By Joana Colussi, Nick Paulson et.al

Department of Agricultural and Consumer Economics

University of Illinois

Brazilian farmers have begun harvesting the second crop of corn – known as “safrinha” – and expect production to reach 4 billion bushels (102 million metric tons), which would be a record and should drive the recovery of world ending stocks. The record crop, combined with price declines in the international market, has resulted in a 30% decline in the price of corn in the Brazilian market in recent months. Crop sales, for both the 2022/23 soybean and corn crops, have occurred at a relatively slow pace, lagging historical levels for the same time period. The combination of lower corn prices and a shortage of storage capacity in Brazil will be issues to monitor closely as the harvest continues to advance into June and July.

Record Second Crop Corn Production

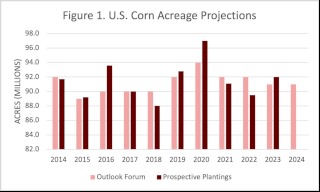

Brazil’s second-crop corn production for the current season is projected to be 4,030 million bushels, an 11% increase over the previous year, according to data from Agroconsult, a private Brazilian consultancy. In the last estimate made in March, the projection was for a harvest of 3,826 million bushels. The higher projection has resulted from favorable weather. The area in Brazil planted to corn remained the same as last year – about 41 million acres (see Figure 1) – but expected corn yields have increased.

Good weather has fostered high yields, which are expected to reach 97.6 bushels per acre, 11% higher than last crop season. Although the second corn crop has become Brazil’s primary corn crop and an increasing share of world corn production, safrinha yields are more variable than Brazil’s first crop. Yields for the last five harvested crops (2017/18 – 2021/22), for example, averaged 92 bushels per acre in the first crop and 80 bushels per acre in the second crop, according to data from Conab.

As of June 3rd, about 1% of the second corn crop was harvested in Brazil, according to the National Supply Company (Conab), Brazil’s food supply and statistics agency. Six percent of the safrinha corn in Mato Grosso, the country’s largest corn-producing state, had been harvested by June 2nd, according to the Mato Grosso Institute of Agricultural Economics (Imea). The harvest should begin in earnest across Brazil by mid-June.

Declining Domestic Corn Prices

Corn prices have fallen by nearly one-third in Brazil since April, as the country expects to harvest a record crop this season and markets seemingly have adjusted to the Ukraine-Russia war. In Campinas, São Paulo state, corn cash prices are below $5 per bushel, well below the highs of more than $8 per bushel in March 2022, according to data from the Center for Advanced Studies in Applied Economics of “Luiz de Queiroz” College of Agriculture (Cepea/Esalq) at the University of São Paulo (see Figure 2).

In Mato Grosso, responsible for almost half of the country’s second season corn production, the average cash price for corn was $3.11 per bushel on June 2nd, the lowest level since July 2020. From January to May 2023, the cash price fell 40% in Mato Grosso, according to data from the Mato Grosso Institute of Agricultural Economics. With the advance of the harvest in June and July, it is expected prices will fall even further. The U.S. corn crop is also expected to be a record in 2023 with projections of a harvest of 15,265 million bushels, an increase of 1,535 million bushels from the previous year, according to the U.S. Department of Agriculture (USDA).

The cash price for corn has fallen significantly from its high in March 2022 but remains above price levels in the first half of 2020. In other words, corn prices have declined from recent market highs to levels that would be considered more typical averages. Fertilizer prices have also trended downward since reaching record highs in 2022. Some relative stability in fertilizer markets may have also been achieved as the Ukraine-Russia war continues (see farmdoc daily, February 28, 2023).

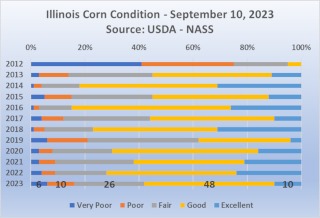

Large Soybean Stocks

Brazilian farmers in various states plant corn immediately after the soybean harvest, typically in February. Brazilian farmers have been slow to sell the 2023 soybean crop amid decreasing prices. Brazil’s 2023 soybean harvest, estimated by Conab at 5,688 million bushels (155 million tons), topped the prior record by 11%. As of June 2nd, about 57% of the soybeans produced in the 2022/23 crop season had been sold in Brazil, compared with the five-year average of 73% for that same time period, according to Safras & Mercado, a private Brazilian consultancy (see Figure 3). This means that almost 2,572 million bushels of soybeans (equivalent to 70 million tons) are stored in warehouses in Brazil, while a record safrinha harvest is underway.

Sales of the second corn crop have also lagged historical pace. As of June 2nd, 27.5% of the safrinha crop had been sold in Brazil, compared with the five-year average of 39% for that same time, according to Safras & Mercado. In other words, almost 3,000 million bushels of corn (75 million tons) have yet to be sold and will need space to store once harvested.

In the current crop season, the storage deficit is expected to reach more than 100 million tons in Brazil, according to data from Conab. The grain storage deficit in Brazil is concentrated in the Center-West states and the Matopiba region, northern agricultural frontier. Matopiba is formed by the Brazilian state of Tocantins and parts of the states of Maranhão, Piauí, and Bahia. In Brazil, only 15% of farms have warehouses or silos (see farmdoc daily, November 23, 2022).

In Mato Grosso, for example, the storage capacity is 1,617 million bushels (44 million tons), while grain production for the 2022/23 crop season is estimated at 3,344 million bushels (91 million tons), more than double the storage capacity, according to Imea. The lack of storage capacity and record production suggest even more downward pressure on corn prices.

Source : illinois.edu