By Rob Hatchett

The U.S. Department of Agriculture (USDA) issued its quarterly Grain Stocks report in mid-January. The much-anticipated report is one of four regular updates provided throughout the marketing year. The January release contains state-level stocks estimates as of December 1 and provides the first quarterly figure for the U.S. soybean marketing year that runs from September through the end of August. The stocks figure, when combined with known crushing and trade estimates for the September through November quarter, results in the implied feed and residual calculation that round out the demand components for the balance sheet. In this update, we will take an in-depth look at USDA’s December 1 stocks estimates, what they mean in terms of USDA’s latest balance sheet projections, and outline some key implications for buyers of U.S. soybeans.

Perspective on Stocks and Implied Quarterly Usage

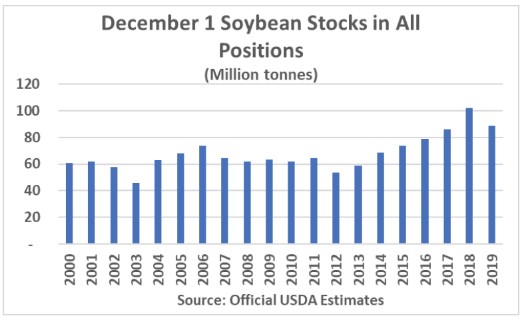

USDA’s estimate of U.S. soybean supplies in all positions as of December 1, 2019 totaled 88.50 million tonnes for a year-over-year decline of 13.44 million tonnes or 13.2% from record levels of 101.94 million in 2018. One important feature that was added to the beginning of the report was a special note that on-farm stocks included estimates of output that was still in the field but was unharvested as of early December. While this has been standard policy, this year’s figure includes a much higher number of soybean acres that had yet-to-be harvested. This is expected be more of a feature for the corn crop, where a much larger share of the crop is shown to have not yet been harvested but is a noteworthy consideration when contemplating the potential for sizeable revisions in the March 1 stocks report.

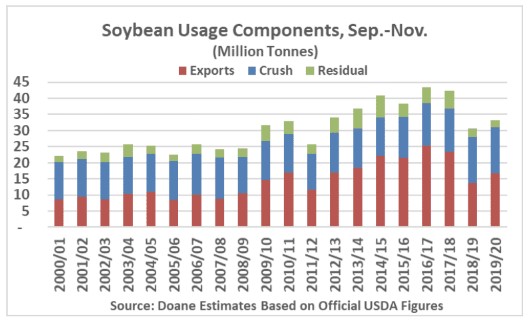

As noted in the lead section, the December 1 stocks estimate provides the final figure that is needed to calculate the usage components for the first quarter of the 2019-20 soybean marketing year. The following chart shows the history of the three major demand components for the soybean market beginning with the 2000-01 marketing year. An interesting feature of this particular chart shows the gradual advance in exports (red columns) relative to crush (blue columns) during the first quarter of the U.S. soybean marketing year. At the beginning of the window, crush accounted for 52.1% of the total usage for the quarter followed by exports at 39.0% and residual usage of just 8.9%. Fast forward to 2016-17, when a year-over-year surge in exports of 3.74 million tonnes outpaced a more modest year-over-year advance in crush of 392,000 tonnes. Shipments accounted for 58.1% of the September-November usage, leaving crush at 30.3% and residual usage of 11.6%. This increase in exports over the period highlights the surge in shipments of new-crop U.S. soybeans experienced in recent years. Much of this increase can be attributed to rising Chinese demand for U.S. soybeans ahead of new-crop South American supplies. This feature helps to explain the dip in U.S. exports over the September-November window experienced the last two years. An interesting feature in terms of the residual, or unaccounted for disappearance, of U.S. soybeans over the quarter is the recent decline. Between 2000 and 2017, residual usage averaged 3.79 million tonnes, while that figure slipped to 2.46 million in 2018 and most recently 2.11 million in 2019.

Looking at these data in terms of USDA’s January World Agricultural Supply and Demand Estimates (WASDE) projections, first quarter exports of 16.84 million tonnes represent 35.4% of USDA’s projection for the 2019-20 marketing year of 48.31 million. This compares with just 28.7% of total shipments in 2018-19, but falls short of the average pace since 2000-01 of 36.5% and the most recent five-year pace of 39.3%. By extension, one can assume that USDA is looking for a solid shipment pace in the remaining three quarters of the 2019-20 marketing year, but not nearly as great as that which was experienced last year. In terms of the agency’s crush projection, the most recent quarterly data stands at 24.9% of the marketing year projection of 57.29 million tonnes versus 25.4% last year, an average of 25.5% since 2000-01 and the latest five-year average pace of 24.7%. This pace should be viewed as being consistent with current expectations.

Residual usage is much more variable when comparing the September-November quarter to the total for the marketing year. This year’s implied figure of 2.11 million tonnes represents 242% of USDA’s current projection totaling about 871,000 tonnes. First quarter residual usage in 2018-19 totaled 211% of the 1,165 thousand tonne sum. Perhaps the best explanation for this irregularity is that years with larger implied disappearance occurs when December exports have surged, making a larger portion of soybeans more difficult to count as of December 1 due to being in transit. These bushels are later ‘found back’ in later stocks reports which imply negative residuals.

On- and Off-Farm Stocks Insights

Dissecting the overall stocks figure into on-farm and off-farm storage figures helps to provide a more in-depth look at the geographical dispersion of soybean supplies across the U.S. and also gives insight as to how many supplies remain unsold and in farmers’ hands.

