Main Takeaways

- U.S. farm production expenditures declined by a moderate 4.1% in 2024 compared to 2023, but remained elevated relative to recent decades, totaling $453.9 billion.

- Forecasted U.S. farm production expenses for 2024 show increases in labor, livestock/poultry purchases, and property taxes/fees, along with reductions in feed purchases, fertilizer, pesticides, and fuel/oil.

- In 2025, we expect relatively stable total production costs as reductions in categories such as interest on operating capital and fertilizer are expected to be mostly offset by increases in categories such as labor and custom operations.

Inputs and Production Expenditures

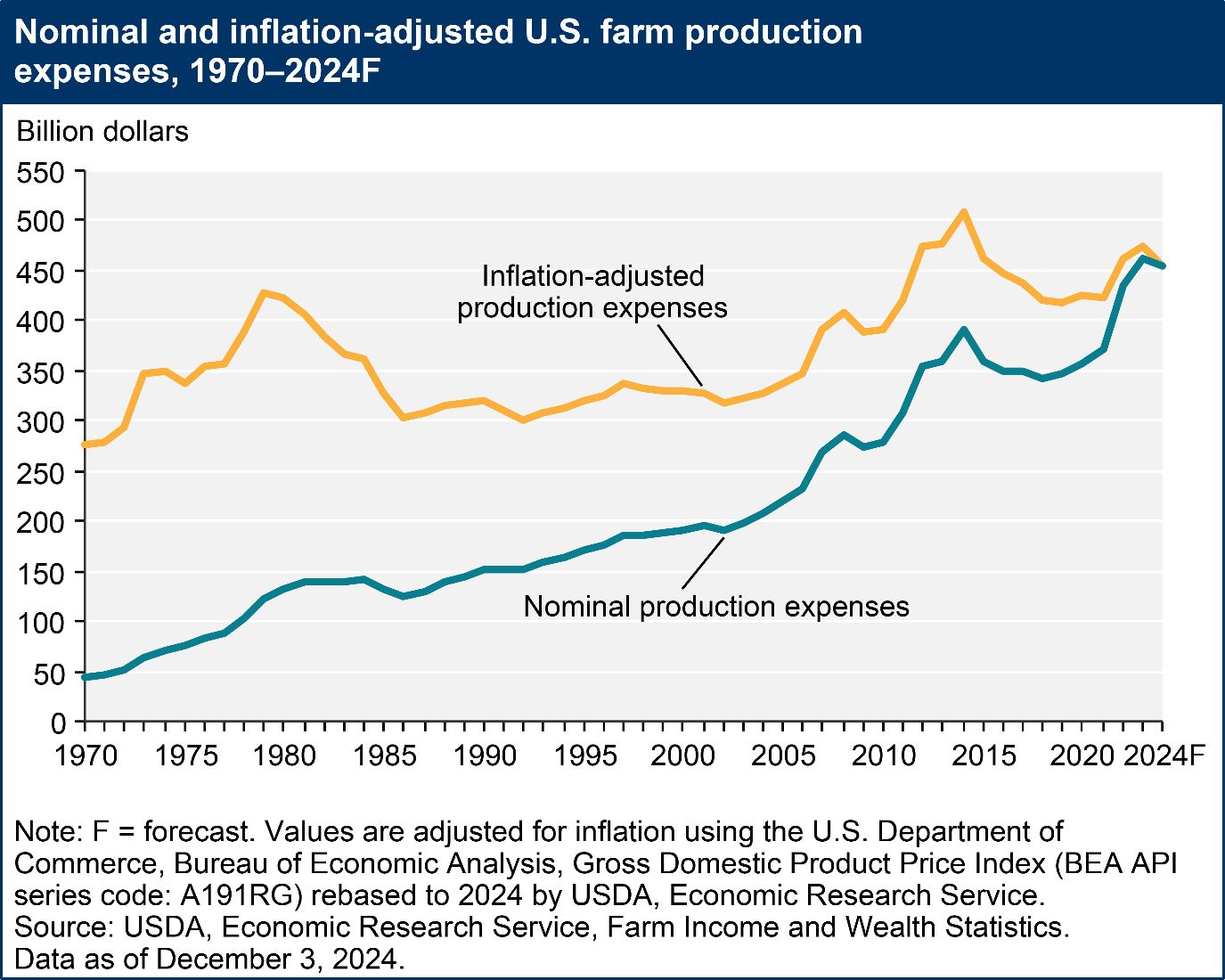

Total U.S. farm production expenditures are forecast to decline by $19.2 billion in 2024, representing a 4.1% decrease, following a significant increase of $50.3 billion (11.9%) from 2021 to 2023 (Economic Research Service [ERS], 2024b). This decline marks a respite for producers after a consecutive 3 years of sharply rising farm expenses. Despite the forecasted expenses reduction, farm expenditures in 2024 remain elevated, totaling $453.9 billion—positioning the year as the seventh most costly on record when adjusted for inflation (Figure 1).

The 3-year surge in farm expenditures can be attributed to a mix of global and domestic economic factors. Among these are significant geopolitical developments, including military conflicts in the Middle East and Ukraine, which disrupted global markets and farm input prices. Domestically, the lingering effects of postpandemic supply chain disruptions drove up production costs further from 2021 to 2023. Additionally, the Federal Reserve’s monetary policy adjustments, aimed at curbing inflation through interest rate hikes, have contributed to heightened volatility in production expenses.

Figure 1. Nominal and Inflation-Adjusted U.S. Farm Production Expenses, 1970–2024f.

