By Gary Schnitkey and Krista Swanson et.al

Department of Agricultural and Consumer Economics

University of Illinois

By Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

Corn and soybean budgets for 2021 are shown using prices of $3.40 per bushel for corn and $8.50 per bushel for soybeans. Without additional Federal aid, these prices would result in low returns, perhaps lower than will occur in 2020. Given 2021 revenue projections, costs will have to be reduced to reach a breakeven return level. All production inputs should be scrutinized, but we suggest a particular focus on fertilizers applied and number of tillage passes. We also suggest use of variable cash rental arrangements for 2021, with an appropriate base rent given the price environment and additional rent contingent on the level of Federal aid.

2021 Price Scenario

Prices used in 2021 budgeting are $3.40 per bushel for corn and $8.50 per bushel for soybeans. These prices reflect current-levels of futures prices for 2021 harvest-time delivery. On July 20, settlement prices on Chicago Mercantile Exchange (CME) contracts were $3.66 per bushel for the December 2021 contract and $8.92 per bushel for the November 2021 contract. Usual basis places cash prices near $3.40 per bushel for corn and $8.50 per bushel for soybeans.

The planning prices of $3.40 for corn and $8.50 for soybeans are near projections for a post-COVID scenario in an April 28, 2020 farmdoc daily article. In that article, we suggested 2021 Market Year Average (MYA) prices of $3.40 for corn and $8.30 for soybeans. The soybean price used in this article is slightly more optimistic than in the April 28 article. The budget prices are consistent with a V-shaped recovery, a quick recovery after COVID-19 control measures are relaxed. There are signs that a V-shaped recovery is a possibility, with both meat processing capabilities and ethanol production rebounding. Of course, it also is possible that COVID-19 control measures will be longer-lived, perhaps continuing well into 2021, resulting in expectations for lower prices than used here.

Projected prices for 2021 are below prices farmers have received since ethanol use stopped increasing in 2013 (see farmdoc daily, June 10, 2020). From 2014 to 2019, average corn price for farmers enrolled in Illinois Farm Business Farm Management (FBFM) has been $3.62, $.22 higher than the $3.40 planning price. Average soybean price from 2014 to 2019 has been $9.57 per bushel, $1.07 higher than the $8.40 planning price.

2021 Gross Revenue

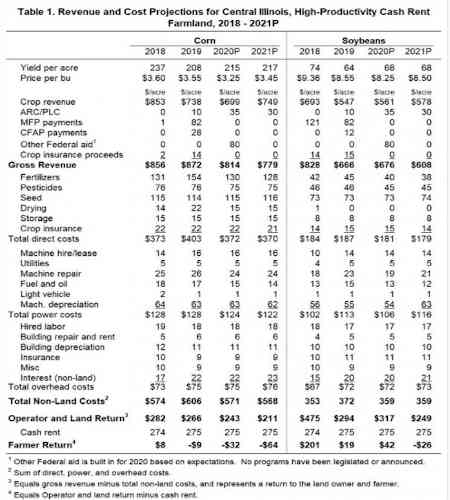

Table 1 shows budgets for high-productivity farmland in central Illinois. For 2021, trend-yields are 217 bushels per acre for corn and 68 bushels per acre for soybeans. Higher yields are possible. Given the importance of Illinois in total production of both crops, higher yields likely would result in lower prices, leaving revenue roughly the same.

Built into budgets are $30 per acre of ARC/PLC payments associated with Commodity title programs (i.e., Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLC)). Because base acres are not dependent on planting, the same $30 ARC/PLC payment is budgeted for both corn and soybeans. The $30 payment is roughly a $60 payment on corn and no soybean payment. These are 2021 payments, which will be received in October 2022. The ARC/PLC payments will occur in October 2021, but these payments will be associated with 2020 production.

