Robust Ukraine and Russia Grain Shipments are Nearly Back to Pre-War Levels.

By Aleah Harle

Farms.com Risk Management Intern

Following weeks of intense negotiations, on March 25, Ukraine and Russia agreed to a limited ceasefire. The discussions focused on ensuring safe navigation for Black Sea shipping and pausing long-range strikes on energy facilities.

Despite this announcement, Russia has made it clear that the deal would only be implemented if sanctions against the Russian Agricultural Bank and other financial institutions were lifted and access to the SWIFT system of international payments was guaranteed.

These agreements follow talks initiated by US President Trump, who has pledged to help Moscow regain access to global markets for agricultural and fertilizer exports, lower maritime insurance costs, and enhance access to ports and payment systems for such transactions.

U.S. efforts to negotiate a Black Sea ceasefire coincides with robust grains shipments, which are nearly back to pre-war levels. Even without the agreement, Russia and Ukraine have continued to dominate the global grain market, despite infrastructure damage from attacks.

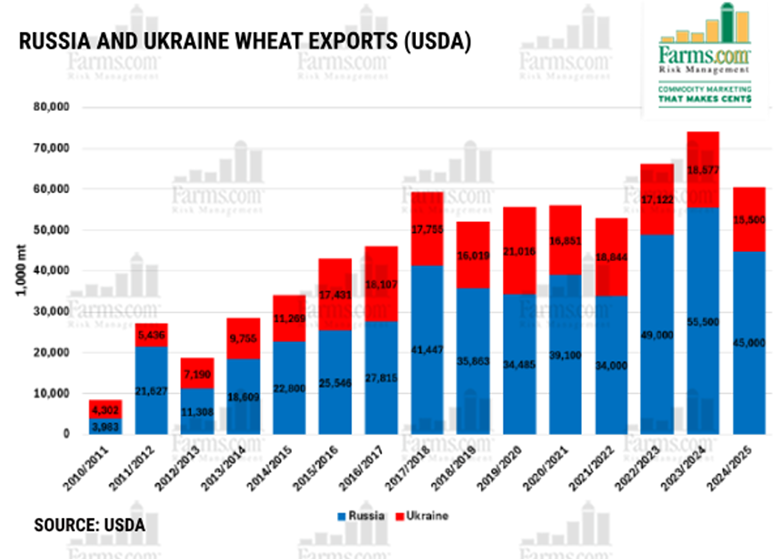

Ukraine’s Black Sea shipments are near pre-war levels with Russia being on track to being the worlds top wheat exporter for the 8th consecutive season. (See Chart).

Russia is expected to export 45 million metric tons of wheat this season down from 54.7 mmt from last year. In the Black Sea wheat exports are also expected to drop from 5.4 million metric tons to 2.5 a 35% YoY decline. Exports are lower from slightly lower production with the Russian wheat crop down to 81.5 mmt from 82.4 mmt last year.

An end to the Ukraine/Russian war would be bearish on wheat and corn as it introduces more production and competition long-term!

Grains are not the only component that will be affected by the end of the Russia-Ukraine war impact; crude oil and fertilizer will also be impacted with potentially lower prices all other things being equal.

An end to the war would lift sanctions on Russia and the U.S. could remove the countervailing duties on Morocco/Russia and release more crude oil and fertilizer supplies to the globe and drive prices lower long-term.

Russia has maintained its dominant share in the global fertilizer market and was on track for record exports last year. Russia is the largest exporter of fertilizers in the world and the 3rd largest producer.

In the end, a ceasefire has the potential to reduce risks to Black Sea shipping, ensuring steady grain flows from Ukraine and Russia. With Ukraine’s exports already near pre-war levels and Russia remaining the top wheat exporter, a more secure passage can aid in stabilizing global grain markets and preventing further price volatility within markets.

Easing Russian trade restrictions may allow for Russian wheat to become more competitive, putting pressure on other major exporters. While the ceasefire reduces immediate risks, long-term uncertainty remains, including potential shifts in trade policies, sanctions, and Ukraine’s ability to maintain export capacity amid infrastructure challenges.

For daily information and updates on agriculture commodity marketing and price risk management for North American farmers, producers, and agribusiness visit the Farms.com Risk Management Website to subscribe to the program.