AEM released July 2016 report

By Diego Flammini

Assistant Editor, North American Content

Farms.com

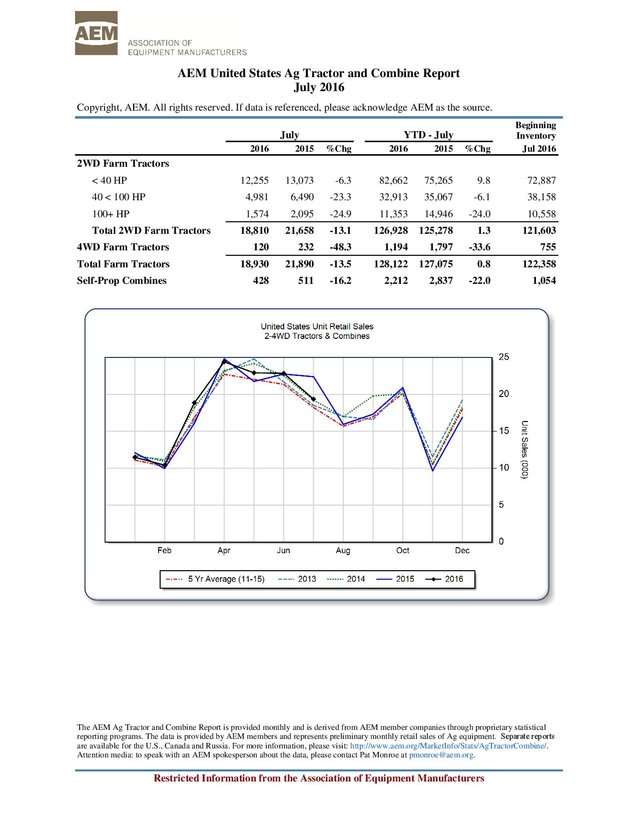

A new report by the Association of Equipment Manufacturers (AEM) shows a decline in combine and tractor sales.

According to the report, 1,194 4WD tractors were sold in July 2016, compared to 1,797 in July 2015. That represents a 33 per cent decline.

Sales of 2WD tractors in the 100+ horsepower range fell by 24 per cent between July 2015 and July 2016.

The report also shows a decline in self-prop combines.

In July 2016, 2,212 combines were sold, compared to 2,837 last July. Those numbers represent a 22 per cent drop.

Those within the machinery industry say the trend is linked to crop prices.

“Well a lot of it has to do with commodity prices,” HARDI North America CEO Wayne Buchberger told Iowa’s KWQC. They have shifted substantially over the last couple years. Corn and soy bean primarily, and wheat have taken notable shifts in market pricing. That ties directly then to disposable income on the farm and what they’re able to capitalize for expenditures each year.”

Glen Keppy, a fifth-generation farmer from Davenport, told KWQC at the end of the day, the weather helps decide how producers spend their money.

“You’re at the mercy of Mother Nature,” he said. “(If) the price of corn goes down, people can’t pay as much rent, we can’t spend as much money on new equipment.”

Buchberger said the trend will turn around. It’s just a matter of when.