Propane and natural gas are the primary heating fuels used by commercial poultry growers across Alabama and the southeastern broiler belt. Heating fuel is often a significant portion of the farm’s variable expenses. Depending on the farm location, local weather pattern, bird size, and number of flocks per year, heating fuel expense for a poultry enterprise can vary from as low as 10% to as high as 40% of the total variable costs. Most often, propane is paid for on an as-delivered basis or an arrangement is made to be paid at the end of a flock of chickens. Sometimes these delayed payment arrangements carry fees or interest that can increase costs. This often results in an uneven expense outlay throughout the year since most of the heating costs occur during winter months. Even with natural gas that is typically billed monthly, the winter months will bring most of the cost.

With the high cost of heating, it is necessary for a poultry grower to pay attention to price changes and trends in the propane and natural gas markets to better prepare for these large expense outlays that may or may not coincide with flock settlement payments. This knowledge must be combined with long range local weather forecasts and matched up with the current flock cycle. If a grower will be brooding chicks during an especially cold time of year, or even a local snap of cold weather, they will likely incur a larger than average heating bill for that flock. Being able to foresee this potential weather gives a grower the opportunity to take steps to secure ample supply of the lowest-priced heating fuel possible in the short-term. Long-term, it is always beneficial for the poultry grower to closely examine their grow-out structures, looking for every possible way to economically insulate, seal, tighten, and otherwise make their houses more fuel efficient. These efforts will pay dividends for years to come, but what can a grower do to address rising heating fuel prices today?

Ways to Address Rising Fuel Prices

Emergency Budgeting

The first step is proper emergency budgeting. Having cash set aside for fuel expenses is the best defense against being blindsided by an unexpectedly high fuel bill. This can be a difficult proposition for many farms operating on tight margins, but it can be done with some proper planning and budgetary discipline. It may not be possible to bank an entire year’s fuel bill, but that is often not necessary. Having an emergency fund available that would cover one typical cool-weather flock’s fuel bill can prevent a disastrous financial situation that can create a cascade of financial catastrophes. It is recommended that every poultry grower build and maintain such an emergency fund to help cover the situations that will inevitably occur.

Forward Contracting Fuel

The second way to lessen fuel cost risk is by forward contracting or forward purchasing fuel. These methods usually involves liquefied petroleum gas (LP). Forward contracting is simply a way of locking in a price today in the expectation of cash prices increasing in the future. Most LP companies have pre-purchase or forward contracting programs, but they are not all the same. Sometimes price changes can occur under a contract. Delivery fees may be added to the price, along with other delivery stipulations. Also, there may be quantity limitations and price differences between quantities contracted or purchased. The exact terms must be understood before signing a price securing agreement. A grower should begin contacting their propane supplier as soon as possible to discuss the opportunities available. It is also a good idea for a grower to discuss the various local supplier’s programs with their neighboring growers to find out their experiences.

Purchase During Low-cost Periods

The most secure way to reduce the risk of rising heating fuel prices is to purchase fuel during lower-cost periods, and hold the physical fuel on site at the farm. LP is by far the most feasible to obtain and store in this manner using large storage tanks. To capture the most cost savings, a farm must be able to receive LP in full truckload amounts of typically 8,000 to 9,000 gallons. It is also a good idea to have additional storage so some LP will be always on-hand.

LP tanks can only be filled to 80% of the listed capacity to allow for gas expansion. This means a single storage tank would need to have at least a 12,000-gallon listed capacity to receive a truckload of fuel, and larger to have some gas on-hand at delivery. Unfortunately, the cost today for a large storage tank can be $5 per gallon of capacity, or higher. With additional hook-up costs to be considered, installing a 12,000 to 15,000-gallon tank could easily approach $75,000. Even with savings of over $0.50 per gallon, it could take over 20 years to pay for this option. One positive to consider is that the tank will likely last the life of the farm. While the large storage tank option is the most secure way to reduce the risk of LP price swings, the high cost may keep it from being the best long-term investment for a farm.

The more widely used option to help mitigate fuel cost risk is for the grower to own 1,000-gallon LP tanks that normally reside at each house. If a grower has leased LP tanks, they are typically restricted to only purchasing from the tank owner and, if not forward contracted, at the current cash price. By owning the tanks, the grower can shop around and purchase from whichever company has the best price at the time and can deliver in a timely manner. New tanks cost between $1,000 and $3,500 each. Used or off-lease purchases are also often available. The typical farm could cover the cost of purchasing four new 1,000-gallon tanks in 10 years or less by saving $0.25 per gallon on average. Often, the benefit of timely delivery options from multiple LP companies trumps price when a cold snap hits unexpectedly and fuel is needed immediately.

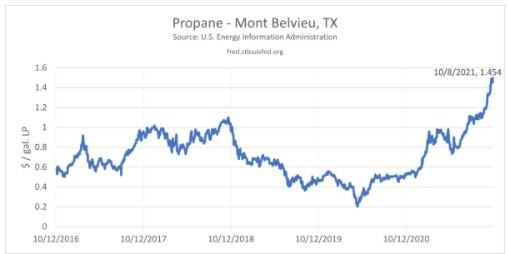

Figure 1. Liquefied petroleum gas (LP) prices per gallon are based on the distribution hub price, which for the Southeast is Mont Belvieu Texas. Add approximately $0.10 per gallon for piping to further distribution points in Alabama. Additional charges for trucking to LP company storage points, farm delivery, and company margin will be added as well.

2021–2022 Season Outlook

Liquified petroleum (figure 1) and natural gas are currently trading at 5-year highs on the commodity market. The current national LP supply is at a deficit, approaching 30 million barrels, or 1.05 billion gallons according to the October 6 U.S. Energy Information Center’s inventory update. Low supply going into a high demand time of year typically equals higher prices. LP prices also generally follow the crude oil price, which is currently above $75 a barrel, up from $35 a barrel, because of many reasons including offshore production disruptions.

Since LP and natural gas are byproducts of crude oil production, lower oil production equals lower supplies. When these circumstances are combined with higher trucking costs, it is expected that LP and natural gas prices will continue to rise throughout the winter and could likely reach all-time highs in the short-term. With the limited supplies again this winter, it is unknown if prices in the Southeast will reach the $4.00+ a gallon LP prices that were briefly saw in 2014.

The natural gas commodity price has also more than doubled in the past year. The natural gas crisis in Europe and Asia has created a driver for higher prices as traders purchase various heating fuels across multiple energy commodities. During the weather-related LP supply crunch of 2014, natural gas remained mostly stable. That may not be the case for this winter. The bottom line for poultry growers is that they need to do all they can to prepare for significantly higher heating fuel costs this winter, including taking price security opportunities as soon as possible and doing all the tightening and insulating of their poultry houses they can manage.

Source : aces.edu