By Carl Zulauf and Gary Schnitkey et.al

This article continues the assessment of the FARM (Farmer Assistance and Revenue Mitigation) Act of 2024 initiated in the November 4, 2024 farmdoc daily. FARM’s coverage of current estimated 2024 economic loss varies considerably by crop, potentially prompting the “fairness issue.” Moreover, commodity program payments will not be known until October 2025. This information hole increases the odds of miscompensation, providing another reason to move commodity program payments forward from the end of the marketing year (farmdoc daily, October 30, 2024).

Estimated 2024 Economic Loss

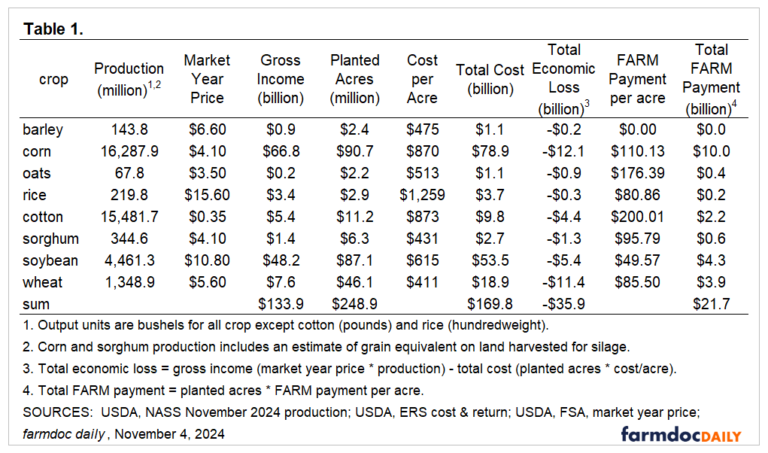

Economic loss from 2024 production of barley, corn, oats, rice, seed cotton, sorghum, soybeans, and wheat are estimated using current data for 2024 output, planted acres, market year price, and total economic cost of production. These crops are the eight listed in the FARM act, although the legislation defines eligible commodities as all covered commodities in the Farm Bill (farmdoc daily, November 4, 2024). Economic cost of production includes a charge for all inputs except management, including an opportunity cost return for unpaid labor and owned land. Inputs are determined by the US Department of Agriculture, Economic Research Service (USDA, ERS).

Estimated economic loss for 2024 production of the eight crops totals -$35.9 billion (see Table 1). Each crop has an economic loss, ranging from -$12.1 billion for corn and -$11.4 billion for wheat to -$0.3 billion for rice and -$0.2 billion for barley. Cotton includes upland cotton, pima cotton, and cottonseed; rice includes long-grain, medium grain, and small-grain; and corn and sorghum production includes an estimate of grain equivalent on land harvested for silage. The latter uses current estimates of 2024 US corn and sorghum grain yields (183.1 and 60.8, respectively) and planted acres, as well as share of planted acres harvested for grain and silage over 2019-2023 (corn, 98%; sorghum, 90%).

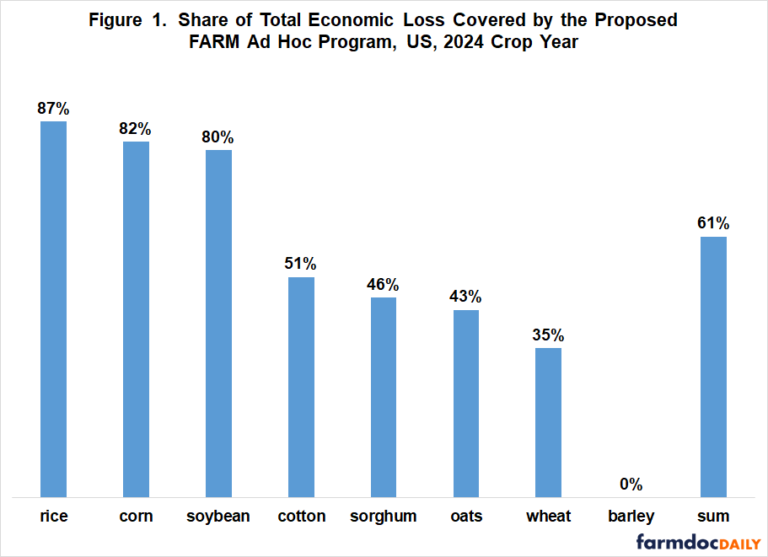

Economic Loss Covered by FARM

Estimated payments by FARM cover $21.7 billion or 61% of the $35.9 billion of total economic loss incurred from producing in 2024 the eight crops listed in Table 1 and Figure 1. Share of the estimated loss covered by the estimated FARM payments by crop ranges from 87% (rice) to 0% (barley) (see Figure1). Coverage is 82% for corn and 80% for soybeans. For the remaining four crops, coverage ranges from 51% for cotton to 35% for wheat. The per acre FARM payment rates in Table 1 are from the November 4, 2024 farmdoc daily.

