By Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

Krista Swanson and Nick Paulson et.al

Department of Agricultural and Consumer Economics

University of Illinois

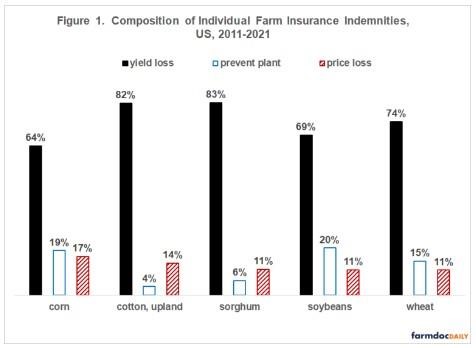

Individual farm crop revenue insurance covers losses from low yield, prevented planting, and low price. We assess the relative role of these three types of loss by examining the indemnities paid by revenue insurance to the 2011-2021 crops of corn, upland cotton, sorghum, soybeans, and wheat. Yield loss, prevent plant, and price loss, respectively, accounted for 70%, 16%, and 14% of indemnities paid to these crops as a group. Crop revenue insurance is thus predominately yield loss insurance. Potential implications for crop insurance policy in light of recent disaster assistance legislation are discussed.

Background

Individual farm crop revenue insurance products are Revenue Protection (RP) and Revenue Protection – Harvest Price Exclusion (RP-HPE). RP contains the Harvest Price Option (HPO) while RP-HPE does not have HPO. HPO results in the insured liability being calculated using the higher of the projected or harvest insurance price. RP and RP-HPE accounted for 91% of all indemnities paid to corn, upland cotton, sorghum, soybeans, and wheat over the 2011-2021 crop years, the years when RP and RP-HPE have been offered to farmers.

Procedures and Data

The “Cause of Loss” files maintained by RMA (Risk Management Agency, July 2022a) contain total and prevent plant indemnities paid by crop insurance product. For a given crop insurance product, subtracting prevent plant indemnities from total indemnities gives non-prevent plant indemnities. Non-prevent plant indemnities were divided into indemnities from yield loss and price loss as follows:

- If insurance price increases, all indemnities are due to yield loss. Since the higher harvest price is used to value both the insured liability and the value of production at harvest, there is no price loss. An indemnity can thus be collected only if yield loss exceeds the deductible.

- If insurance price declines, indemnities may be due to price or yield loss. The “Cause of Loss” files do not report indemnities by yield loss and price loss. They must be estimated. The estimation involves several steps and thus is discussed in Data Note 1.

- Yield loss indemnities from steps 1 and 2 were summed together.

Because of step 2, the calculations provide only an indication of indemnities due to price and yield loss. The share due to these two losses is thus less precise than the share due to prevent plant.

Indemnities by Loss Type

Yield loss accounted for well over half of revenue insurance indemnities for each crop, ranging from 64% (corn) to 83% (sorghum) (see Figure 1). The share due to price loss ranged from 11% (sorghum, soybeans, wheat) to 17% (corn) while the share due to prevent plant ranged from 4% (upland cotton) to 20% (soybeans). Price loss share varied the least as the shares for yield loss and prevent plant were inversely related. For example, corn and soybeans have the smallest yield loss share and largest prevent plant share.

Summary Observations

The current individual farm crop revenue insurance products are predominately yield loss insurance. Yield loss accounted for 70% of all indemnities paid by revenue insurance to corn, upland cotton, sorghum, soybeans, and wheat over the years the current revenue products have been offered.

More broadly, the current individual farm crop revenue insurance products are production loss insurance. Yield loss plus prevent plant accounted for 86% of revenue indemnities to the five crops.

Yield loss and prevent plant were two of the losses addressed by the two most recent disaster assistance programs (farmdoc daily, June 7, 2022 and June 14, 2022). From this perspective, crop revenue insurance can also be viewed as largely being a standing disaster assistance program.

The increase in assistance for prevent plant and disaster assistance provided by Congress in the two recent disaster assistance programs suggests that Congress may view crop insurance as providing inadequate coverage of yield loss and prevent plant.

Increasing yield loss and prevent plant coverage requires budgetary funds. Sources of funds are new budget authority or reassignment of existing budget authority. The latter could involve focusing crop insurance on production losses. This focus would free up the 14% share of premium subsidies now devoted to covering price loss to fund a higher subsidy for yield loss and prevent plant.

Consideration of such a reassignment of existing budget authority would in essence ask farmers if they prefer assistance for price loss or increased assistance for yield loss and production loss.

Data Notes

- Variables used in the calculations are (1) liabilities and indemnities for revenue insurance contracts paying indemnities other than prevent plant indemnities available in the “Cause of Loss” file; (2) average coverage level for a crop and year calculated using data in the “Summary of Business” file; and (3) insurance prices available in the “Price Discovery” file (see Data Note 2). Liability per insured acre equals projected insurance price times insured yield times coverage level. Dividing insured liability by coverage level therefore gives the insured value of the crop before the deductible. Dividing the indemnity by the insured value before the deductible and adding this percent to the percent deductible gives the total percent loss. Percent decline in price is divided by total percent loss to calculate the share of total percent loss due to price loss. The share due to yield loss equals (100% minus price loss share). These shares are multiplied by indemnities to obtain the dollar value of indemnities due to yield and price loss for a crop and crop year. These calculations are illustrated using 2017 corn. Liabilities for corn revenue insurance that paid an indemnity other than prevent plant indemnities was $6.5 billion, indemnities paid by these insurance contracts were $1.0 billion, average revenue insurance coverage level elected by farmers was 77% (i.e. average deductible was 23%) (see Data Note 3), and projected and harvest insurance prices were $3.96 and $3.49, respectively.

- Dividing liabilities of $6.5 billion by average coverage level of 77% gives a total insured value before the deductible of $8.5 billion.

- Dividing indemnities of $1.0 billion by $8.5 billion equals 12%.

- Summing 12% and the 23% average deductible gives a total percent loss of 35%.

- Insurance price was 12% lower at harvest (1-($3.49/$3.96)).

- The 12% price decline is 34% of total percent loss (12% / 35%), implying price loss and yield loss accounted for approximately one-third and two-third of total loss, respectively.

- Multiplying indemnities of $1.0 billion by 34% and 66% gives indemnities due to price loss of $340 million (34% times $1.0 billion) and indemnities due to yield loss of $670 million (67% times $1.0 billion) for 2017 corn.

Note, the loss due to lower price is slightly overstated. A joint loss interaction exists since both price and yield decline. This joint loss is included with price loss in these calculations.

- Insurance price is for a state that is a large producer of the crop: Illinois for corn and soybeans, Texas for cotton, and Kansas for sorghum. For wheat, a composite price was calculated for a year by weighting price of a wheat type by its share of US production. States were Illinois for soft red winter, Kansas for hard red winter, North Dakota for hard red spring, and Washington for white.

- As comparative information, for 2017, average revenue insurance coverage level elected by farmers was 76% for soybeans, 72% for wheat, 71% for sorghum, and 68% for cotton.

Source : illinois.edu