The buildings farmers heat are crucial to daily operations, a rancher said

By Diego Flammini

Staff Writer

Farms.com

Reaction continues to come in from the Canadian ag community about a legislative decision that could cost farmers thousands of dollars.

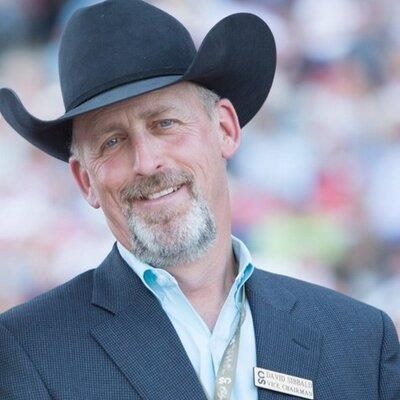

“The buildings we heat are crucial to our day-to-day operations, David Sibbald, chair of the Canadian Beef Breeds Council and rancher from the Alberta foothills, told Farms.com. “Heating our barns ensures that not only is our livestock comfortable, but makes sure our equipment runs smoothly in the colder months to help us care for our livestock.

David Sibbald

“It’s disappointing that the government has failed to recognize the importance the exemption is to the animal care strategies we’ve all incorporated.”

Sibbald and other industry members are concerned with an amendment made to Bill C-234, which, in its original form, provided farmers with carbon tax exemptions on fuels like propane and natural gas used to dry grain and heat barns or greenhouses.

But on Oct. 19 during a Senate ag committee meeting, Senator Pierre Dalphond introduced a change to remove the heating exemption.

The bill will be put in front of the full Senate for a third reading.

If senators reject the amendment, Bill C-234 could appear in its original form for its third reading before receiving royal assent.

But if the Senate approves the change, the bill will have to go back to the House of Commons to get support from MPs.

Removing the barn and greenhouse heating exemption will cost farmers thousands of dollars.

Rick Prejet, chair of Manitoba Pork, for example, told Farms.com in July he pays about $80,000 in carbon taxes per year.

And Jan VanderHout, president of the Fruit and Vegetable Growers of Canada, estimated a 30-acre greenhouse pepper operation would pay about $150,000 in carbon taxes per year.

As the carbon tax increases, one of two things will happen, Sibbald said.

“This all ends up meaning consumers pay higher prices for food,” he said. “And when consumers can’t afford the food, production stops. And once primary producers can’t afford it, we lose those farms and production that Canada is known for.”

Canada has experienced a decrease in the number of farms reporting cattle and calves.

On July 1, 2018, before the carbon tax came into effect in 2019, Canada had 72,495 farms in this category, Stats Canada data shows.

And as of July 1, of this year, that number is down to 71,075, or 1,420 farms fewer than in 2018.

The carbon tax is scheduled to increase to $80 per tonne in 2024.

Without support from the federal government to help farmers, the ag industry could be in trouble, Sibbald said.

“You can only stretch a rubber band so far before it breaks,” he said. “We farm because it’s a passion and lifestyle but it’s also a business. If we continue to operate like this, you get to a point where it doesn’t make any business sense. I hope the government looks at the big picture and changes course on this policy.”

A report from the Parliamentary Budget Officer has painted a broader picture of how carbon tax exemptions can help farmers.

The report estimates eliminating the carbon tax for grain drying and barn heating could save Canadian farmers almost $1 billion by 2030.

That represents money that doesn’t have to be made up through higher prices, which helps farmers domestically and globally, Sibbald said.

“It’s a constant conversation,” he said. “The world relies on Canada to produce these crops and proteins, and Canadian farmers have spent decades building trust and our reputation around the world. If government continually impedes our ability to compete on the global market, we will lose those markets because customers will find other places to buy what they need.”

In addition, that’s money that could be reinvested into a farm.

“Our barns are more efficient, and we look at different energy sources, and we look at water management tools,” he said. “But these initiatives take time, and they take dollars. Our margins are razor thin as it is. If the government continues to take from that, how are we supposed to adopt these advancements?”

The proposed Bill C-234 amendment is even more frustrating for producers considering the prime minister’s recent announcement.

On Oct. 26, Prime Minister Trudeau announced a three-year carbon tax exemption for home heating oil and a doubling of the rural top-up rate on the Climate Action Incentive Payment from 10 per cent to 20 per cent.

Supporting some people but not everyone doesn’t add up, Sibbald said.

“It sends mixed messaging,” he said. “And at the end of the day it’s probably a net loss for agriculture.”