By Yuri Clemets Daglia Calil

In its October World Agricultural Supply and Demand Estimates (WASDE) update, USDA forecasted a roughly 2% increase in total corn supply for the 2024/25 season, contrasting with last year’s levels, while demand is forecasted to hold steady. This supply growth and stable demand has led to a downward trend in corn prices, projected at $4.10 per bushel – a 10% decrease from last season.

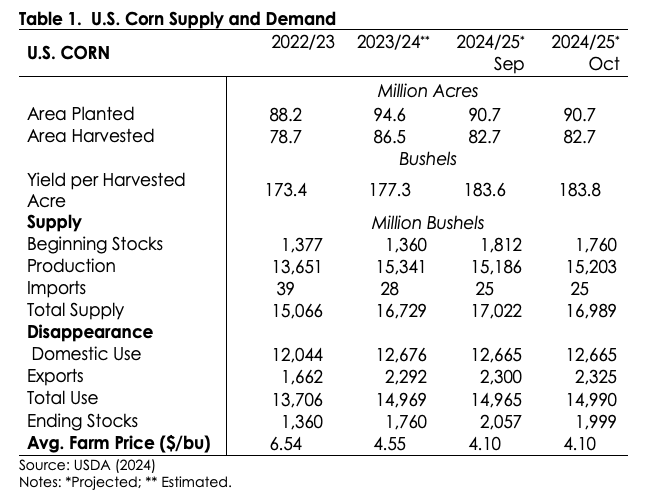

On the supply side, a 29% rise in beginning stocks has boosted total supply availability by 400 million bushels over last year. Despite a 3.7% increase in yields, a 4.4% reduction in harvested acreage shaved overall production by 0.9%, leaving output 138 million bushels below last year’s total (Table 1). Recent USDA ratings show roughly two-thirds of the crop in good or excellent condition, suggesting strong yield potential. Dry weather across the Corn Belt created ideal harvest conditions, accelerating progress to 81% of the crop harvested in the top 18 corn-producing states by October 27 – well ahead of the five-year average of 64%.

On the demand front, feed and residual use for corn is projected to edge up by 0.2%, or 11 million bushels, compared to last season, as growth in the broiler and hog sectors offsets a decline in the cattle herd. While corn usage for ethanol may see a slight dip of 21 million bushels (-0.4%), corn exports are forecast to climb 1.4%, adding 33 million bushels over last year’s total. The export boost can be partially attributed to competitive U.S. prices and limited supplies from drought-affected South American countries, particularly Brazil. However, total corn demand is projected to remain largely unchanged from the 2023/24 crop season, as shown in Table 1.

With supply anticipated to surpass demand, the USDA projects ending corn stocks to climb by 239 million bushels, a 14% increase over last season (Table 1). The “Days of Use on Hand at the End of the Marketing Year” built from ending stock levels indicates how many days the remaining corn supplies would last, based on average daily consumption, assuming no additional supply. This metric has a strong inverse relationship with season-average farm prices (SAFP), as illustrated in Figure 1. Given this relationship, along with USDA projections, Figure 1 suggests prices will hover around $4.10 per bushel in the coming year.

Latent factors could shift these projections, with geopolitical tensions playing a key role. The outcome of the U.S. elections may spark trade tensions, potentially changing global commodity markets. Meanwhile, the ongoing conflicts in the Middle East and between Russia and Ukraine can impact fertilizer and grain prices. In South America, recent rainfall has improved growing conditions, but the onset of La Niña brings uncertainty. After months of bearish sentiment and a period of neutrality, non-commercial net long positions in corn have turned positive, signaling a shift; speculators now hold more long than short positions, betting on a price rise.

Click here to see more...