By Ryan Hanrahan

Reuters reported at the end of this past week that “the U.S. government on Friday released short-term guidance on how companies can secure clean fuel tax credits under the Inflation Reduction Act, but fell short of finalizing the program’s key details.”

“Biofuels groups are eager for clarity on the tax credits for fuels that combat climate change, which they hope will ultimately provide a pathway for corn-based ethanol to expand its market as a feedstock for sustainable aviation fuel,” Reuters reported. “The U.S. Treasury Department issued the guidance, saying it provides new details on how to ensure fuels meet certain emissions-reductions criteria to access the subsidy, and adding that a crucial climate model upon which the program relies will be available in the coming days.”

“‘This guidance will help put America on the cutting-edge of future innovation in aviation and renewable fuel while also lowering transportation costs for consumers,’ said Deputy Secretary of the Treasury Wally Adeyemo,” according to Reuters. “…Reuters reported earlier on Friday that the administration intends to release the program’s climate model next week, but that it will not include adjustments for so-called climate smart agriculture practices – like no-till farming – which the ethanol industry hoped it could use to meet lifecycle emissions requirements.”

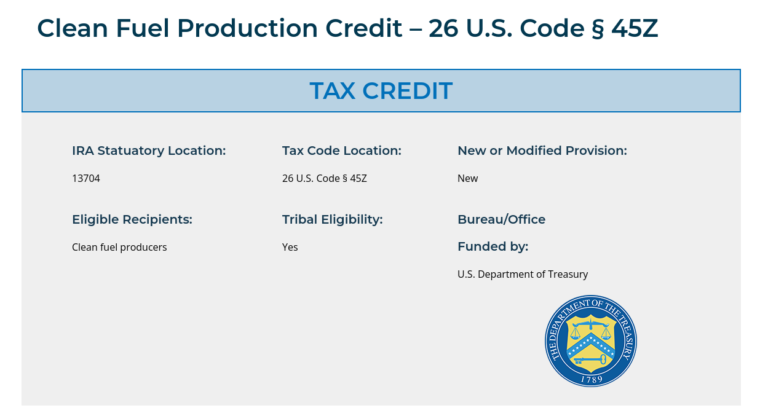

Agri-Pulse’s Rebekah Alvey reported that “it will be up to the incoming Trump administration to finalize the guidance for the credit, which was authorized from the Inflation Reduction Act and consolidates expired credits for biodiesel, renewable diesel, alternative fuels and sustainable aviation fuel. The new administration will also have to clarify what farming practices will be required for eligibility. The credit took effect Jan. 1 and expires at the end of 2027.”

Renewable Fuels Industry Says Guidance Lacking

Bloomberg’s Kim Chipman and Michael Hirtzer reported Friday that “US biofuels and corn groups criticized the overall guidance as lacking details on what qualifies for tax credits.”

“Geoff Cooper, chief executive officer of ethanol trade group Renewable Fuels Association, said it fell short of expectations and doesn’t give producers of corn-based US ethanol the certainty they seek,” Chipman and Hirtzer reported. “Emily Skor, CEO of ethanol lobbying group Growth Energy, said the guidance ‘still lacks the critical details that are needed to help ensure that American biofuel producers and their farm partners can lead the world in clean fuel production.'”

“The National Corn Growers Association said more clarity is needed about the specific environmental practices that will be required for accessing the credit,” Chipman and Hirtzer reported. “‘What a missed opportunity for growers,’ said President Kenneth Hartman Jr., an Illinois farmer.”

In addition, Successful Farming’s Mariah Squire and Noah Rohlfing reported that the American Coalition for Ethanol said that “‘ACE thanks the Biden Treasury Department for issuing preliminary guidance, acknowledging the need to incorporate climate-smart agriculture practices, and agreeing that emission values should be determined using the most recent GREET model, which is updated annually,’ said ACE CEO Brian Jennings. ‘Despite this step in the right direction, the job is unfinished because the preliminary guidance doesn’t provide the clarity our industry has been awaiting. The guidance omits key details essential for biofuel producers to capitalize on 45Z, including how climate-smart agriculture practices will be incorporated. Our focus will be to engage the incoming Trump administration to make the final regulations for the 45Z credit beneficial for our members.'”

Guidance Will Likely Curb Used Cooking Oil Imports

Bloomberg’s Chipman and Hirtzer also reported Friday that “the US is moving to curb imports of used cooking oil, preventing foreign supplies used to make biofuels from qualifying for a lucrative tax credit.”

“In long-awaited guidance, the US Treasury signaled that fuels made with foreign-sourced supplies won’t be allowed under the so-called GREET model, a Department of Energy tool used to determine the full sweep of greenhouse gases emitted from the transportation and energy industries,” Chipman and Hirtzer reported. “The move comes after a flood of supplies from China reached US shores at cheaper prices than soybean oil produced locally. The decision is a win for American farmers, who have been counting on a boom in soy-heavy biofuels like renewable diesel to sell their crops.”

“The issue of foreign used cooking oil has been a growing concern of agriculture groups and lawmakers over the past year. Growers bristled as they saw soybean prices plunge as UCO from Asia flowed into the country for making fuels like renewable diesel and SAF. Fuel made with UCO is highly valued in low-carbon fuel markets like California because of its relatively small carbon footprint,” Chipman and Hirtzer reported. “Adding to the outcry was suspicion that China shippers were adding fresh palm oil to UCO, making it fraudulent under US renewable fuel law. Palm, the world’s most widely used vegetable oil, is a bane to environmentalists and many countries because the industry is a key driver of deforestation in places like Indonesia and has been tied to labor abuses.”

“The Treasury rules issued on Friday allow fuels made with UCO from the US to qualify for the 45Z credit, which provides a per-gallon, or gallon-equivalent, tax credit for makers of so-called clean transportation fuels based on the carbon intensity of production,” Chipman and Hirtzer reported.

Source : illinois.edu