By Kenny Burdine

Last Thursday, USDA-NASS released their Prospective Plantings report, which serves as an initial estimate for planting intentions for major crops in the US. Given the war in Ukraine, drought in much of the US, rising input costs, and high crop prices, last week’s report was especially of interest for the agricultural sector. Given that feed costs were already at extremely high levels, the cattle sector was also likely paying more attention to this report than usual.

In terms of implications for cattle markets, the estimate for acres to be planted to corn is the number that will garner the most attention. Most expected corn planting to be down in 2022, largely due to increased input costs relative to beans, but the magnitude of the estimated drop was larger than anticipated. Estimated corn planted acreage was down by nearly 3.9 million acres compared to 2021, which is a little more than 4%. Total area anticipated to be planted to principal crops was virtually flat, with soybeans picking up about 3.8 million acres. From my perspective, this report primarily speaks to how sensitive producer intentions have been to input costs and availability concerns. Those discussions have seemed to dominate much of the recent crop narrative and this seems to have played itself out in this Prospective Plantings report.

It is important to note that these acreage estimates are largely based on survey data collected during the first two months of March. Further, over the last few days, the market has responded to what appeared to be a different acreage scenario than was anticipated for the upcoming crop year. Since the report came out on March 31, new crop corn price has gained ground while new crop bean price has lost ground. Certainly, there are constraints to the shifts than can occur, but the new crop price ratio has changed since last Thursday and definitely incentivized some level of shift to corn where feasible. How much shifting of planting intentions to corn will be seen in the coming weeks is a key question.

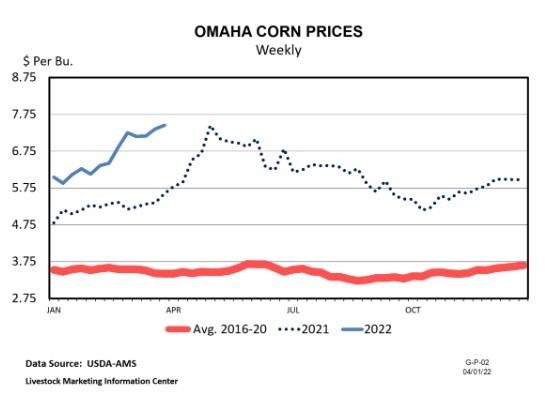

The chart above shows current Omaha corn price, which has been north of $7 for several weeks. But, the fact that new crop (December) corn futures are on the board at nearly $7 per bushel as I write this on April 4, speaks to how tight this corn market is expected to be in 2022. It also suggests that corn prices will be very sensitive to any new information throughout the growing season. Feeder cattle prices are sensitive to feed costs and we have watched them pull back as corn price has increased. Feed price risk continues to suggest that producers should be prudent about risk management strategies as they move through 2022.

Source : osu.edu