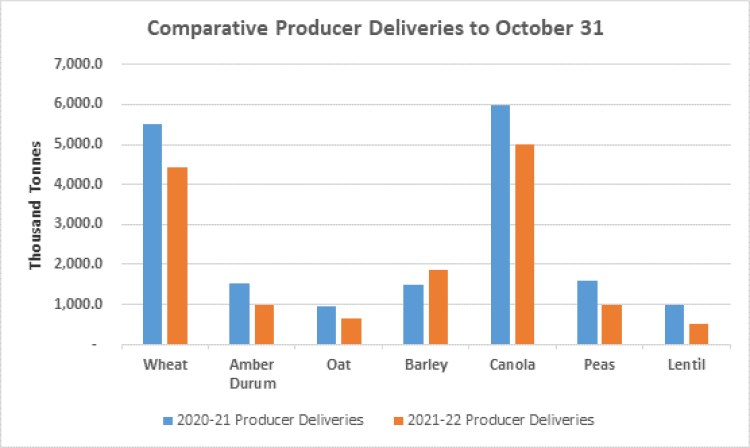

Producer deliveries for most crops are lower due to reduced carryover into this crop year and the drought-reduced crop.

Crop market demand

‘Weekly updates from the Canadian Grain Commission (CGC) provide useful crop market demand information,’ says Neil Blue, provincial crops market analyst with Alberta Agriculture, Forestry and Rural Economic Development. ‘The Canadian Grain Commission numbers include only movement of bulk crops through facilities licensed by the CGC, so exclude container movement of crops as well as overland crop movement to the U.S.’

The latest CGC numbers on Canadian crop movement from August 1 through October 31 show producer deliveries for most crops are lower due to reduced carryover into this crop year and the drought-reduced crop. The notable exception is barley. Crop year to date barley deliveries into licensed facilities are 1.86 million tonnes compared to 1.48 million tonnes a year ago.

Countering the reduction in available crop supplies are the early completion of harvest and the historically attractive crop prices.

Figure 1. Comparative producer deliveries to October 31

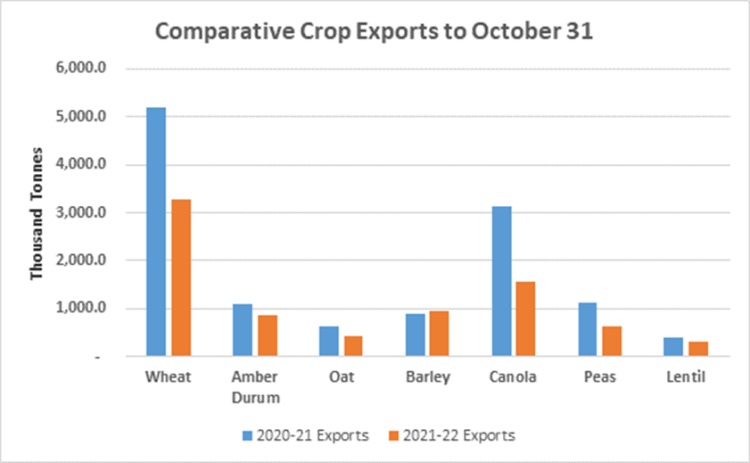

Exports of all major Western Canadian crops are lower so far this crop year except for barley. However, exports are not as low as they could be, considering the reduced available supplies.

Figure 2. Comparative crop exports to October 31

‘Domestic usage of these major crops is similar to or even higher than year ago levels. For some of these crops such as barley and canola, the current pace of exports plus domestic usage is not sustainable for the balance of the crop year, based on current estimates of available Canadian supplies. The function of price is to meter out demand to available supply. That is why prices have remained at historically high levels and have even exceeded all-time highs for some crops,’ says Blue.

Source : alberta