By Carl Zulauf and Ben Brown.et.al

This article analyzes if the history of 2014 farm bill payments can inform 2018 farm bill decisions between ARC-CO (Agriculture Risk Coverage – county) and PLC (Price Loss Coverage). The analysis finds that the ratio of prior market year average (MYA) price to the expected reference price for the forthcoming market year provides useful information about the upcoming market year’s payments, especially by PLC. The analysis suggests PLC is likely to make higher payments for wheat in the upcoming 2020 market year, consistent with results from payment calculators. For corn and soybeans, the issue of diversification of program choice is raised since the analysis provides little guidance as to whether ARC-CO or PLC will pay more for the 2020 market year. This article builds upon the February 6, 2015 farmdoc daily article by Zulauf.

Overview – ARC-CO and PLC as Different Programs: Three differences are highlighted. First, PLC is a price program that provides assistance only when US MYA price is below the reference price. ARC-CO is a revenue program that can provide assistance with low yields and when US MYA price is above the reference price. Second, assistance starts at 86% of ARC-CO benchmark revenue vs. 100% of the reference price for PLC. Third, ARC-CO payment is capped at 10% of a county’s revenue benchmark. PLC’s cap is much larger. On a per unit basis, the cap on PLC payments is the difference between a program commodity’s reference price and loan rate. For 2019 corn, soybeans, and wheat; this per unit cap is 41%, 26%, and 39%, respectively. In summary, an assistance trade-off exists: assistance with low yields and when market price is above the reference price by ARC-CO vs. larger assistance when market price is below the reference price by PLC.

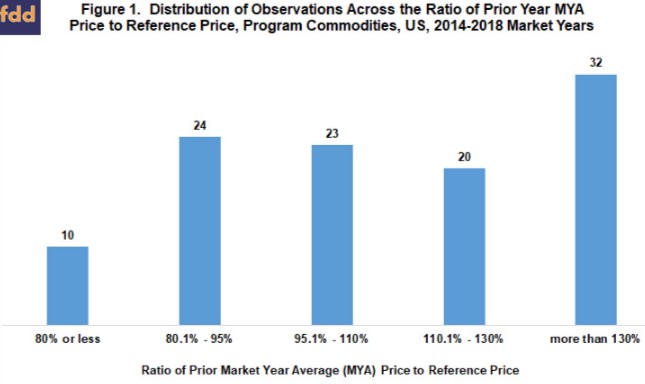

Analysis of 2014 Farm Bill Payments: Ratio of MYA price for the prior market year to reference price for the upcoming market year is found to provide insights into payments for the upcoming market year. Putting this general finding into a specific example, 2013 US MYA corn price was $4.46 while 2014 market year reference price was $3.70, resulting in a ratio of 2013 (i.e., prior year) MYA price to 2014 reference price of 121%. The ratio was calculated for all program commodities for the 2014-2018 market years. There are 109 observations: 22 program commodities times 5 market years, excluding Japonica rice for 2018 (payments not reported yet). Prior year MYA price was 20% or more below the reference price for 10 observations (see Figure 1). On the other extreme, 32 observations had a prior year market price that was more than 30% above the reference price.

ARC-CO and PLC payments for the US are divided by US base acres enrolled in the program during the 2014 farm bill signup period. ARC-CO and PLC payments are adjusted by subtracting payments made to cotton generic base acres in the 2014-2017 market years.

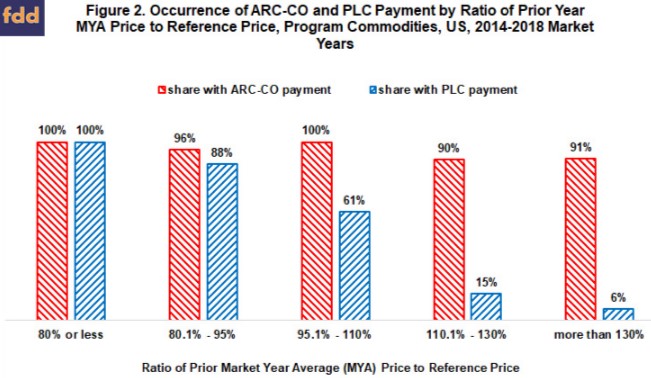

It is often useful to examine payments in terms of whether or not a payment is made and size of the payment when it is made. Both ARC-CO and PLC always made payments when prior year MYA price was 20% or more below the reference price (see Figure 2). As prior year MYA price increased relative to the reference price, share of observations with a PLC payment declined. When prior year MYA price was 30% or more above the reference price, PLC made payments only 6% of the time. ARC-CO made a payment for the US at least 90% of the time, no matter the ratio of prior year MYA price to the reference price. The high occurrence of ARC-CO payments for the US likely reflects that some area of the US experiences a yield-reducing event almost every year.

When made, PLC payments averaged over $50 per base acre if the ratio of prior year MYA price was 5% or more below the reference price but averaged $6 or less if prior year MYA price was more than 10% above the reference price (see Figure 3). Compared with PLC, ARC-CO payment per US base acre when made averaged less in the first situation but more in the second situation. Average program payment when made was similar for the two program options if the prior year MYA price was between 5% below and 10% above the reference price.

Summary of 2014 Farm Bill Experience: Ratio of prior year MYA US price to reference price provided useful information about ARC-CO and especially PLC payments under the 2014 farm bill.

