By Gary Schnitkey and Krista Swanson et.al

Department of Agricultural and Consumer Economics

University of Illinois

Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

Given the same coverage level, Revenue Protection with the harvest price exclusion (RPhpe) has a much lower premium than Revenue Protection (RP). Both RPhpe and RP can be combined with the Supplemental and Enhanced Coverage Options (SCO and ECO). An insurance bundle containing RPhpe, SCO, and ECO at the 90% coverage level (ECO-90%) often has lower premiums than RP alone. While having a lower premium, the bundle containing RPhpe, SCO, and ECO-90% often provides more downside risk protection than RP alone. However, the RPhpe bundle will pay less in years where losses are due to a combination of yield losses and price increases, such as the widespread drought year of 2012. Farmers who want more downside risk protection than RP provides may consider the RPhpe/SCO/ECO-90% bundle, with the caveat that insurance payments could be much less from the RPhpe bundle under certain conditions.

Situation

The most used crop insurance product for corn and soybeans is RP, being used on over 90% of insured acres (farmdoc Daily, November 17,2020). RP has a provision that causes the guarantee to increase when the harvest price is above the projected price. Harvest prices have been above projected prices in 40% of the years, with the most impactful years being drought years like 2012. In the 2012 drought year, the projected price for corn was $5.68, and the harvest price was $7.50. Using the much higher $7.50 harvest price in guarantees resulted in much higher RP payments than RPhpe.

RPhpe does not have a guarantee increase, resulting in much lower premiums than RP. RPhpe often has premiums that are 50% less than RP premiums, particularly at 70% and higher coverage levels (see the 2021 Crop Insurance Decision Tool, a Microsoft Excel spreadsheet, which can be downloaded here).

RP and RPhpe will have roughly the same impacts on reducing downside revenue protection. While having the same downside risk protection, the major concern will be the performance of the two products in years where yield losses are combined with price increases.

RPhpe can be combined with SCO and ECO. Since SCO and ECO mimic the underlying COMBO product, the RPhpe, SCO, and ECO bundle will not have the guarantee increase for either the farm coverage offered by RPhpe or the county coverage offered by SCO and ECO. The RPhpe, SCO, and ECO-90% bundle often has a lower premium than RP alone. However, a bundle of RPhpe, SCO, and ECO-90% may provide better downside risk protection than will RP alone.

A tradeoff exists between the RPhpe, SCO, and ECO-90% bundle and RP alone:

- A farmer can choose an RPhpe, SCO, and ECO-90% bundle and have county coverage from 90% to the coverage level of RPhpe. The farmer gives up the harvest guarantee.

- A farmer can choose RP alone and have the guarantee increase, which is helpful in scenarios such as a drought year. In this case, the farmer does not have county coverage from 90% to the coverage level of RP.

Note that RP provides protection for farm yields while SCO/ECO provides protection at a county level. There is always a possibility that a farm will have a poor yield and the county will not, a form of “basis” risk. However, the examples below have the same coverage level on RP and RPhpe, thereby minimizing issues associated with this basis risk. If one was lowering the coverage level of RP or RPhpe when using the county products, the basis risk would be more of an issue.

Because the coverage levels are the same, prevent planting payments, if they occur, will be the same regardless of whether RP or RPhpe is used.

In northern and central Illinois, RP/SCO/ECO-90% combinations will have lower premium costs than RP. Where yield-price correlations are lower, such as in southern Illinois, the RPhpe/SCO/ECO-90% bundle may have higher premiums

Empirical Comparisons

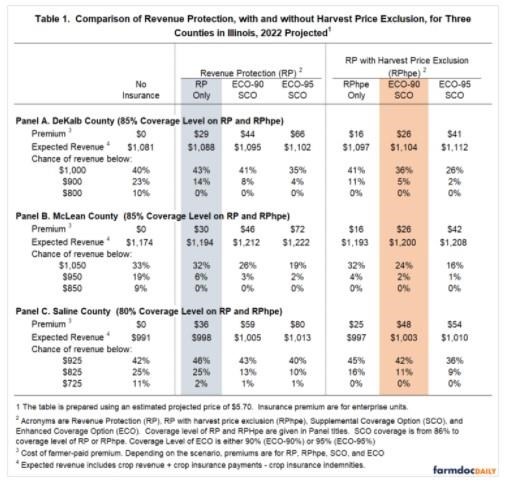

The nature of these tradeoffs is illustrated in Table 1, which shows return and risk comparisons for RP and RPhpe policies in:

- DeKalb County, a county in northern Illinois. Panel A shows RP and RPhpe policies at 85%, the most common coverage level in DeKalb County. The TA-APH yield for the DeKalb County farm is 202 bushels per acre.

- McLean County, a county in central Illinois. Panel B shows RP and RPhpe policies at 85%, the most common coverage level in DeKalb County. The TA-APH yield for the McLean County farm is 220 bushels per acre.