Gross revenue is project at $779 per acre for corn, significantly below gross revenues in 2018 ($856), 2019 ($872), and 2020 (projected at $814). The $779 gross revenue would be the first time gross revenue has been below $800 per acre since 2009. Soybean revenue is projected at $608 per acre, lower by over $40 per acre than the other revenues in 2018 through 2020. Lower 2021 revenue occurs because Federal aid outside of ARC/PLC payments is not budgeted. Market Facilitation Program (MFP) and Coronavirus Food Assistance Program (CFAP) payments significantly supported revenue for the 2018 and 2019 production years. For soybeans, MFP payments totaled $121 per acre in 2018, and MFP and CFAP payments totaled $94 per acre in 2019. Expectations for another $80 of Federal aid in 2020 is included in the budget and would support 2020 income, although this Federal aid is not legislated or announced by the U.S. Department of Agriculture. Without any Federal aid in 2021, gross revenue will be lower than in recent years without an increase in commodity prices.

Reductions in 2021 Costs

Table 1 includes estimates of direct, power, and overhead costs for 2021. These costs result in total non-land costs of $568 per acre for corn and $359 per acre for soybeans. Budgets also include $275 per acre for cash rent, the same rate used in 2018 and 2019. Given those revenue and cost estimates, farmer return is -$64 per acre for corn and -$26 per acre for soybeans. Both of those return estimates are negative. In recent years, soybeans had a positive return although corn returns have been negative.

Costs will need to be reduced for farmer returns to approach positive levels. While each farm will have specific areas for cutting costs, results from field level data from Precision Conservation Management (see Illinois Corn Growers Association, The Business Case for Conservation) suggests focusing on reducing fertilizer applications and tillage passes. Building flexibility into rental arrangements also seems prudent.

Fertilizer costs: In recent years, University recommendations have been reduced for phosphorus and potassium (Nafziger, 2014). Agronomic research suggests that removal rates are about 15% less than the recommended levels before 2014. Reducing phosphorus and potassium costs by 15% would result in $10 lower costs per acre for corn and $6 per acre less for soybeans.

Moreover, nitrogen rates for corn may be lowered in certain cases. Maximum return to nitrogen rates can be obtained from a Corn Nitrogen Rate Calculator, and typically run between 170 and 190-pounds of nitrogen per acre. A 20-pound over-application of nitrogen would add $6 per acre in costs.

Power costs: Farmers who tend to be more profitable tend to have lower power costs in depreciation, repairs, and fuels. Over time, more tillage on an acre will tend to raise depreciation and repair levels. Reducing tillage passes to lower levels will reduce costs. Results from Precision Conservation Management (PCM) suggest that more than one tillage pass does not increase yields on either corn or soybeans; thus, reducing tillage passes could have the impact of reducing costs and increasing returns.

Adjusting land rents: Average cash rents have not declined in recent years, even with notably lower corn and soybean prices. A major factor associated with the stability in cash rents has been MFP payments and CFAP payments in 2018 and 2019. Without those, farmer returns on cash rented land would have been at negative levels. Returns shown for 2020 include estimated Federal aid totaling $80 per acre which has not been announced or legislated up to this point. Even with the additional estimated Federal aid, corn returns are still negative with an average cash rent.

Many 2021 rental arrangements will be negotiated this fall. At this point, there may be a temptation to not reduce cash rents under the assumption that another round of Federal aid in the form of an MFP/CFAP-style program will occur in 2021. There is no guarantee of Federal aid in 2021, and it is after an election year which may suggest less aid is forthcoming, regardless of election outcomes. Given the importance of Federal aid, we suggest lowering the base cash rent to around $200 for high-productivity farmland and using a variable cash rent arrangement for 2021. Importantly, the variable cash rent will include Federal aid in its calculation, and it will flex upward if either revenue is higher than expected or Federal aid occurs.

Summary

Ad hoc Federal aid in the form of MFPs and CFAP payments have been important in recent years. Continuing Federal aid is not guaranteed in 2021. For 2021, low returns will again prompt farmers to evaluate options for cutting costs. Fertilizer and power costs seem like obvious areas for focus. Building flexibility into cash rents which reflect cash flow outcomes seems prudent.

Source : illinois.edu