By Taylor Kaus and Cory Walters et.al

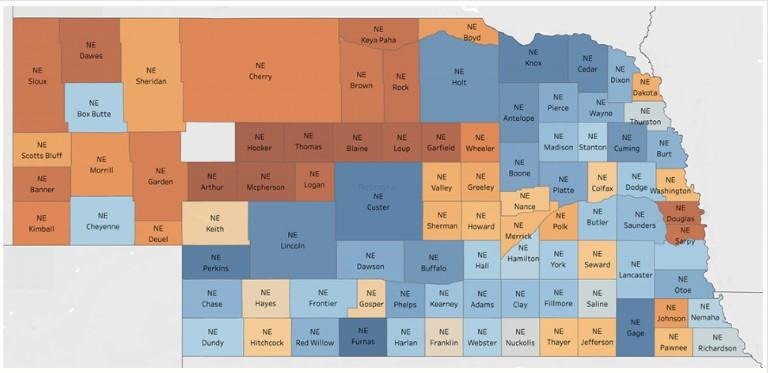

The U.S. current taxpayer-subsidized crop insurance program represents a culmination of a series of legislative acts, beginning in 1980 with the Federal Crop Insurance Act, followed by the Federal Insurance Reform Act in 1994, and the Agricultural Risk Protection Act (ARPA) in 2000. All acts aimed at encouraging producer participation through increased premium subsidies and enhanced coverage options. Increased subsidization was effective in increasing participation, as more than 90% of corn acres were covered by some form of crop insurance by 2020. For 2021, premium subsidies in Nebraska for all crop insurance policies ranged from just over $36,000 in Hooker County to $10 million in Furnas County, with an average of just under $5 million (to view each county, see the interactive map found here https://public.tableau.com/app/profile/jessica.groskopf/viz/CropInsuranceIndemnity-Subsidy/Sheet2). These subsidies can produce unintended consequences, and the identification of these unintended consequences can be useful to policymakers in rethinking future crop insurance policy design.

One unintended consequence is farm consolidation, whereby farms are bought out using rents acquired from subsidized insurance and consolidated into larger farms. A legislative rise in premium subsidies, as was the case through ARPA in 2000, raises expected returns to participation in crop insurance. To the extent that an increase in expected returns induces individual participating farmers to increase crop supply (e.g., Yu et al. 2017), they may collectively see their benefit from insurance offset by declining market revenue, and non-participating farmers may incur losses as well. That is because the increase in aggregate crop supply induced by participation in subsidized insurance results in declining market prices (Young et al. 2001). This logic provides a theoretical link between crop insurance subsidization, market prices and output, and long-run market participation. How these factors interplay in the real world is not clear.

By affecting market returns for participating and non-participating farmers alike, subsidized crop insurance may also affect the farm industry's structure in the long run through changes in farm numbers in response to the interplay between market returns and expected returns from subsidized insurance. Positive net returns to program participation may give a strategic financial advantage to insurance participants over non-participants. Program participants may outbid financially strapped non-participants in land purchase and rental markets. More importantly, after a rare and adverse event such as a drought, which generally triggers indemnity payments, those with insurance can better compete in the land rental and purchase market due to a substantially better-off financial position. Non-participants in a poor financial position who are losing shares in the land rental and purchase market may exit the industry. These points provide the basis for the question we posed in the paper recently published in the Journal of Policy Modelling: Does Subsidized Crop Insurance Affect Farm Industry Structure?

We address the question by drawing on the theory of long-run competitive equilibrium to formulate and empirically implement an economic model that incorporates returns of subsidized insurance participation into producer profit and drives profits to zero in the long run. We use the comparative statics with respect to an increase in the crop insurance premium subsidy through ARPA in 2000 to generate propositions about how changes in the subsidy influence the number of farms and farm output in the long run.

This work analyzed county-level farm numbers and average farm output between 1992-2012 for five major corn and soybean producing states, including Nebraska. After accounting for other relevant factors contributing to farm consolidation, we find evidence that crop insurance premium subsidies contributed to farm consolidation. Interestingly, premium subsidies had the most significant effect on farm consolidation in counties with riskier crop production profiles. Higher consolidation in riskier counties may be explainable because premium subsidies on a per-acre basis are higher. These results are consistent with other findings suggesting crop subsidies, in general, contribute to farm consolidation. Our findings suggest that the premium subsidy mechanism produces unintended consequences by reducing farm numbers and increasing average farm size. Subsidized crop insurance can only accelerate the trend toward further consolidation with consequences for sustainability and depopulation of rural communities. To the extent the USDA has indicated keeping rural communities and family farms healthy and vibrant is a policy goal, crop insurance may be deleterious to that goal. These unintended effects could make the case for reverting to ad-hoc disaster payment programs.

Source : unl.edu