By Robert C. Goodling and David L. Swartz

Feed and Milk Prices Start to Cool

Most of 2020 and the first half of 2021 saw a wave of ups and downs first with milk prices, then with feed costs. Though feed costs remain at near high levels, there has been some reprieve in prices heading into the fall. Certainly, the 2021 corn crop is a bright spot for most producers in Pennsylvania. Yields in many locations are 20% or more over historical farm averages. Producers are using this extra yield to build silage inventories or harvest shelled corn from the acres not needed for silage. With the price of corn at very high levels, this homegrown corn will be a boost to the bottom line.

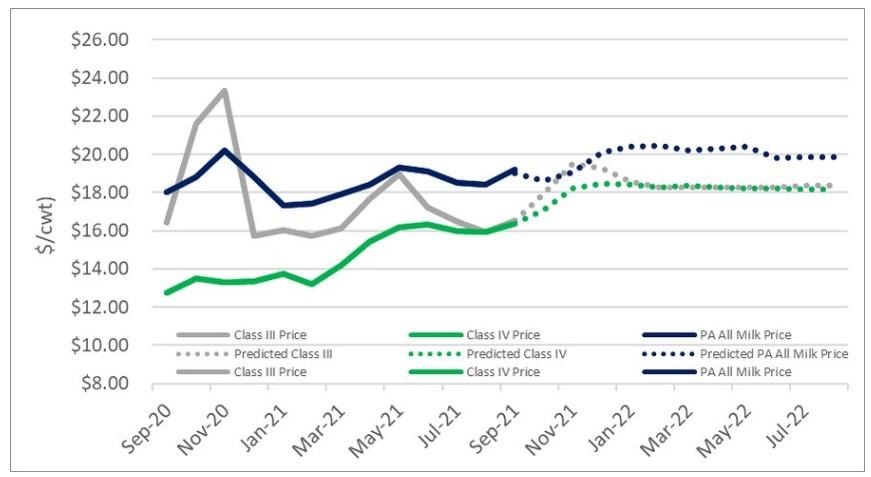

Milk prices are also starting to show some potential stability (Figure 1). Class III and Class IV futures have come into alignment and are trending to the $18/cwt level for most of 2022. This should encourage a Pennsylvania All Milk Price to be around $20/cwt for the start of next year. USDA’s World Agricultural Supply and Demand Estimates (WASDE) reduced milk production forecasts for 2021/22 as there is a slower growth in milk/cow (WASDE 2021). WASDE revised the all milk price at $18.45 /cwt for 2021 and $19.20/cwt for 2022.

With the increase in domestic milk production that started in the second half of last year and has continued through this year, exports were crucial to balance the tsunami of new milk in the United States. Mexico is maintaining its status as the top customer for US dairy products and purchases both non-fat dry milk and cheese, supporting both Class III and Class IV prices.

Figure 1: Twenty-four month Actual and Predicted* Class III, Class IV, and Pennsylvania All Milk Price ($/cwt)

*Predicted values based on Class III and Class IV futures regression (Goodling, 2021).

Challenges Remain

However, these bright spots can’t eclipse the significant challenges faced by the dairy industry. The biggest of these challenges is the breathtaking inflation in farm inputs. The inflation started nearly two years ago with feed prices, followed by labor costs, and now fuel and energy costs. And, as energy costs rise, so do fertilizer costs. There are many reasons for this inflation, from natural disasters to government policies, to continuing supply chain disruptions. While some of this inflation has been muted on farms in the near term due to risk management practices of locking in input prices, those contracts will soon expire, and the full weight of these escalating input prices will hit the bottom line. Unfortunately, very few market observers believe input prices will retreat in the near future, and they see high input prices challenging agricultural production through next year and into 2023.

Income Over Feed Cost, Margin, and All Milk Price

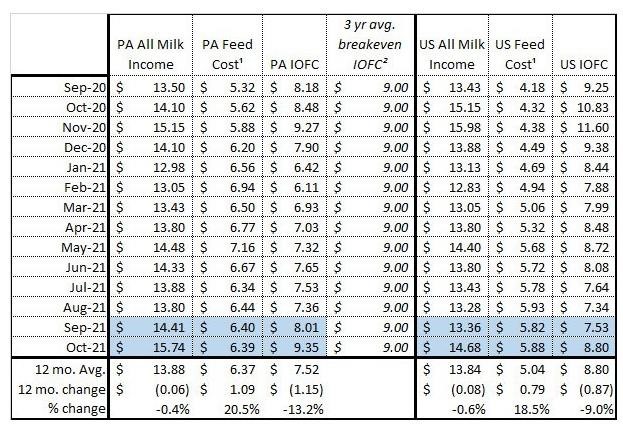

Table 1: 12 month Pennsylvania and U.S. All Milk Income, Feed Cost, Income over Feed Cost ($/milk cow/day)

¹Based on corn, alfalfa hay, and soybean meal equivalents to produce 75 lbs. of milk (Bailey & Ishler, 2007)

²The 3 year average actual IOFC breakeven in Pennsylvania from 2015-2017 was $9.00 ± $1.67 ($/milk cow/day) (Beck, Ishler, Goodling, 2018).

