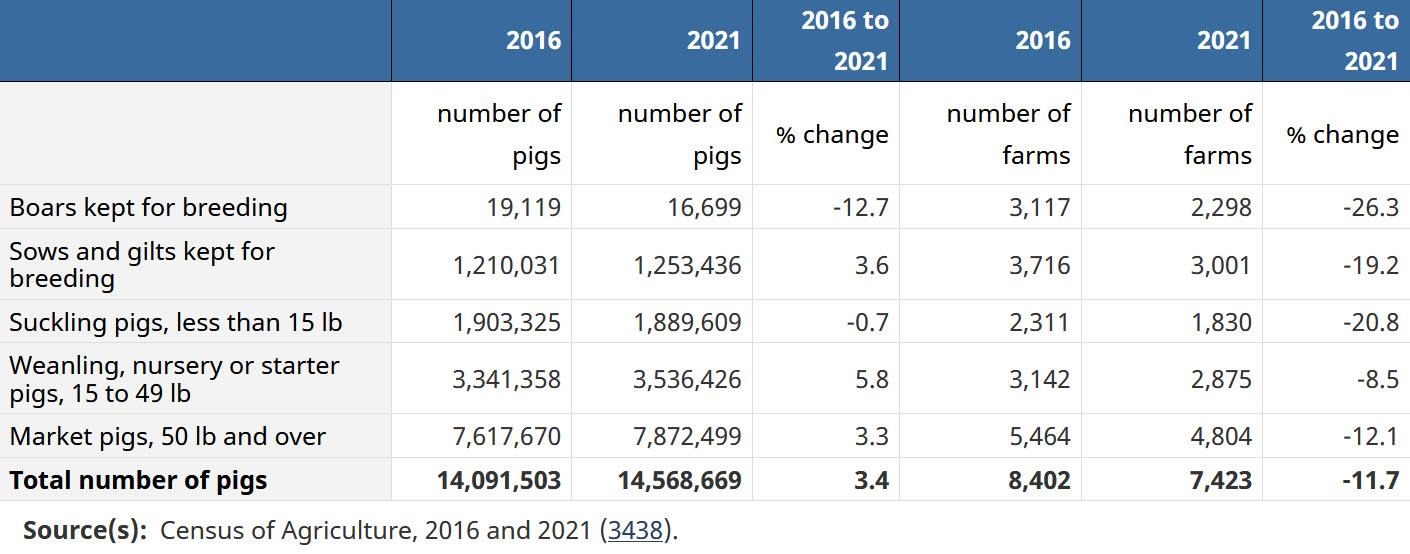

Within the swine sector, farms in Canada reported a 3.4 percent increase in the number of hogs and pigs from the previous census.

In 2021, there were 14.6 million hogs and pigs in Canada, up from 14.1 million in 2016.

During the same period, total exports in Canadian dollars for hogs and pigs to the US increased by 27.7 percent.

While the number of hogs and pigs increased, the number of farms reporting hogs and pigs decreased 11.7 percent, indicating growing concentration within the industry.

Cattle:

Canada’s cattle and calf inventories increased slightly from the previous census.

In 2021, Canadian farms counted 12.6 million total cattle, up from 12.5 million in 2016.

However, the percentage increase in milk cows, steers and beef cows offset declines in heifers for slaughter, heifers for dairy herd replacement, heifers for beef herd replacement and bulls.

Poultry:

The Canadian chicken population increase by 4.7 percent, counting 152.3 million head in 2021—this is despite a decrease in the number of farms reporting chickens (-1.5 percent).

The increase in chicken inventories was driven by farms with sales of at least $2-million, where the respective farm numbers rose 27.9 percent.

Turkeys decreased by 27.8 percent, while the number of farms reporting turkeys declined 17.3 percent from 2016 to 2021.

No data regarding ducks was provided. However, a 2022 culling of ducks including 400,000 breeding stock eggs by large commercial producer Brome Lake Ducks Ltd. (https://www.farms.com/ag-industry-news/avian-flu-devastates-quebec-duck-producer-947.aspx) of Knowlton, Quebec owing to an outbreak of the avian flu H5N1 virus, will impact numbers of the commercial duck segment moving forward.

Ovine:

The total number of sheep and lambs was down by 0.2 percent from the 2016 census, with a total count of 1.1 million head in 2021.

The number of farms reporting sheep and lambs was down by 9.6 percent—in 2016, there were 9,390 farms reporting sheep and lambs, with numbers decreasing to 8,487 in the 2021 census.

SUMMARY

The census noted that farms incur 83 cents in expenses for every dollar of revenue, with 2020 Canadian farm operating revenues totalling $87-billion, with expenses reached $72.2 billion.

The expenses-to-revenues ratio across farm types shows that farms classified as oilseed and grain farming were the most profitable farm type in 2020, with an expenses-to-revenues ratio of 0.76. Conversely, sheep and goat farms had the highest ratio, at 0.97. Baaaa.

For additional information on the 2021 Census of Agriculture, see the Farms.com article: https://www.farms.com/ag-industry-news/stats-canada-releases-2021-census-of-agriculture-data-653.aspx.