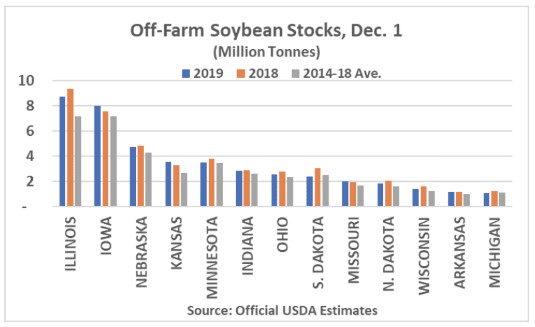

To begin, we will look at off-farm stocks for the 13 states totaling more than 1.0 million tonnes of soybeans as of December 1, 2019. These figures reflect those inventories reported to be on-hand and in commercial storage. When comparing latest stocks figures against last year’s levels, only three states show year-over-year increases – Iowa (453,000 tonnes), Kansas (268,000 tonnes), and Missouri (60,000 tonnes). The greatest declines from 2018 levels totaled nearly 688,000 tonnes in South Dakota followed by 645,000 tonnes in Illinois. Much lower soybean supplies in South Dakota can be explained by the 41.8% decline in output reported by USDA in its Crop Production 2019 Summary, while the year-over-year drop in Illinois supplies can also be explained in part by a reduction in output of 20.1% along with increased export and crushing paces for the September-November quarter highlighted in the preceding section of overall stocks.

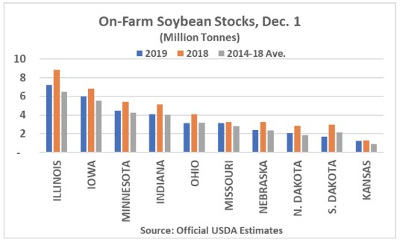

A similar look at on-farm soybean supplies reported as of December 1 shows the ten individual states where more than one million tonnes remain in the hands of farmers. As one would imagine given the year-over-year decline in all soybean stocks, each state is showing a drop in soybean inventories when compared with 2018 levels. On-farm stocks are, however, mostly above the previous five-year average levels for these key states with eight of the ten states reporting above average inventories. This serves as a reminder as to how extraordinary the 2018-19 marketing year was in terms of available U.S. supplies. These comfortable stocks levels are expected to provide ample supplies in order to meet USDA’s current demand forecasts while maintaining comfortable carry-in supplies for the upcoming 2020-21 marketing year.

December 1 Soybean Stocks by Major Export Pull

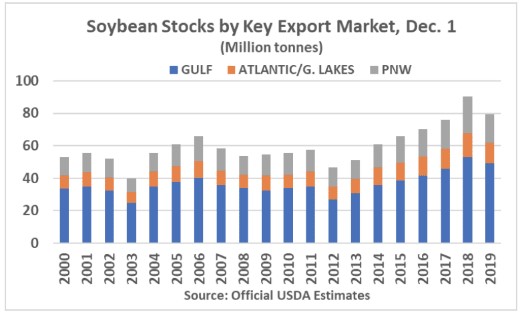

For the benefit of foreign buyers of U.S. soybeans, we believe that it will be beneficial to highlight stock levels at some key geographies that feed key export markets. While it is an impossible task to determine the source of all of the soybeans that might flow through an export market, we can attempt to aggregate USDA’s reporting states into three major exporting regions.

For the Pacific Northwest market, Montana, North and South Dakota, Nebraska, and Minnesota are primary soybean suppliers. States that are closer to the Mississippi River such as Wisconsin, Iowa, Kansas, Missouri, and Illinois are key suppliers for export terminals at the Gulf. While further east, the most likely suppliers of soybeans via the Atlantic Coast and Great Lakes are the reporting states of Ohio and Indiana. There are other smaller states that are also reported by USDA, including an entry for ‘Other States’, that were not included in this analysis and explains the variance between the regional breakouts considered and the overall figure discussed previously.

Based on the compilation of these data, 49.16 million tonnes of soybeans were reported as of December 1 to feed the Gulf export market, 17.83 million tones were available to flow through the Pacific Northwest (PNW) and 12.58 million tonnes were available in states feeding ports along the Atlantic Coast and the Great Lakes. The greatest percentage decline compared with 2018 is 21.2% for the PNW, 15.6% for the Atlantic Coast and Great Lakes while states seen as feeding the Gulf reported a year-over-year decline in supplies of 7.2%. Looking over the past five years, available supplies to the Gulf as of December 1 were up 6.20 million tonnes while those states feeding the east coast markets and the Gulf states were up 0.45 and 0.14 million tonnes.

Key Implications

USDA’s quarterly Grain Stocks report provides the soybean market with regular updates as to available supplies to provide transparency that helps analysts to formulate their own supply and demand estimates. These same figures are incorporated into USDA’s regular monthly World Agricultural Supply and Demand Estimates that correspond with the release of the stocks and provide the missing link for soybean usage when export and crush are already known. In addition, these estimates provide buyers with reliable figures to estimate available supplies.

The key takeaway from the December 1 soybean stocks report is one of more normal, but less burdensome, U.S. soybean supplies when compared with last year. This reduction in supplies reflects of a combination of lower output in the 2019 crop along with improved offshore demand for U.S. soybeans relative to the same time last year. A look at soybean totals being stored by commercial interests shows that stocks remain ample in key states, while sufficient on-farm stocks being held by farmers are expected to provide supplies to meet current demand projections while maintaining comfortable ending stocks for the upcoming 2020-21 marketing year. USDA is scheduled to release the agency’s next regular update which will recap supplies as of March 1 on Tuesday, March 31.

Source : ussoy.org