By Nick Paulson and Gary Schnitkey et.al

The price discovery period for federal crop insurance policies with a March 15th sales closing date ended on February 28th. The projected price for corn in 2025 is $4.70 per bushel, slightly above the projected price of $4.66 in 2024. The projected price for soybeans is $10.54, much lower than the $11.55 projected price in 2024. The 2025 volatility factors are 0.18 for corn and 0.14 for soybeans. Both volatility factors are slightly lower than they were in 2024.

Producer-paid premiums on corn policies should be similar to levels in 2024 while soybean premiums will be lower. For the same coverage level and approved yield, guarantees for corn policies will be marginally higher in 2025 as in 2024. Soybean guarantees will be lower because of the $1.01 lower projected price. Insurance guarantees are low compared to the 2022 and 2023 crop years when projected prices were higher for both corn and soybeans. This coupled with a higher subsidy rate for 2025 might make the Enhanced Coverage Option (ECO) of greater interest to producers to supplement their Revenue Protection (RP) or alternative individual plan coverage.

Projected Prices and Volatility Factors for Corn and Soybeans

Settlement prices on the December 2025 corn futures contract averaged $4.70 during February, while the implied price volatility averaged 0.18 over the final 5 trading days in February. The $4.70 projected price is $0.04 higher than the $4.66 price for 2024 but $1.21 and $1.20 lower than the $5.91 and $5.90 projected prices for the 2023 and 2022 crop years (see Figure 1). The slightly higher projected price, along with trend yield increases in most situations, will result in marginally higher guarantees than were achievable last year. The slightly higher guarantees will also marginally increase premium costs. However the lower volatility factor will tend to lower premiums. The net effect for corn policy premiums may vary and will tend to be relatively small.

The November 2025 soybean futures contract had an average settlement price of $10.54 during February and price volatility average 0.14 over the last five trading days of the month. As shown in Figure 2, the projected price is $1.01 lower than 2024 projected price ($11.55), $3.22 below the 2023 projected price ($13.76), and $3.79 below the 2022 projected price ($14.33). The lower projected price for soybeans will result in lower guarantees and premiums than last year; the lower volatility factor will also lead to lower premium costs for soybean policies.

Premium Estimates for Corn and Soybeans

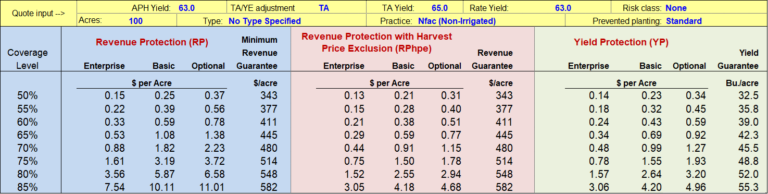

Estimated corn premiums for COMBO product policies over a range of coverage levels and unit structures are provided for a sample Champaign County farm. The sample farm has a trend adjusted actual production history (T-APH) yield of 225 bushels per acre.

At the $4.70 projected price for 2025, 85% revenue protection (RP) coverage provides a minimum revenue guarantee of $899 per acre. The producer-paid premium is estimated at $23.44 per acre for enterprise units and increases to just over $40 per acre for optional units. Premiums decline at lower RP coverage levels. RP and its predecessor products with guarantee increases has been the most popular form of coverage selected by farmers in Illinois for the past 25 years (see farmdoc daily articles from November 17, 2020 and December 17, 2024). Moreover, the average RP coverage level elected by Illinois farmers for corn and soybeans has been between 80% and 85% indicating the higher coverage levels are most preferred, particularly in northern and central Illinois (see farmdoc daily from December 1, 2020).

Lower premium levels can also be achieved with alternative policies. An 85% coverage level for revenue protection for the harvest price exclusion (RPHPE) is estimated at $12.04 per acre for enterprise units, while 85% yield protection (YP) has an estimated premium of $12.75 per acre. Compared with RP, RPHPE does not provide the guarantee increase if the harvest price ends up being higher than the $4.70 projected price and YP coverage will only cover yield losses (with the insurance price fixed at the projected price).

