The value of agriculture in Alabama is a significant component of the economy. In 2018, the USDA reported farm gate commodity sales totaled $5.8 billion.[1] Livestock, poultry, and aquaculture make up over 77% of the total, combining for $4.5 billion. The greatest value is in broilers ($3.5 billion) with cattle and calves accounting for $524 million. Crops totaled $1.25 billion, of which cotton was $310 million and feed crops were $221 million. However, net cash income (excluding government payments) for Alabama agriculture was 25% less in 2018 compared to the recent peak of 2014. Agriculture has also faced great uncertainty and risk in production in recent years from weather events and trade disputes, with the global coronavirus pandemic now adding to the concern.

COVID-19 Ag Impact Survey

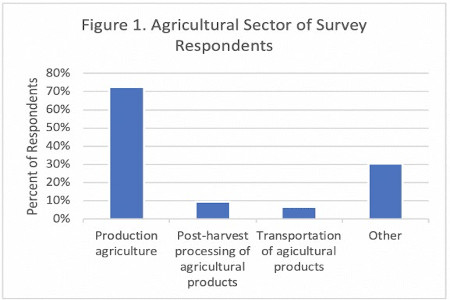

In an effort to assess the impacts of COVID-19 on Alabama agriculture and closely related industries, Auburn University and the Alabama Cooperative Extension System conducted an online survey of agricultural producers and agribusinesses in June 2020.[2] A total of 181 responses were obtained across all agricultural related sectors in Alabama. Figure 1 shows the distribution between production agriculture, post-harvest processing, and transportation sectors.

A total of 72% of the respondents classified their business as production agriculture, including farming, ranching, forestry, and aquaculture. The “other” category also received a large number of responses, with 30% of respondents indicating they had operations that fell under another business sector classification. Many of these were specified as landscaping and turf industry, as well as farmer’s markets. It is important to note that respondents could have chosen more than one sector for their business.

Farmers Report Mixed Impacts

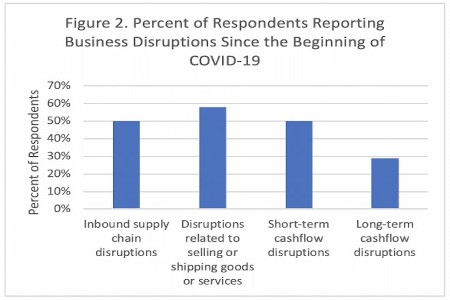

With approximately three to four months having passed since significant impacts started to be felt in the US, many agricultural producers and agribusiness in Alabama have reported no change in operations for their business. However, 41% reported an altered customer base while 26% reported needing to alter products and/or services. Furthermore, some businesses have had more substantial impacts. Figure 2 shows the percentage of respondents that have experienced impacts on receiving inputs for production, distribution of goods and meeting cashflow needs, with 50% or more experiencing immediate issues. From a long-term perspective, almost 30% of respondents indicated they have experienced long-term cash flow disruptions.

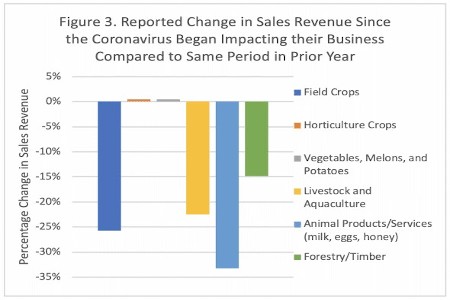

Respondents were also asked to compare their total sales revenue since the coronavirus began impacting their business. Compared to the same period in 2019, producers of field crops reported a 26% decline in sales revenue, while producers of forestry and timber (including pine straw) reported a 15% decline. Livestock and aquaculture were presented as a combined question in the survey, with a 33% overall decline. Within that sector, beef cattle producers reported a 25% decline, aquaculture producers (primarily food fish producers in our sample) reported a 27% decline, and poultry producers reported an 8% decline. While these broad categories show significant decreases in revenue for many sectors, the impact is not uniform across all commodities. Respondents of horticulture crops (greenhouse and nursery) reported a slight increase in sales revenue, although the range of responses was significant and negative for some producers. Unfortunately, we have insufficient data at this time to report at more refined levels.

Stimulus Packages

In response to hardships suffered from the pandemic, the US government passed a series of economic stimulus packages to help businesses impacted by the virus. In particular, the Coronavirus Food Assistance Program (CFAP) was targeted to agricultural producers. This program is designed to provide financial assistance to producers of specific commodities that have sustained marketing losses. Commodities eligible for payments include cotton, corn, soybeans, cattle, dairy, and an assortment of fruits and vegetables.[1] As of July 6, 2020, a total of 8,971 applications from Alabama producers have been submitted to the United States Department of Agriculture (USDA) Farm Service Agency (FSA) and $56.4 million in payments have been approved.

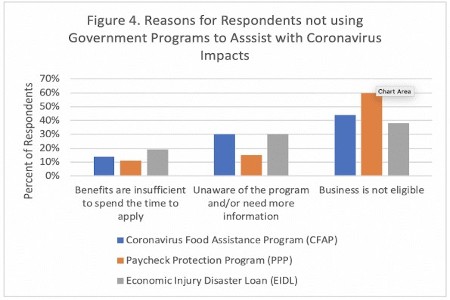

The survey also assessed participation and reasons for lack of participation in related government programs. Respondents to the survey were asked if they have participated or intend to participate in three different programs. CFAP was the most popular one with 43% responding they are participating, followed by 42% of respondents for the Paycheck Protection Program (PPP), and 12% for the Economic Injury Disaster Loan (EIDL). Respondents who indicated they are not participating were then asked for reasons they are not participating. Respondents reported a combination of insufficient benefit levels, a need for additional information, and business ineligibility, as shown in Figure 4. The lack of eligibility for CFAP is not surprising with the relatively narrow commodity scope. However, those that reported their business is not eligible for CFAP, also reported a 39% decline in sales revenue.

Survey Results

While the results of this survey represent a snapshot of Alabama agriculture, they do identify some of the challenges faced by agricultural producers and agribusinesses in the state. Government programs designed to alleviate these issues are not applicable to all businesses or they are viewed as not providing sufficient benefits. Additional education is also needed on program availability to ensure businesses are aware of the available resources.

Disruption Continues

As COVID-19 continues to spread throughout the country, agricultural producers and agribusinesses will continue to experience issues with uncertain and changing markets, risks of further disruptions in the supply chain, and increased costs of doing business. Businesses need to use caution in mitigating the risks of exposure as well as the risk to their operations. The impact on agriculture will not be fully realized until seasonal crops are harvested and marketed, supply chain disruptions are further restored, and virus outbreaks are contained.

[1]http://www.ers.usda.gov/data-products/farm-income-and-wealth-statistics.aspx

[2]The survey instrument was adapted from an Assessment of COVID-19 Impacts on Florida Agriculture developed by Christa Court, John Lai, and Andrew Ropicki at the University of Florida, Food and Resource Economics Department.

[3]Specific details and a complete list of commodities eligible for CFAP can be found at http://farmers.gov/cfap

Source : aces.edu