U.S. corn export program show a robust recovery

By Colin McNaughton

Farms.com Risk Management Intern

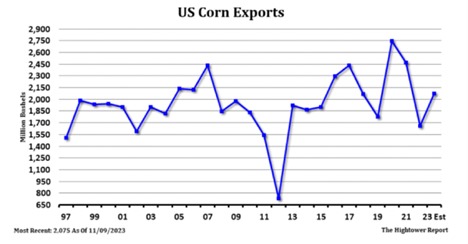

The U.S. corn export program for the 2023/24 marketing year has seen a robust recovery after a sluggish start. In September, export volumes reached an impressive 125 million bushels, marking a substantial 25-million-bushel increase compared to the same month in 2022. Notably, export commitments through November 2, 2023, were 31% higher than the previous year, totaling nearly 760 million bushels.

The overall progress is significant, with corn sales and shipments for the 23/24 marketing year standing at 22.5 MMT, a substantial 27% increase over the previous year's figure of 17.8 MMT. Despite starting the marketing year with the full year target projected at a 33% deficit compared to the previous year, current exports are now up year-on-year by an impressive 27%. To meet the USDA target, only 27.3 million bushels or 1,074,000 MT per week of business is required.

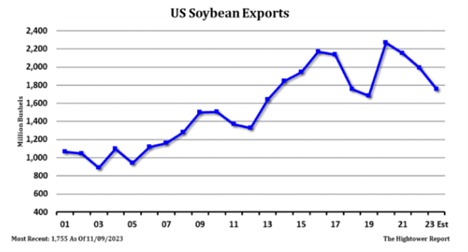

Turning to U.S. soybean sales, meeting the USDA's current export forecast necessitates an average of 584,000 MT or nearly 15.9 million bushels per week of business. As of now, USDA’s soybean export target for the U.S. 23/24 marketing year remains unchanged at 1.755 billion bushels, and the forecasted U.S. corn ending stocks for 23/24 is 245 million bushels.

The weekly USDA export sales report on November 30th revealed substantial figures, with both corn and soybeans reaching 1.9 MMT. Despite some demand from China being diverted to South America by cheaper Brazilian soybean prices, expectations suggest that U.S. sales could improve for the current marketing year. Weekly wheat export sales were also robust, totaling 622,000 MT, and included renewed interest from China. This marks the ninth consecutive week with solid corn and soybean sales, surpassing trade expectations.

Brazil, the world's leading soybean exporter, is grappling with early-season weather concerns. In 2022, issues were localized in the south, but this year, attention is on the hot and dry conditions in Mato Grosso, a key soybean-producing state in the center-west. A potential 30-40 MMT reduction in Brazil's soybean production, compared to current estimates for a cut of 5-10 MMT, could translate into increased export opportunities for the U.S. Hypothetically, this has the potential to add 300+ million bushels to the current USDA's 23/24 U.S. soybean export target. Such a scenario could theoretically reduce 23/24 U.S. soybean ending stocks from 245 million bushels to well below 200 million bushels, underscoring the critical correlation between global supply-demand shifts and the U.S. export program.

For daily information and updates on agriculture commodity marketing and price risk management for North American farmers, producers, and agribusiness visit the Farms.com Risk Management Website to subscribe to the program.