Table 1. Estimated COMBO Product Premiums for a Champaign County Farm, Corn

Similar to 2024, the projected price of $4.70 may limit producer’s ability to achieve insurance guarantees at levels which cover a desirable portion of production costs using only individual COMBO products such as RP. The Supplemental and Enhanced Coverage Options (SCO and ECO) can be used to add additional county-based coverage to increase the overall guarantee of a producers’ insurance coverage portfolio. Moreover, ECO may attract greater interest in 2025 due to an increase in its subsidy rate to 65% (see farmdoc daily articles from November 5, 2024 and February 11, 2025). Prior to 2025 the subsidy rate for ECO when coupled with a revenue product (RP or RPHPE) was 44% (see farmdoc daily from November 24, 2020).

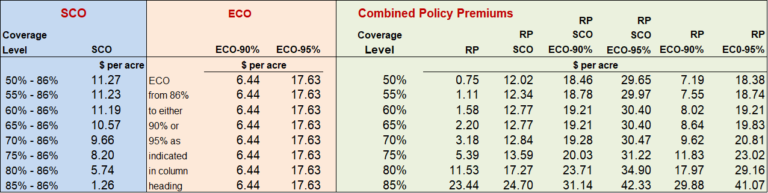

Table 2 provides estimates of SCO and ECO premiums for the Champaign County case farm, along with combined premiums when the SCO and ECO products are added to underlying RP coverage for corn. The premium cost of SCO ranges from $1.26 per acre when coupled with 85% RP to $11.27 per acre when the RP coverage level is reduced to 50%. ECO coverage is estimated to cost $6.44 at the 90% coverage level and $17.63 at the 95% coverage level.

Adding 90% ECO to an 85% RP policy results in a combined premium of $29.88 per acre, while 95% ECO with 85% RP would exceed $41 per acre. The combined policy premiums (green box) in table 2 show a range of coverage options using RP, and corresponding premium costs, available to producers.

Table 2. Estimated SCO, ECO, and Combined (with RP) Policy Premiums for a Champaign County Farm, Corn

Table 3. Estimated COMBO Product Premiums for a Champaign County Farm, Soybeans

Discussion

Production costs remain at elevated levels for row crop producers since adjusting to higher prices and income during the 2020 to 2022 crop years. The average non-land costs projected for central Illinois farms planting corn in 2025 are around $750 per acre, with land costs (average cash rent for the region) pushing total costs to more than $1,050 per acre (see farmdoc daily from January 14, 2025). The example Champaign County farm above can guarantee $899 per acre in farm-level revenue on corn acres using the highest coverage level available for individual revenue products, covering average non-land costs but falling short of total costs in typical cash rent situations (note the guarantee could increase for RP coverage if the harvest price is higher). The same is true for soybeans based on the latest production cost projections for Illinois. The ECO product can be used to increase overall guarantees to 90% or 95%, but relies on county-based triggers for payments and comes at additional premium expense.

Even though farm-level guarantees may not fully cover costs of production and producers are seeking ways to cut costs, significant uncertainty exists this year beyond the normal market supply – demand dynamics and risks. For example, the potential for negative price shocks due to proposed trade actions should not be understated. So, as in all years, your crop insurance decision should be given considerable weight, particularly if a majority share of the operation’s land is rented and/or cash flow issues are a potential concern.

Decision Tools and Calculators

The premium estimates in tables 1 to 3 above come from farmdoc’s 2025 Crop Insurance Decision Tool, an Excel-based calculator that can be downloaded and used free of charge. They are specific to the case farm for Champaign County – producers are encouraged to use the information and tools available to compare and analyze their 2025 crop insurance coverage options specific to their operation. The farmdoc decision tool allows users to enter their own county, crop, and APH yield inputs to get tailored premium estimates. The web-based Crop Insurance Premium Calculator can also be used to get tailored premium estimates for COMBO and area-based products for corn, soybeans, and wheat in 11 US states. The web-based Crop Insurance Payment Evaluator can be used to compare expected performance of various policies and coverage levels for county-level case farms.

Additional decision aid can be found with the full set of Crop Insurance Tools available for use on the farmdoc and farmdoc daily websites.

Source : illinois.edu