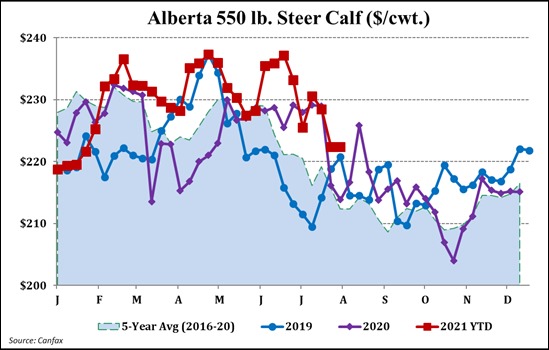

Alberta feeder cattle prices trend in line with seasonal expectations and have remained above the 5-year average throughout most of 2021.

‘Calf prices typically follow a seasonal decline into the fall as the volume marketed increases,’ says Jason Wood, livestock market analyst with Alberta Agriculture and Forestry. ‘Alberta steer calves have declined 7% in the last 7 weeks, averaging $220.83/cwt the second week of August, which is over $4/cwt higher than the same week a year ago.’

The Alberta steer calf market has ranged between $219/cwt and $237/cwt this year. Year-to-date, 500 to 600 lb steer calves are averaging $229.48/cwt, up 2% from 2020, 3.4% above 2019 and 1.9% above the 5-year average. Forward/electronic sales of 500 to 600 lb steer calves, for October/November delivery, averaged just under $215/cwt the second week of August.

‘Low yields, high feed costs and an above average volume of feeder cattle at auction are expected to pressure calf prices into the fall’ explains Wood.

Figure 1. Alberta 550 lb Steer Calf ($/cwt)

Southern Alberta barley prices averaged $392/tonne in July, compared to $246/tonne a year ago. For the second week of August, southern Alberta barley ranged from $415 to $425/tonne. New crop barley bookings, delivered southern Alberta have recently been reported at $325 to $345/tonne, appearing to be capped by purchases of US corn. Buyers in southern Alberta have been actively booking US #2 corn with recent sales reported between $350 and $370/tonne for new crop delivery.

‘The cost of feed affects a feedlot’s willingness to pay or purchasing power for feeder cattle,’ says Wood. ‘The decline in southern Alberta feed barley costs of $47/tonne between July ($392/tonne) and current new crop reported sales ($345/tonne) should be a net gain for calf prices. However, other factors such as the number of calves on offer and forward fed cattle prices will also affect prices. Deferred live cattle futures have been moving higher but a change in this trend could lead to additional downward pressure for feeder cattle.’

A look at breakeven pricing

How does the current to new crop price decrease of $47/tonne for feed barley affect the feeding period and the price a feedlot is willing or able to pay for a 550 lb steer calf?

Using the average volume of barley required to finish a steer calf to a fed weight of 1,325 lbs, the $47/tonne decrease in barley lowers the cost of gain by about $13/cwt. The lower cost of gain of $13/cwt implies that a higher price can be offered on a steer calf. In this case, a buyer’s ability to bid increases by about $19/cwt on a 550 lb feeder steer calf. All calculations assume a constant breakeven sale price for the fed (slaughter) steer.

‘But this estimate does not take into account that feedlot margins are currently below breakeven,’ says Wood. ‘Therefore, what is a feedlot’s breakeven purchase price for a steer calf?’

Pricing against the April 2022 live cattle futures contract, a July barley price of $392/tonne, an 80-cent dollar and accounting for other finishing costs, the estimated breakeven purchase price on a steer calf works out to $207/cwt. August barley prices are averaging higher than in July.

Using the same variables above, but changing the average southern Alberta feed barley price to $420/bushel as reported for the second week of August, returns a breakeven steer calf purchase price of $196/cwt.

Using a new crop barley price of $345/tonne, a steer calf placed on feed this fall and finished against the June 2022 live cattle futures has an estimated breakeven purchase price of $211/cwt.

‘These examples indicate there is little upside in the calf market this fall. Strengthening live cattle futures, weaker Canadian dollar, stronger basis levels or lower feeding costs would support stronger calf prices. However, current feed and market conditions suggest there is likely more downside risk on calf prices as we head into the fall run,’ says Wood.

Source : alberta