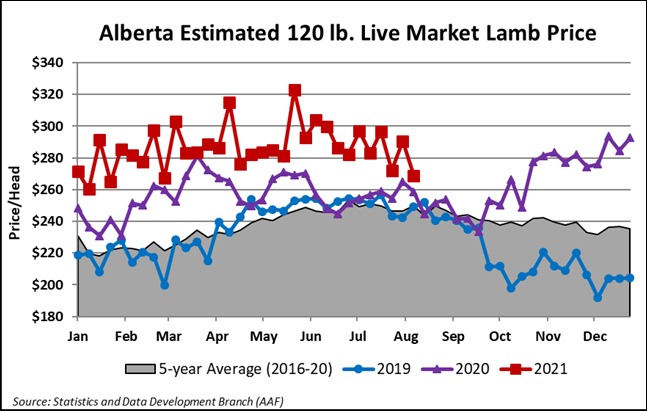

Lamb prices are trading above 2020 levels and the 5-year average.

‘Year-to-date, the estimated live Alberta market lamb price, based off the rail, is averaging $286 per head (120 lbs live weight), up 11.7% from a year ago and 21% higher than the 5-year average,’ says Jason Wood, provincial livestock market analyst with Alberta Agriculture and Forestry. ‘Lamb prices continue to be supported by robust demand and tight supplies.’

Figure 1. Alberta Estimated 120 lb Live Market Lamb Price

Alberta auction prices for light and heavy lambs have been trending lower, recently falling below year ago levels after recording market highs back in April.

‘Seasonally, prices tend to peak in June then trend lower in the second half of the year,’ explains Wood. ‘Besides seasonal price variation, high feed costs and a larger volume of live imported lambs are influencing the local feeder lamb market.’

Canadian live lamb and sheep exports in the first 7 months are 3,096 head, down 62% from 2020 and 42% lower than 2019. Live lamb and sheep import data for the first 6 months of 2021 lists 12,006 head coming into Canada, a significant increase from the reported 8,449 head imported in 2020. Previously, 2013 was the last time live imports were reported at these levels.

Canadian lamb and mutton imports for January to July 2021 are 12,793 tonnes, marginally lower than 2020 but 1.8% above the 5-year average. In 2021, fresh/chilled lamb imports are up 8.8% from 2020, frozen imported lamb has increased 8.6% and processed lamb products are 148% higher. Mutton imports are down 47.2% in 2021 at 1,584 tonnes.

‘Globally, lamb and mutton supplies have tightened. Production levels in Australia and New Zealand are lower than historical averages, while demand continues to rise in Asia. Recovery of Chinese pork production would have the largest effect on global sheepmeat supplies; however, China’s hog sector continues to be affected by ongoing African Swine Fever (ASF) outbreaks.’

Chinese hog prices have declined in response to producer liquidation following ASF outbreaks earlier this year.

‘The decline in quarter 3 Chinese hog slaughter is supportive of stronger hog prices, but this hinges on imported pork volumes and Chinese pork demand. While pork prices have declined, Chinese demand for lamb and mutton remains strong.’

Global container turnaround rates have slowed due to rising COVID-19 variant outbreaks in several countries and weather related events. These disruptions, combined with an under-supply of containers has lifted container shipping rates to 4 to 10 times the typical price.

While there are indications of softening global lamb prices, ongoing tight supplies and high container shipping costs may continue to offer domestic market support in the short-term. However, this is dependent on local supply and demand.

‘Overall, demand is expected to remain steady as we transition through the global economic recovery. Given the current market factors at play, it would not be out of line to expect the current price trend to remain supported this year. Moving into 2022, downward price pressure is expected as global lamb supplies slowly increase and pre-pandemic routines fully return,’ says Wood.

Source : alberta