By Gary Schnitkey

Department of Agricultural and Consumer Economics

University of Illinois

Most 2018 payments on Federal crop insurance products have now been entered into the Risk Management Agency’s (RMA’s) record system and losses for 2018 can be stated accurately. Similar to 2016 and 2017, low losses again occurred in 2018. Losses were particularly low in Illinois and, more generally, the eastern Corn Belt.

Background on Loss Ratios

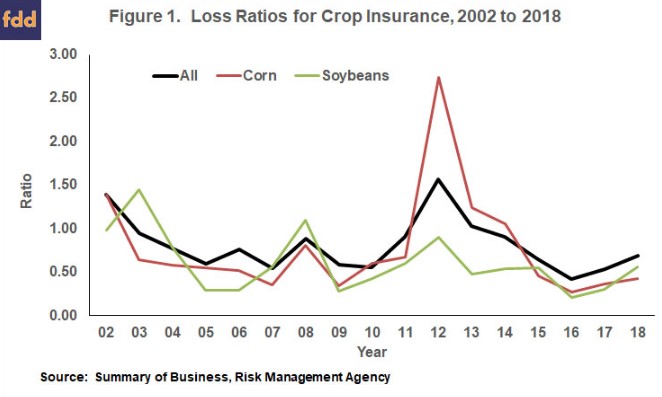

This article presents loss ratios, which equal payments on crop insurance policies divided by total premium paid on crop insurance policies. A loss ratio of 1.0 means that crop insurance payments are equal to total premium. Ratios above 1.0 indicate that payments exceed premium, which occurs with some regularity. On the other hand, loss ratios below 1.0 indicate that payments are less than premium. Given the way RMA sets premiums, loss ratios should average slightly below 1.0 over time. Given the high correlation of losses across policies in a year, variability in aggregate loss ratios will occur from year to year.

Data reported in this article come from the Summary of Business which is available from the RMA website. Data were downloaded in late April of 2019. Some changes to loss ratios will occur over time as more loss data become available. However, 2018 loss performance will not materially vary from loss ratios presented here.

Loss Ratios in 2018

For all insurance products, the 2018 loss ratio was .69, indicating that crop insurance payments were less than total premium. Overall, 2018 was a low loss year, continuing a string of low loss years that have occurred since 2013 (see Figure 1). Loss ratios exceeded 1.0 in the drought year of 2012 when the overall loss ratio was 1.57. Payments also exceeded premium in 2013 when the loss ratio was 1.03. Since 2013, loss ratios have been below 1.0 in each year: .91 in 2014, .65 in 2015, .42 in 2016, .54 in 2017, and .69 in 2018. These low loss years correspond to relatively high yielding years in corn and soybeans (farmdoc daily,

April 16, 2019).

The overall loss ratio is highly influenced by the performance of corn and soybeans, as these two crops account for 56% of total premium. In 2018, corn policies had 32% of total premium while soybeans had 23%. In 2018, loss ratios were .43 on corn and .56 on soybeans. Since 2014, both crops have had low loss ratios. Corn loss ratios were .46 in 2015, .27 in 2016, .37 in 2017, and .43 in 2018. Soybean loss ratios were .55 in 2015, .21 in 2016, .30 in 2017, and .56 in 2018.

2018 Loss Ratios by County

Many counties in the Corn Belt had very low loss ratios, as would be expected given that corn and soybeans have very low loss ratios. Figure 2 shows loss ratios by county for all policies in that county. Loss ratios below .4 predominated in a stretch of counties beginning in eastern Iowa, going through Illinois, Indiana, and ending in Ohio. Low loss ratios also were in western Corn Belt counties including Minnesota, North Dakota, South Dakota, and Nebraska. In contrast, there was a concentration of counties along the Iowa-Minnesota border that had higher loss ratios above 1.0.

Other sections of the country had higher loss ratios. Loss ratios above 1.2 predominated in North and South Carolina, Georgia, Florida, northwest Missouri and eastern Kansa, and western Texas.

Summary

Overall, loss ratios were low in 2018, continuing a string of years since 2014 that have had low loss ratios. Low loss ratios occurred primarily because of low losses on corn and soybean policies in the Corn Belt.