By Doug Mayo

Source: NASS July 1 2021 Cattle Report

Source: NASS July 1 2021 Cattle Report

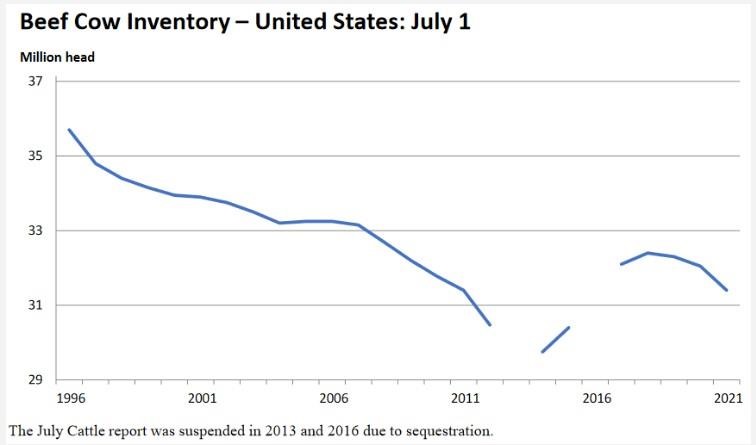

USDA’s National Agricultural Statistics Service (NASS) released the July 1, 2021 Cattle Inventory Report at the end of last month. This report shows that the National Cattle Inventory has continued to shrink since the peak in 2018. The chart above tracks the national inventory of beef cows that calved. You can see the decline in inventory since the most recent peak of 2018.

Source: NASS July 1 2021 Cattle Report

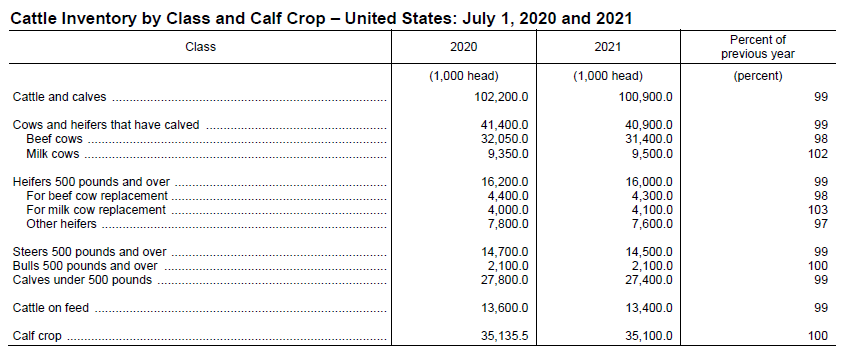

In the report, NASS broke down the inventory by class of animal. You can see that the all cattle and calves inventory is down only 1% from 2020, but beef cows and beef replacement heifers are down 2% since last year. Interestingly dairy cattle are up 2%, and replacement diary heifers are up 3% this year with the recent increase in milk prices. Dairy cattle contribute to the beef supply at some point, but the dairy herd represents not quite a third of the total cattle inventory. Weaned calves and steers are off 1% from last year, as were cattle on feed. The glut in the feedyards of cattle waiting for slaughter and processing is also improving, with slightly fewer cattle to be fed this coming year. The final class reported where the 2021 calf crop which was off very slightly (less than 1%) from last year.

What does this mean for local ranchers?

The national beef cow herd is still shrinking. Economics 101 tells you that when you reduce the supply of a commodity, the price or value of the product should improve, as long as demand for the product is constant or improving. With restaurants and schools back open for in-person business, demand for beef should also continue to improve. We have definitely seen higher demand for beef in grocery stores since COVID19 took hold last spring. While there were real issues getting beef processed in 2020, that issue is also improving. The drought in the western states is likely the most significant reason for the reduction in beef cattle this year, but this reduction should be of benefit to producers in the South where rainfall has been much more plentiful. This is one of the tough things about agriculture, western ranchers are in trouble, but eastern ranchers benefit from the improved market price. While the change in inventory reported were not large changes, it is good news that national beef herd is still contracting. Cattle prices should continue to improve, baring some major economic jolt to the system that changes demand for the product. As more and more people are employed again, and are working away from home and traveling, demand for beef should also continue to improve. As more Americans eat food from restaurants, we should also see the value return for high quality products as well. But, the changes highlighted in this recent report are still relatively small, so I would not get too excited about this yet. It is still moving in the right direction though, so there is reason for optimism in the future.

Source : ufl.edu