Notable Input Expense Changes in 2024

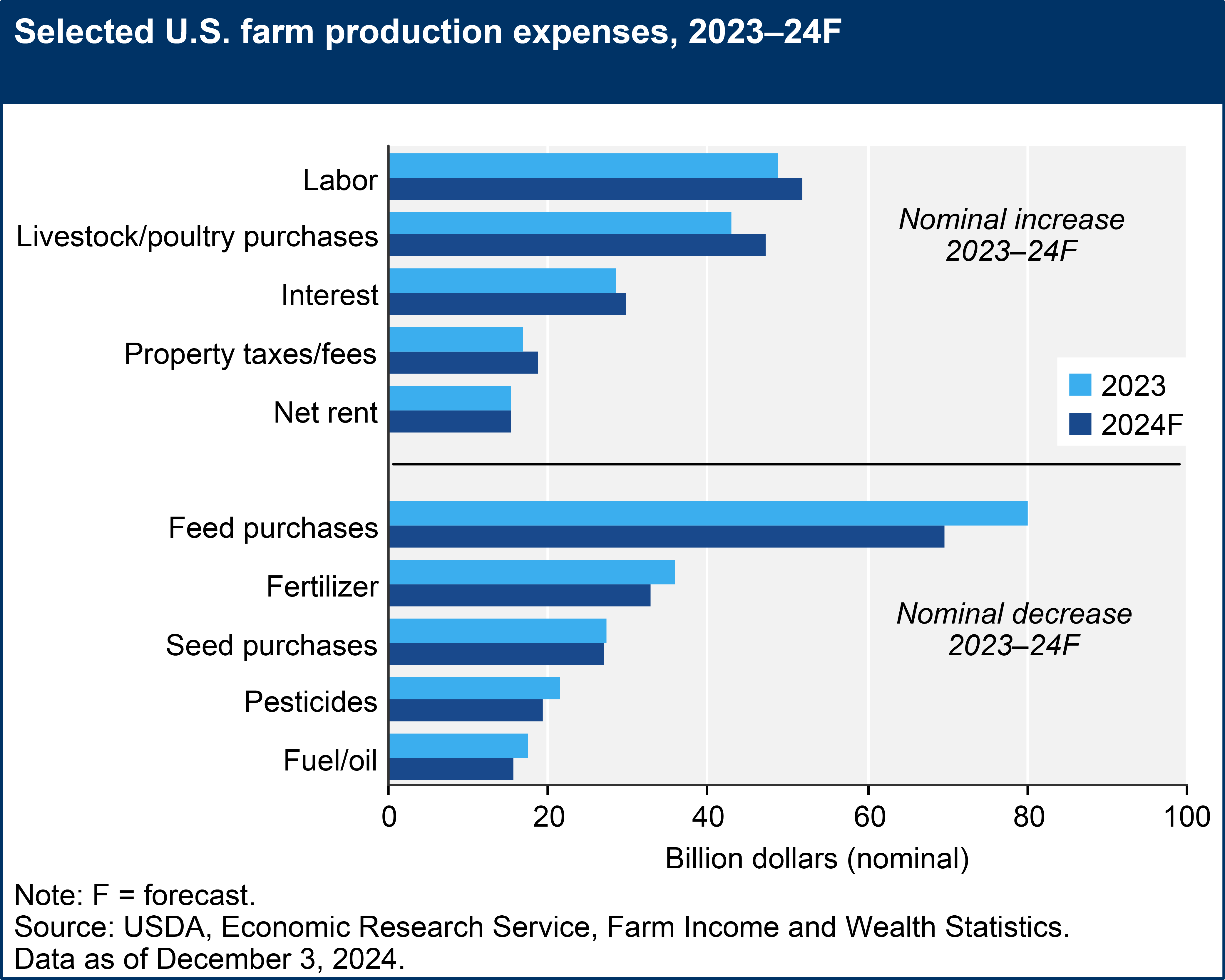

In 2024, the U.S. Department of Agriculture (USDA) ERS reported significant fluctuations in farm production expenditures across various categories. Notably, spending on labor, livestock and poultry purchases, and property taxes and fees is forecast to increase by $3.0 billion (6.1%), $4.38 billion (10.2%), and $1.9 billion (11.3%), respectively.

Conversely, several major expense categories are forecast to experience notable declines. Feed purchases are anticipated to decrease by $10.5 billion (13.2%), while expenditures on fertilizer, pesticides, and fuel/oil are projected to drop by $3.0 billion (8.4%), $2.3 billion (10.7%), and $2.0 billion (11.3%), respectively. The declines in these expense categories can be attributed primarily to reductions in product prices rather than decreases in the actual quantities of these inputs used by U.S. farms. Other major categories of U.S. farm expenditures are forecast to remain relatively stable, mostly with variations of less than 5% compared to 2023 levels (Figure 2).

Figure 2. Selected U.S. Farm Production Expenses, 2022-2024f.

Outlook for 2025

In 2025, farm production input prices are expected to exhibit mixed trends across expense categories. For key Georgia crops, inputs (including fertilizers and interest on operating capital) are projected to decrease by 7% to 15% as fertilizer prices continue to moderate and the Federal Reserve moves to stabilize inflation around 2%. In contrast, costs for custom operations and other variable expenses are forecast to rise by 2% to 4% (ERS, 2024b).

Among variable production expenses, farm labor is anticipated to see a significant increase. The U.S. Department of Labor’s Farm Labor Survey indicates that the southeastern Adverse Effect Wage Rate (AEWR), which includes Georgia, will rise by 9% to $16.08 per hour in 2025 (National Agricultural Statistics Service, 2024). This wage rate increase is expected to place the greatest strain on producers of crops for which mechanized planting and harvesting are not viable options. These price fluctuations in USDA-projected 2025 input expenses are largely expected to offset, resulting in relatively stable total production costs for many Georgia crops, with variations not exceeding 1% compared to 2024 levels (ERS, 2024b).

Despite these projections, several potential developments could disrupt current agricultural input forecasts, such as shifts in U.S. trade policy and other external factors that introduce uncertainties into the current agricultural economic outlook. For instance, tariffs imposed on imported agricultural inputs could significantly alter cost projections. A 25% tariff on Canadian goods alone could increase potash prices for U.S. producers by $80 per ton (Quinn, 2024). Nevertheless, the anticipated reductions in expense categories such as interest on operating capital, fertilizers, and other inputs provide a measure of optimism for producers seeking to improve their financial positions in 2025.

Source : uga.edu