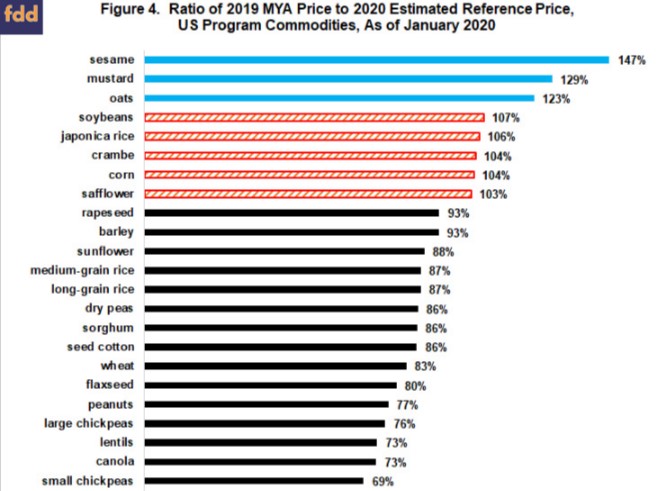

Assessing 2020 Likely Payments: Assuming the 2014 farm bill experience is relevant for the 2018 farm bill, Figure 4 presents the ratio of current Farm Service Agency (FSA) estimates for 2019 US MYA price to the 2020 market year forecasted reference price. For 15 of the 22 program commodities, including wheat; this forward-looking ratio is 5% or more below the 2020 reference price. The 2014 farm bill payment experience in Figures 2 and 3 suggest PLC is likely to make large 2020 payments for these 15 program commodities. 2020 ARC-CO payments are also likely to be notable, but they are notably less than PLC payments. This finding reinforces information from payment calculators (for example, Schnitkey, et al., farmdoc daily, January 22, 2020).

In contrast, the 2014 farm bill experience suggests ARC-CO will likely pay more than PLC across the US for sesame, mustard, and oats. PLC payments are likely to be infrequent and small since 2019 MYA price is at least 10% above the forecasted 2020 reference price for these three crops.

Five program commodities, including corn and soybeans, are in the middle category with a 2019 US MYA price that is between 5% below and 10% above their estimated 2020 reference price. The 2014 farm bill experience suggests this ratio provides little guidance as to which program option will likely pay more.

Program Diversification as a Corn – Soybean Strategy: If expected payments for the 2019 crop, which will be known with a fair degree of certainty after the February 20, 2020 release of county yields; do not make the 2019-2020 program decision; a question of importance could be, “What risk is of more concern for 2020 corn and soybeans?” If low yield is of more concern, then leaning toward ARC-CO seems reasonable. If low price is of more concern, then leaning toward PLC seems reasonable.

Program diversification may also be worth considering for corn and soybeans in this situation. The 2014 farm bill experience suggests it is not clear whether ARC-CO or PLC is likely to make more payments for the 2020 crop year. Diversification is a standard strategy for managing uncertainty. In this situation, it involves choosing different programs for corn and soybeans and/or different programs for the same program commodity across different FSA farms. Diversification rarely ends up with the highest payment but it can increase the odds of getting some payment and thus some risk protection. Besides ARC-CO and PLC, program diversification options include ARC-IC (ARC – individual) and PLC with Supplemental Coverage Option (SCO) insurance. ARC-IC is discussed in the October 29, 2019 and February 11, 2020 farmdoc daily articles (Zulauf, et al. and Schnitkey, et al.). Historical participation in SCO is discussed in the January 31, 2020 farmdoc daily article (Zulauf, et al.).

If diversification has appeal, it is useful to decide on a strategy for matching up program option with program commodity or FSA farms. For example, a reasonable, but not only, diversification strategy for the ARC-CO vs. PLC decision would be to consider putting the county and program commodity with the greater percent yield variation into ARC-CO since yield variability increases the odds ARC-CO will make a payment. Note, diversification does not necessarily mean putting the same number of base acres into ARC-CO and PLC. Also, it is advisable to write down your diversification strategy so you can track performance and make future adjustments.

Summary Observations

ARC-CO and PLC differ on many important features and thus are not substitute programs.

The key trade-off is that ARC-CO is more likely to make payments, primarily because low yields can cause payments, while PLC is more likely to make a larger payment when payments are made.

The March 15, 2020 sign-up deadline is well within the 2019 market year for all program commodities. Considerable, but not all, information will be known about 2019 payments.

Considerable uncertainty exists for 2020 market year payments since this market year starts after the March 15, 2020 sign-up deadline. However, payment experience during the 2014 farm bill suggests the ratio of the 2019 MYA price to the estimated 2020 reference price can provide information about 2020 market year payments, especially by PLC. An implication is that focusing on estimating PLC payments may be a useful decision-making strategy.

When prior MYA price is more than 5% below the reference price, PLC is likely to make large payments. Payments by ARC-CO are also likely to be notable, but also notably less than by PLC. Wheat falls into this category for the upcoming 2020 market year.

When prior MYA price is more than 10% above the reference price, the 2014 farm bill experience suggests PLC payment is likely to be small to nil. ARC-CO payment is likely to be larger.

When prior MYA price is between 5% below and 10% above the reference price, the 2014 farm bill experience is not clear which program option will pay more. Corn and soybeans currently fall into this situation for the 2020 market year.

A key question in this situation is, “What is the more important risk concern?” If low yield is of more concern, then leaning toward ARC-CO seems reasonable. If low price is more of a concern, then leaning toward PLC seems reasonable.

Another strategy is to diversify program choice across crops (in this case, corn-soybeans) and FSA farms. One reasonable, but not the only, diversification strategy is put crop(s) or county(ies) with more variable yields into ARC-CO (low yields can trigger ARC-CO but not PLC payments).

In conclusion, it is worth emphasizing that the past does not always predict the future. But, assuming the historical experience of 2014 farm bill payments remains relevant for the 2019-2020 market years, this historical analysis reinforces information from payment calculators for wheat. It also provides new information and perspectives for consideration, such as for corn and soybeans.

Source : farmdocdaily