- Saline County, a county in southern Illinois. Panel C shows RP and RPhpe policies at 80%, a common coverage level in Saline County. The TA-APH yield for the Saline County farm is 186 bushels per acre.

Results in Table 1 are generated for a $5.70 projected price. All RP and RPhpe premiums are for enterprise units. The probability of being below specific revenues are shown for three different revenue levels. For all three cases, the highest revenue is near total per acre costs using an average cash rent. The lower levels are incremented to be $100 below the previous category.

The discussion below focuses on the McLean County case. Note that illustrations of the risk/return tradeoffs are the same for the DeKalb and Saline Counties. More detail on the McLean County cases can be found in a February 15, 2022, farmdoc daily article.

Corn in McLean County

Table 1 contains several insurance bundles including various combinations of RP and RPhpe, SCO, and ECO. The tradeoff of switching can be evaluated by looking at the column labeled “RP only” (the second column highlighted in gray) and the column labeled “ECO-90%, SCO” for the RPhpe policy scenarios (sixth column, highlighted in orange). For the McLean County case (Panel B), the comparison is:

- RP-85% has a farmer-paid premium of $30 per acre compared to $26 per acre for RPhpe-85%, SCO, ECO-90% bundle. A farmer could reduce the premium by moving from RP-85% to RPhpe-85%, SCO, ECO-90%.

- Expected revenue for RPhpe-85%, SCO, ECO-90% is $1,200 per acre, slightly higher than the $1,194 per acre for RP-85%.

- Risk reductions are higher for the RPhpe-85%, SCO, ECO-90% than RP-85%

- RPhpe-85%, SCO, ECO-90% has a 24% chance of revenue below $1,050 compared to 32% for RP-85%

- RPhpe-85%, SCO, ECO-90% has a 2% chance of revenue below $950 compared to 6% for RP-85%

- Both bundles have 0% chance of revenue below $850 per acre.

Overall, these results suggest that there are more risk reductions associated with RPhpe-85%, SCO, ECO-90% bundle than for RP-85% alone.

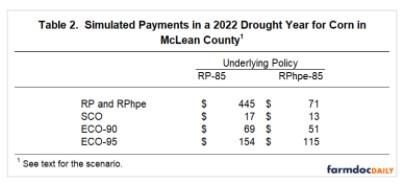

The caveat to the above results is that the guarantee increase will offer higher payments during drought years. To examine these impacts, a 2012 drought year is simulated for 2022. In 2012, the projected price was $5.68 per bushel, and the harvest price was $7.50 per bushel, and McLean County yields were 60% of expected levels in 2012. Table 2 shows insurance payments for a simulated 2012 event in 2022. We assume that a 2012 event in 2022 results in the following:

- The harvest price is $7.80, well above the projected price of $5.70

- The county and farm yields are 60% of the expected yield: 130 bushels per acre

Given this simulation, RP-85% has a $445 per acre payment compared to $71 per acre for RPhpe-85% (see Table 2). ECO-90% has a $69 payment when combined with RP-85%, and a $51 payment when combined with RPhpe-85% (see Table 2) This difference occurs because ECO mimics the underlying RP or RPhpe, and the guarantee does not increase when RPhpe is used. Under this scenario, an RP-85% policy would have a $445 per acre payment, while the RPhpe-85%/SCO/ECO-90% would have a $131 per acre payment ($71 from RPhpe + $14 from SCO + $51 from ECO-90%.

An RP-85%, SCO, ECO-90% bundle will not have the drought year concern. This combination is shown in Table 1 labeled as “RP, EC0-90%, and SCO” (third column). The RP-85%, SCO, ECO-90% bundle has a $46 per acre premium compared to $26 per acre for the RPhpe-85%, SCO, ECO-90% bundle.

Another alternative is to use ECO-95%, which will have larger downside risk reductions associated with higher premium

Summary

A RPhpe, SCO, ECO-90% bundle will provide better downside risk protection than RP alone. However, the RPhpe bundle will make lower payments than RP in years that have reduced yields and increasing prices, such as drought years. To a large extent, the choice comes down to the preferences of the individual. We suggest the following:

- Those most concerned with downside revenue risk likely will find the RPhpe/SCO/ECO-90% bundle preferred. Farmers with higher costs, higher cash rents, or higher debt positions likely will prefer this bundle.

- Individuals concerned about yield risk and droughts will likely prefer RP alone.

- RP and its associate products likely are preferred by those who pre-harvest hedge aggressively, as the guarantee increase can offset losses from pricing grain before harvest. A measure of aggressive pre-harvest hedging is having over 50% of expected production priced before harvest.

Of course, a farmer could use RP, SCO, ECO bundles and have both county-level revenue projection and the guarantee increase. However, this bundle will come with relatively high per acre premium costs.

Source : illinois.edu