By Gary Schnitkey, and Nick Paulson

Department of Agricultural and Consumer Economics

University of Illinois

Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

Interest rates increased in 2022 and likely will continue to increase in 2023. As a result, interest rates are higher than from 2008 to 2021. Rising interest rates will have three impacts on agriculture: 1) Costs of using debt capital will increase, 2) The required breakeven to cover investments will increase, and 3) Downward pressures will be placed on asset values, including farmland.

Recent History of Interest Rates

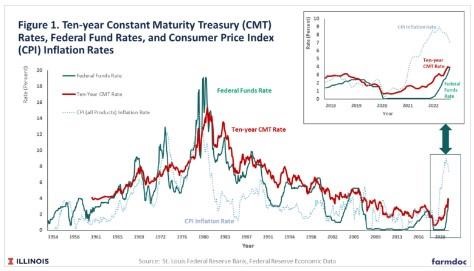

Overall, interest rates exhibited a general trend of decline from the early 1980s to 2021. For example, the ten-year Constant Maturity Treasury (CMT) rate was 15.3% in September 1981. From that high, ten-year CMT rates had short periods of increase but exhibited a general downward trend, reaching a low of 0.62% in July 2020 (see Figure 1).

Interest rates were high in the early 1980s because of inflation. As measured by the Consumer Price Index (CPI), inflation rates exceeded 10% in the late 1970s and early 1980s, a high level for the United States. As a result, the Federal Reserve Bank (FED) took actions to control inflation, including increasing the Federal Funds rate. Commercial banks use the Federal Funds rate to maintain liquidity through overnight borrowing and lending. In addition, interest income on reserves held at the FED is based on the Federal Funds rate. To control inflation, the FED took actions to raise the Federal Funds rate to over 15% in the early 1980s, a historically high level (see Figure 1). As inflation decreased, the Federal Funds rate declined.

To counter recessionary impacts from the 2008 Financial Crisis, the FED lowered the Federal Funds rate to below 0.25% in 2009. At the same time, the FED introduced Quantitative Easing (QE), a seldom-used monetary policy in which the FED buys Treasuries and other assets and holds those assets on its balance sheet. The Federal Funds rate remained below 0.25% until the beginning of 2016 when the FED began moving to more historically normal monetary policy. As this normalization process was underway, COVID occurred, and the FED lowered the Federal Funds rate to below .10% in 2020 while implementing more QE. Overall, interest rates were low from the 2008 Financial Crises to the end of 2021, during which time the ten-year CMT rates averaged 2.3%.

Inflation has increased as the global economy has progressed from the COVID-induced recession. Fiscal policy injected funds into the economy during and after COVID to reduce the recessionary impacts of COVID responses. Those Fiscal payments, stimulative monetary policy, and COVID-induced supply disruptions led to inflationary pressures. As a result, inflation rates averaged over 9.0% in June 2022 (see Figure 1). To combat inflation, the FED undertook more restrictive monetary policies, including increasing the Federal Funds rate. At the end of 2022, the Federal Funds rate was at 4.33%, with prospects of more increases into 2023.

The Future of Interest Rates

Interest rates in the future will depend on many factors, but two seem fundamental at this point. The first is inflation. In November 2022, the inflation rate was 7.1%, down from a 9.0% high in June 2022 but still at a level viewed as unacceptably high (see Figure 1). Whether inflation remains at a high level remains to be seen, with hopes that most inflationary pressures are transitory. Downward movements in the inflation rate from June to November 2022 might indicate that inflation is transitory, but this is by no means a certainty. The 1980s history suggests several years could be needed before inflation again reaches longer-term targets of 2 to 4%.

The second factor is the FED’s commitment to reducing inflation. So far, the FED seems resolved to implement more restrictive monetary policies, but a recession could result in a more accommodative monetary policy.

Even given this uncertainty, higher interest rates should be expected, and planned for over the next several years. These expectations are based on the following:

- At best, inflation rates will return to a range from 2% and 4%. A sustained period of inflation rates below 2% has not occurred since the early 1960s. Inflation rates could be higher if existing pressures on price levels remain. For example, lower labor supplies and continued demand for tangible goods could lead to higher inflationary pressures, resulting in inflation rates above 4%.

- Even if inflation rates are between 2 to 4%, the FED will prefer not to have as accommodative of a monetary policy that existed from 2008 to 2021. Extremely low Federal Fund rates and QE are still viewed as exceptions rather than the rule. Average expectations of FED participants in Federal Open Markets Committee (FOMC) meetings suggest a Federal Funds rate at or above 5.0% for 2023, and moving back towards 3% by 2025 (here). However, a recession could lead to another round of QE and accommodative monetary policies.

- Interest rates will average above the inflation rate. Most of the time, the ten-year CMT rate is above the inflation rate (see Figure 1 and farmdoc daily, December 23, 2021, and October 12, 2022). For ten-year CMT rates to continually average below the inflation rate, market participants have to be willing to take real losses on Treasury holdings. While market participants taking losses is a possibility, that possibility seems unlikely. A 2 to 4% inflation rate suggests a ten-year CMT rate in the 4 to 6% range and interest rates on agricultural debt in the 7 to 9% range. Higher interest rates are possible if inflation rates are above 4%.