The large variation in FARM coverage of economic loss across crops prompts the “fairness question,” especially since most farmers plant multiple crops and the rationale for FARM assistance is a decline in US market-wide revenue and prices from recent levels while production costs remain high.

Potential Commodity Program Payments

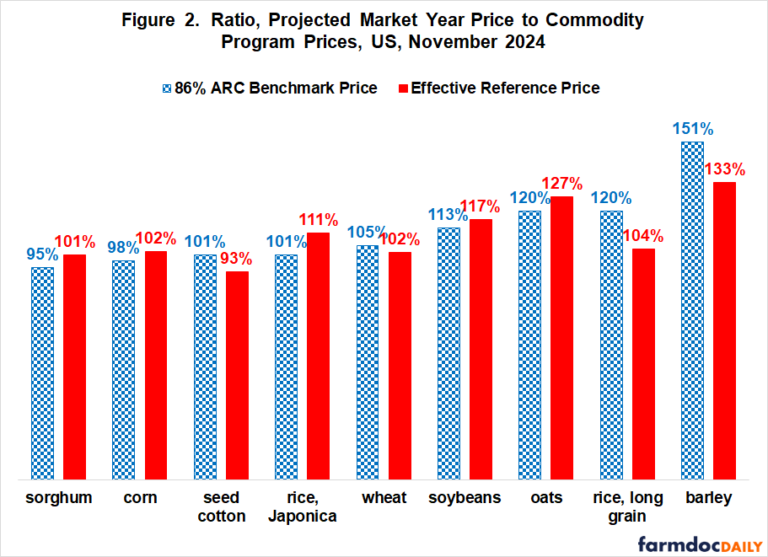

Any payments by the ARC (Agriculture Risk Coverage) and PLC (Price Loss Coverage) commodity programs for the 2024 crop will reduce the economic loss for 2024. These payments will not be known until October 2025, but the ratios of the current forecast for US 2024 market year price to 86% of ARC benchmark price and PLC effective reference price provide an indication of the potential for payments. ARC pays if market year price is below 86% of ARC’s benchmark price, assuming county yield equals ARC trend yield. PLC pays if market year price is below the effective reference price. USDA, Farm Service Agency data are used to calculate the ratios.

Currently, ARC payments for corn and sorghum and PLC payments for cotton are likely as their ratios are below 100%. ARC payments have a reasonable chance for seed cotton, Japonica rice, and wheat, especially for counties with yields below trend. PLC payments have a reasonable chance for sorghum, corn, wheat, and long-grain rice. Payments for all these crop-program combinations will depend on the eventual resolution of 2024 market year prices and county yields. While payments for these crop-program combinations are unlikely to be large, they could be notable. Any such payments should be counted as reducing economic loss for 2024.

Note that FARM proposes to make payments on planted acres while ARC and PLC make payments on historic base acres. With a few exceptions, any crop can be planted on a base acre. It is thus questionable if commodity program payments should count against the crop assigned to the base acre. However, to not count ARC and PLC payments as reducing economic loss is to overcompensate farmers. A metric is thus needed to divide ARC and PLC payments that are made on base acres among the acres planted to crops.

