Producers market cattle ahead of schedule in response to deteriorating pasture and forage conditions.

‘Pasture and forage conditions continue to deteriorate across western Canada and a large area of the US,’ says Jason Wood, livestock market analyst with Alberta Agriculture and Forestry. ‘Pastures are strained in many areas, leaving producers to market cattle 1 to 2 months ahead of schedule. The decision to market cattle early is being exacerbated in selected areas where access to water is becoming an additional concern for livestock producers.’

Weekly auctions are reporting increased volumes, either in the ring or via electronic sales. Over the last 6 weeks, auction volumes are over 37,000 head higher compared to the same period in 2020. Year-to-date (January to July), over 598,000 Alberta cattle have been reported at live or electronic sales, up 17.7% from 2020, 1.8% above 2019 and 3.1% higher than the 3-year average.

Non-fed cattle marketings, specifically cows, are expected to see additional movements in the short-term. ‘Looking forward to the fall, the below normal forage yields combined with a longer feeding period is a concern for many cow/calf producers and is expected to result in a cull rate above historical levels,’ explains Wood.

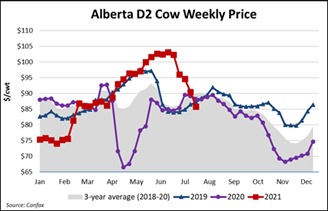

The Alberta D2 cow price declined $3.75/cwt for the week ending July 30, 2021, settling at $82/cwt. The D2 cow market has now declined for 6 weeks from a market high of $103/cwt in mid-June, decreasing 20% or over $290/head on a 1,400 lb cow. The D2 cow price of $82/cwt is the lowest for the last week of July since 2013. Year-to-date, the D2 cow market is averaging $89/cwt, up 6% from 2020, which is 2% higher than in 2019 but 5% lower than the 5-year average.

Figure 1. Alberta D2 Cow Weekly Price

‘Until recently, the Alberta cow market had been trading at a premium to the US cow market for most of 2021. Alberta D2 cows were trading at a $19/cwt premium to the US commercial/utility cow market at the end May, but have declined to an $8/cwt discount for the last week of July. Declining prices have increased US packer interest with more western Canada cows moving to the US for processing,’ says Wood.

The slaughter of cows in western Canada has trended above the 5-year average in 11 of the last 13 weeks. Year-to-date (week ending July 23, 2021) western Canada cow slaughter is 189,809 head, up 8.5% from 2020, down 18% from 2019 and 4% below the 5-year average. Year-to-date, western Canada cattle slaughter is 1.42 million head, up 15.7% from 2020, which is 5.5% higher than in 2019 and 16.7% above the 5-year average.

Source : alberta