Overall, farmers and others should expect higher interest rates than existed from 2008 to 2021.

Implications for Agriculture

Higher interest rates will 1) increase debt costs, 2) increase the breakeven level required to cover investments, and 3) place downward pressure on assets, including farmland.

Higher costs of debt: Higher interest rates will increase the costs of using debt. To illustrate, take a farm with an $800 per acre operating note for one-half of the year. If the rate on operating debt increases from 5% to 8%, the costs of using that operating note increases from

- $20 per acre ($800 x 1/2 year x 5% interest rate).

to:

- $32 per acre ($800 x 1/2 year x 8% interest rate).

The resulting $12 per acre increase is relatively small compared to the over $200 per acre increase in costs for corn from 2022 to 2024 (farmdoc daily, December 6, 2022). Nevertheless, an increase in interest costs will pressure farmers (farmdoc daily, March 21, 2022).

Higher breakeven levels to make investments: Higher interest rates will increase the breakeven return for purchasing an asset. These impacts were illustrated for a $1,000 per acre tile investment that will be repaid over 50 years in a recent farmdoc article (see farmdoc daily, November 29, 2022). A 5% interest rate requires a required return of $54 per acre, while an 8% interest rate has an $82 per acre required return. The $28 per acre increase ($82 – $54) could make the investment unprofitable.

Downward pressure on asset values, including farmland: Higher interest rates generally lead to lower asset values. Given its long life, farmland prices are susceptible to interest rate increases.

Over time, we have evaluated the fundamentals of the farmland market by comparing farmland prices to capitalized values (farmdoc daily, August 16, 2022, December 20, 2016, October 20, 2015, August 19, 2014, August 24, 2012, and Choices 2011). The capitalized value represents an assessment of the fundamental value of farmland. Historically, a straightforward way of estimating the capitalized value is to divide cash rent by the 10-year CMT. Figure 2 shows farmland prices and capitalized values for Illinois farmland.

From 2009 to 2021, farmland prices increased, with a pause in the increase from 2013 to 2020 (see Figure 2). Increased cash rents and farmland returns contributed to the 2009-2021 increases. Decreasing interest rates also increased capitalized values and farmland prices. Both increasing rents and declining interest rates led to capitalized values exceeding farmland prices from 2009 to 2021 (see Figure 2). Capitalized values exceeded farmland prices by large margins in 2020 and 2021 because ten-year CMT rates were at exceptionally low values. Market participants likely did not expect those very low interest rates to continue.

In 2022, capitalized values were slightly below farmland prices for Illinois: $8,905 farmland price compared to $8,237 capitalized value. The significant decline in capitalized value was due to an increase in the 10-year CMT rate: .09% in 2021, 1.4% in 2021, and 3.0% in 2022. At the end of 2022, the simple capitalization formula does not suggest a farmland market that is substantially over-priced or in danger of large decline. However, the move from very low to more normal interest rates has caused farmland prices to come in alignment with capitalized values.

Interest rates likely will continue to increase into 2023. Average ten-year CMT rates of 4 to 5% are possible. At the 2022 cash rent of $243 per acre, those rates would result in capitalized values of:

- $6,075 per acre at a 4% CMT rate, or 24% lower than the current price of $8,950 per acre.

- $4,860 per acre at a 5% ten-year CMT rate, or 40% lower than the $8,850 current price.

Increasing interest rates put downward pressure on farmland prices. However, countering factors could lead to stable farmland prices, including:

- Farmland returns remain robust. As a result, growth in farmland returns could partially offset the impacts of interest rate increases.

- Market participants may believe that the potential rise in interest rates is temporary. Just as farmland prices did not move up to capitalized values in 2020 and 2021, market participants may take a longer view. Higher interest rates could be transitory because 1) inflation will be expected to return to longer-term target levels, 2) the FED will implement more accommodative monetary policies, or 3) market participants no longer require ten-year CMT rates above inflation rates.

- Farmland may be seen as a hedge against inflation and possible financial disruptions when compared to financial assets such as stocks, bonds, and other financial assets. Funds from outside the agricultural sector could continue to move into agriculture.

A large decline in farmland prices in 2023 is not likely. Still, rising interest rates will put downward pressure on farmland prices and prices of other assets. Prices of used machinery could face similar downward pressures. Moreover, prices of all assets — including stocks, bonds, and other financial assets — will face downward pressure. Selling farmland and moving to another asset class does not completely eliminate the risk of asset value pressures from rising interest rates.

Summary

We likely are moving into a prolonged period of interest rates that are higher than those experienced from 2008 to 2021. Farmers need to adjust to this new reality of: 1) Higher costs on using debt, 2) Higher returns needed to breakeven on investments, and 3) Downward pressures on asset values, including farmland.

While these impacts will make the business of agriculture more difficult, rising interest rates likely will only present severe issues to a small number of agricultural firms. The extent of the financial stress created for the industry will depend on how high interest rates increase in the future, and how long they remain at elevated levels.

Source : illinois.edu