By Robert Nathan Gregory

Weather always plays a role in the spring planting decisions of Mississippi row-crop producers, but the market impact of the ongoing COVID-19 pandemic is another variable they will have to consider in 2020.

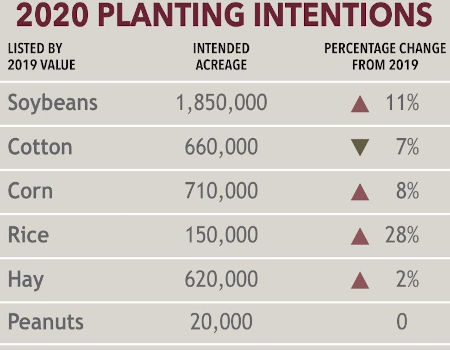

The U.S. Department of Agriculture Prospective Plantings report released March 31 estimates that growers intend to plant 4.06 million total acres of row crops in Mississippi this year. This includes approximately 1.85 million acres of soybeans, 710,000 acres of corn, 660,000 acres of cotton, 620,000 acres of hay, 150,000 acres of rice and 20,000 acres of peanuts.

Will Maples, row-crop economist for the Mississippi State University Extension Service, said growers will likely stick with their intentions on corn and soybeans, but those who normally grow cotton may have some decisions to make.

“Before the pandemic, the fundamentals of the cotton market were looking decent and provided some price support,” Maples said. “Since the start of the overall economic downturn, the price for the December 2020 cotton futures contract has dropped about 30% to around 53 cents a pound. It will be hard for this price to recover as we move through the year if the overall economy remains stagnant.”

Acreage estimates in the USDA Prospective Planting reports are primarily based on surveys conducted the first two weeks of March.

“While we had seen some market downturn towards the end of February due to the COVID-19 pandemic, it really got going during the first part of March,” Maples said. “How the current market downturn has changed the planting intentions of producers is an unknown.”

As was the case in 2019, rain and flooding during wintertime and planting season are issues that producers face this year in addition to market volatility. Another extremely wet winter has delayed planting progress of corn, typically the first row crop planted in Mississippi each year.

“Most areas are 10 to 20 inches of rainfall above normal through March. This is keeping fields wet and substantially restricting opportunity for field work and corn planting, especially in the Delta where we once again have backwater flooding,” said MSU Extension grain-crops agronomist Erick Larson. “Despite that, we have planted a few acres in select areas, primarily in central and south Mississippi, but overall progress is about a week behind normal.”

While the current health crisis will affect what growers plant this year, economics and weather will always be the primary factors dictating crop selection.

“Growers’ concerns regarding COVID-19 are likely mostly related to supply and distribution of agricultural inputs and maintaining farm labor needed to produce crops during 2020,” Larson said. “Our livelihood is based upon the food that growers produce, so a pandemic will not keep us from growing crops.”

Source : msstate.edu