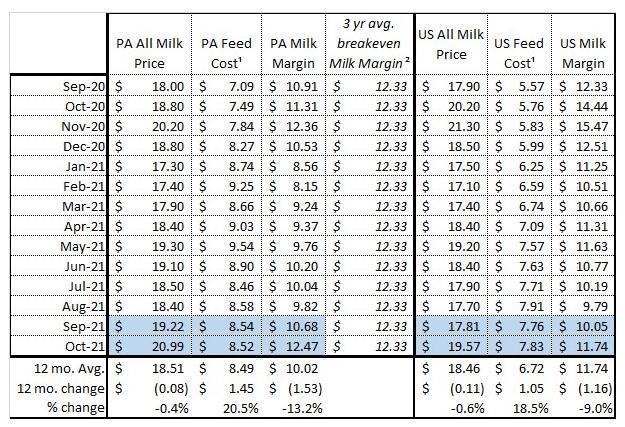

Table 2: 12 month Pennsylvania and U.S. All Milk Price, Feed Cost, Milk Margin ($/cwt for lactating cows)

¹Based on corn, alfalfa hay, and soybean meal equivalents to produce 75 lbs. of milk (Bailey & Ishler, 2007)

²The 3 year average actual Milk Margin breakeven in Pennsylvania from 2015-2017 was $12.33 ± $2.29 ($/cwt) (Beck, Ishler, Goodling, 2018).

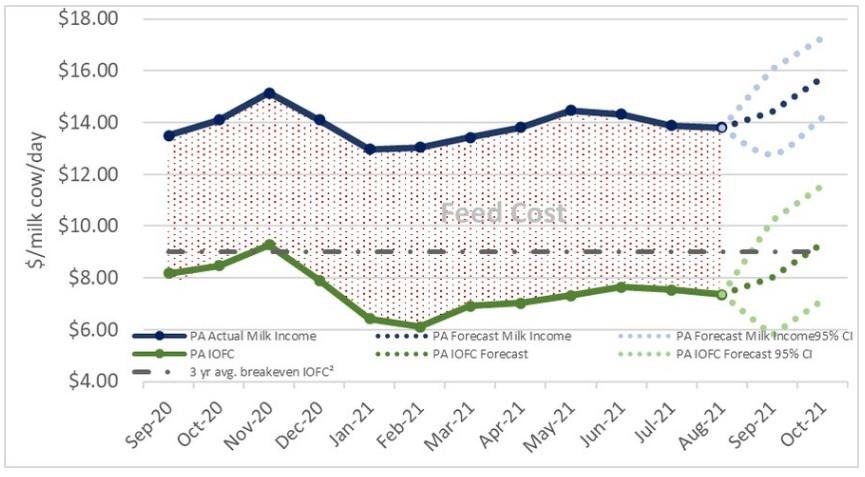

Figure 2: Twelve month Pennsylvania Milk Income and Income Over Feed Cost ($/milk cow/day)

²The 3 year average actual IOFC breakeven in Pennsylvania from 2015-2017 was $9.00 ± $1.67 ($/milk cow/day) (Beck, Ishler, Goodling, 2018).

Table 3: Twenty-four month Actual and Predicted* Class III, Class IV, and Pennsylvania All Milk Price ($/cwt)

| Month | Class III Price | Class IV Price | PA All Milk Price |

|---|

| Sep-20 | $16.43 | $12.75 | $18.00 |

| Oct-20 | $21.61 | $13.47 | $18.80 |

| Nov-20 | $23.34 | $13.30 | $20.20 |

| Dec-20 | $15.72 | $13.36 | $18.80 |

| Jan-21 | $16.04 | $13.75 | $17.30 |

| Feb-21 | $15.75 | $13.19 | $17.40 |

| Mar-21 | $16.15 | $14.18 | $17.90 |

| Apr-21 | $17.67 | $15.42 | $18.40 |

| May-21 | $18.96 | $16.16 | $19.30 |

| Jun-21 | $17.21 | $16.35 | $19.10 |

| Jul-21 | $16.49 | $16.00 | $18.50 |

| Aug-21 | $15.95 | $15.92 | $18.40 |

| Sep-21 | $16.53 | $16.36 | $19.22 |

| Oct-21 | $17.90 | $17.05 | $20.99 |

| Nov-21 | $19.49 | $18.19 | $22.28 |

| Dec-21 | $19.24 | $18.48 | $22.34 |

| Jan-22 | $18.55 | $18.41 | $21.81 |

| Feb-22 | $18.29 | $18.28 | $21.63 |

| Mar-22 | $18.27 | $18.37 | $21.67 |

| Apr-22 | $18.26 | $18.27 | $20.89 |

| May-22 | $18.26 | $18.23 | $20.87 |

| Jun-22 | $18.28 | $18.20 | $20.87 |

| Jul-22 | $18.35 | $18.16 | $20.97 |

| Aug-22 | $18.36 | $18.17 | $20.98 |

| Sep-22 | $18.32 | $18.14 | $20.95 |

| |

*Italicized predicted values based on Class III and Class IV futures regression (Beck, Ishler, and Goodling 2018; Gould, 2019).

To look at feed costs and estimated income over feed costs at varying production levels by zip code, check out the Penn State Extension Dairy Team's DairyCents or DairyCents Pro apps today.

Data sources for price data

- All Milk Price: Pennsylvania and U.S. All Milk Price (USDA National Ag Statistics Service, 2021)

- Current Class III and Class IV Price 8/13/2021 and 8/16-8/19/2021 (USDA Ag Marketing Services, 2021)

- Predicted Class III, Class IV Price (CME Group, 2021)

- Alfalfa Hay: Pennsylvania and U.S. monthly Alfalfa Hay Price (USDA National Ag Statistics Service, 2021)

- Corn Grain: Pennsylvania and U.S. monthly Corn Grain Price (USDA National Ag Statistics Service, 2021)

- Soybean Meal: Feed Price List (Ishler, 2021) and average of Decatur, Illinois Rail and Truck Soybean Meal, High Protein prices, National Feedstuffs (USDA Ag Marketing Services, 2021)

Source : psu.edu