By Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

Gary Schnitkey and Krista Swanson

Department of Agricultural and Consumer Economics

University of Illinois

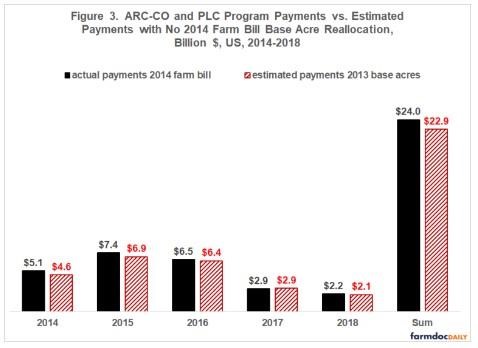

Base acres are an early discussion topic for the next farm bill (farmdoc daily, August 26, 2022). Current base acres date to the 2014 farm bill. This farm bill gave farmers the option to keep their existing allocation of base acres across program commodities or to reallocate existing base acres according to average annual acres considered planted to program commodities during the 2009-2012 crop years (farmdoc daily, July 24, 2014). New base acres were not permitted. We estimate that the 2014 farm bill reallocation increased commodity program payments by $1.2 billion (4.8%) over the five years of the 2014 farm bill. An increase in payments was expected. It is widely accepted that maximizing program payments is a key consideration in farmers’ program decisions (Young, et al., September 2005 and farmdoc daily, January 26, 2022). No expectation existed on the size of the increase.

Data and Procedures: Base acres enrolled in commodity programs were collected from the Farm Service Agency (FSA) for 2013, the crop year preceding the 2014 farm bill, and 2018, the last crop year covered by the 2014 farm bill (see Data Note 1). Also collected were payments made by the Agriculture Revenue Coverage – County (ARC-CO) and Price Loss Coverage (PLC) commodity programs. Payments made to generic (i.e. cotton) base acres in 2014-2017 were excluded (see Data Note 2). Base acres in the third 2014 farm bill commodity program, ARC-Individual Coverage (ARC-IC), were subtracted from 2013 base acres to create a comparable comparison of base acres (see Data Note 3). Total payments to a covered program commodity during the 2014 farm bill were divided by 2018 base acres for that program commodity. This payment per base acre was multiplied by the 2013 base acres for the program commodity to obtain an estimate of payments to the program commodity if its base acres had not been reallocated. It is assumed that reallocation did not impact the average payment per base acre of a program commodity.

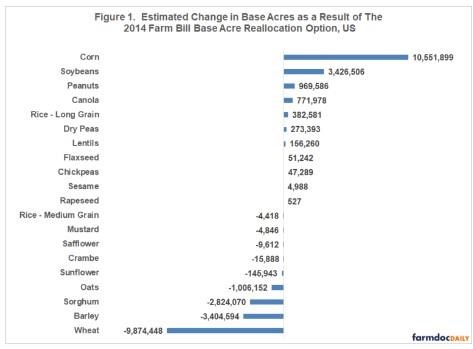

Change in Base Acres: Figure 1 contains the change in base acres due to the voluntary 2014 farm bill reallocation option. The change was largest for wheat (-9.9 million acres) and corn (+10.6 million acres). Besides corn, only soybeans gained more than 1 million acres of base. Peanuts was close. The smaller acreage feed grains (barley, oats, and sorghum) each lost over 1 million acres of base.

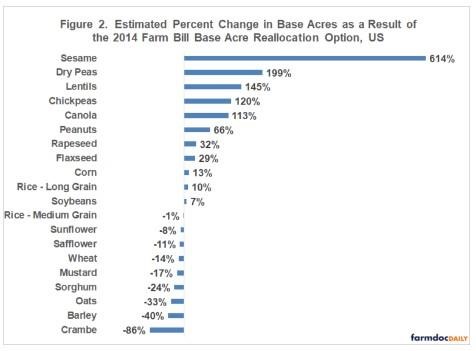

Percent Change in Base Acres: Figure 2 contains relative percent changes in base acres. They highlight the increase in base acres for the most recently added program commodities (large and small chickpeas, dry peas, and lentils). The percent changes also highlight the shift in base acres among the so-called “minor oilseeds.” Base acres declined for crambe, mustard, safflower, and sunflowers while increasing for sesame, canola, rapeseed, and flaxseed.

Estimated Changes in Payments: Figure 3 presents total ARC-CO and PLC payments made by the 2014 farm bill and estimated 2014 farm bill payments if the voluntary base acre reallocation had not been authorized. The base acre reallocation led to higher payments in four of the five crop years. In total, the voluntary base acre reallocation was estimated to increase payments by $1.1 billion or 4.8%.

Summary

The voluntary base acre reallocation authorized in the 2014 farm bill is estimated to have increased ARC-CO and PLC payments during the five years of this farm bill by a little over $1 billion or nearly 5%.

Corn and soybeans gained the most base while wheat, barley, sorghum, and oats lost the most base.

This cost is notably less than the likely cost of allowing new base acres to be added for current program commodities. An analysis reported in the August 26, 2022 farmdoc daily found that allowing new base acres for current program commodities was estimated to increase their total base acres by 17%.

Data Notes

- The FSA website contains only a preliminary report of enrolled acres for the 2014-2016 crop years. No report of enrolled base is posted for 2017. Since total enrolled base acres for a crop vary little across years, the final enrollment report for 2018 is used in this analysis.

- Cotton was not a covered commodity in the 2014 farm bill, and thus not eligible for ARC and PLC payments. This decision was driven by Brazil’s successful World Trade Organization suit against US cotton support programs. Congress however converted cotton base acres into generic base acres and made covered commodities planted on them eligible for ARC and PLC payments. Generic base acres existed for the 2014-2017 crops. Congress eliminated them for the 2018 crop when it made cottonseed a covered commodity. ARC-CO and PLC payments to covered commodities planted on generic base acres totaled $1.3 billion for the 2014-2017 crops.

- For the 2018 crop year, 2.1 million base acres were enrolled in ARC-IC. ARC-IC accounted for 0.9% of all base acres, with wheat accounting for 60% of ARC-IC base acres.

Source : illinois.edu