Potential Crop Insurance Payments

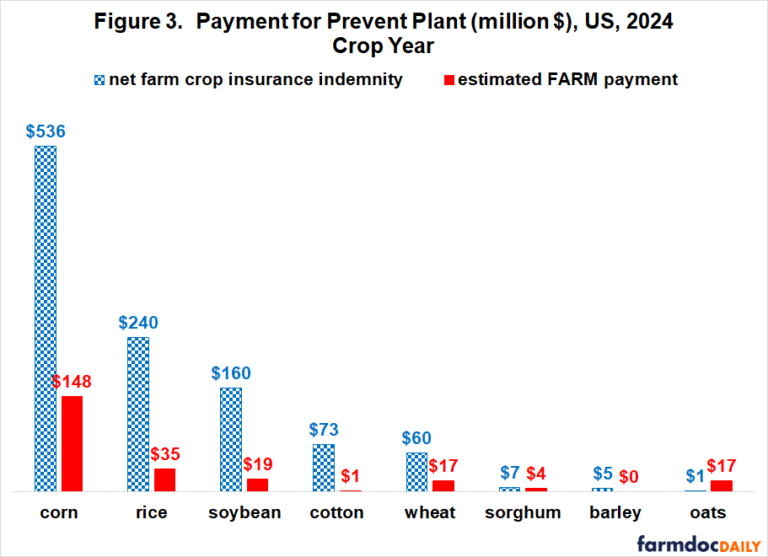

Crop insurance provides a net benefit to farmers when indemnities exceed premiums paid by farmers. One set of 2024 crop insurance payments is largely known at present, specifically prevent plant. Using the cause of loss file maintained by RMA (Risk Management Agency), crop insurance has made 2024 prevent plant indemnity payments net of farm-paid premiums ranging from $536 million for corn to $1 million for oats (see Figure 3). For the eight crops, net prevent plant payments total $1.1 billion. FARM’s estimated payments for prevent plant are $0.2 billion. They are calculated using data in Table 2 of the November 4, 2024 farmdoc daily. Prevent plant acres indemnified by crop insurance total 4.1 million. Prevent plant acres reported to FSA total 4.7 million (farmdoc daily November 4, 2024). The size of crop insurance payments for prevent plant prompts a question, “Should FARM make payments for prevent plant?”

Crop insurance indemnities for low production on harvested acres is just beginning for crops with an October harvest price discovery period. These crops include the large acreage crops of corn, soybeans, sorghum, and cotton. RMA’s Summary of Business currently reports that 2024 indemnity payments to the eight crop in this study are $234 million less than the $3.4 billion in premiums paid by farmers (prevent plant is included in both numbers). Crop insurance indemnities will almost certainly exceed premiums paid by farmers, reducing the economic loss of US farmers for 2024 crops. Unlike commodity program payments, crop insurance payments are to a specific crop.

Discussion

As indicated in recent farmdoc articles (see e.g., farmdoc daily, September 26, 2024), US farmers, as a group, will incur notable economic loss in 2024, resulting from the systemic market risks of declining revenue and prices while costs remain high.

The first question in designing a public policy response is, “What share of the systemic risk downturn should farmers bear?” FARM proposes a 39% farmer share. This share is roughly consistent with the fact that farmers pay 38% of crop insurance premiums for the crops in this study. However, is 39% too small given that farmers have considerable self-insurance built up over the last three years not only due to high market returns but also large ad hoc assistance payments? “Has society already contributed to 2024 systemic risk assistance for farmers?”

The second question is, “Should the coverage of economic loss be the same or vary by crop?” FARM’s design leads to a rather large range in coverage by crop. “Is this range too wide given that almost all farms grow more than one crop and that the risk being addressed is systemic market wide?” Varying coverage by crop favors some crops and regions. If a more uniform coverage rate is desired across crops, a simple fix is to use current 2024 yield estimates rather than the proposed 10-year average of yields for the 2014-2023 crop years.

The third question is, “Should payments by existing safety net programs be counted toward economic assistance by crop?” To conclude otherwise is to invite the potential for excessive public assistance. By the time economic ad hoc assistance, if any, becomes law; payments by crop insurance will likely be close to known, except for payments by area insurance products; as will any ad hoc assistance for production disasters, such as hurricanes. But, commodity program payments will not be known until October 2025.

From the standpoint of providing appropriate assistance, it is desirable to know commodity program payments. The solution is to bring commodity payments forward as proposed in the farmdoc daily of October 30, 2024 to fix the timely payment hole in the current farm safety net. The proposed fix would use futures prices instead of marketing year prices, allowing payment to be made at harvest of this year, not harvest of next year.

In summary, one component of any ad hoc assistance package for the 2024 crop should be to use the ad hoc assistance to address the timing hole in the current crop safety net and thus making timelier commodity program payments an annual feature of the crop safety net. Additional ad hoc assistance should be provided only if it is deemed appropriate after fixing this hole.

Source : illinois.edu