By Bradley Zwilling

Higher costs coupled with higher milk prices resulted in positive cash returns but continued negative economic returns for Illinois dairy producers in 2022, according to figures summarized by the Illinois Farm Business Farm Management Association.

The average net price received per 100 pounds of milk was $25.36, which was less than total economic costs of $26.49, but still higher than feed and cash operating costs of $21.14. The price received for milk in 2022 was $6.07 higher than 2021. On a per cow basis, total returns from milk were $6,376 compared to the total cost to produce milk of $6,589 per cow. Total returns from milk per cow increased from 2021. The net returns per cow in 2022 were a negative $213. Total returns have exceeded total economic costs only once out of the last ten years. During that same time period, total returns have exceeded feed and cash operating costs.

Milk production per cow for all herds averaged 25,085 pounds. The average was 1,355 pounds more per cow than in 2021.

Costs and Returns

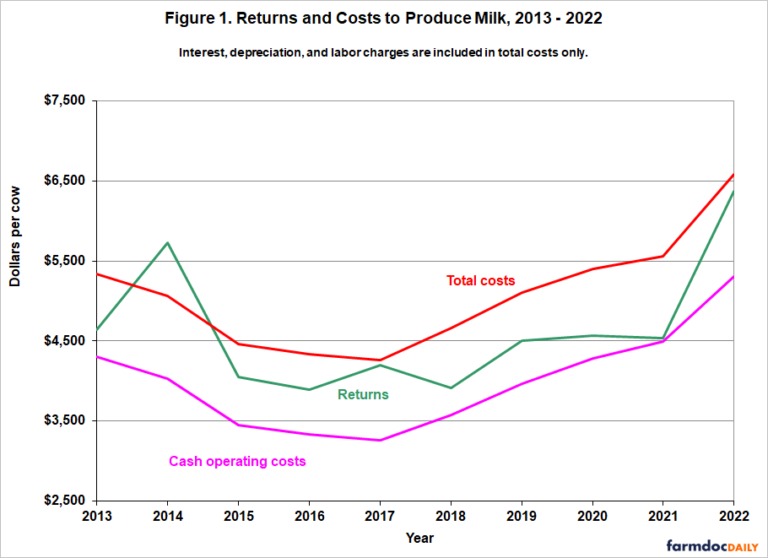

Trends in total costs and returns per cow for all herds are given from 2013 to 2022 in Figure 1. The economic profit margin (return above all cost) decreased— from a negative $1,021 in 2021 to negative $213 per cow in 2022. The last five-year returns above all costs have averaged a negative $684 per cow. During this period, returns above all costs per cow have varied from negative $213 in 2022 to negative $1,021 in 2021. In Figure 1, labor and interest charges are included in total costs only. Most dairy producers will incur hired labor and cash interest expense and would include them as cash operating costs.

The 2022 economic returns were $3.24 per 100 pounds produced less than the 2021 returns. The average net price received for milk was $25.36 per 100 pounds. This is $6.07 per 100 pounds or thirty-one percent higher than the average price received in 2021. Based on 25,085 pounds of milk produced per cow, this increase in price increased total returns per cow by $1,523. The average net price received for milk for the last five-year period is $19.59 per hundred pounds. Dairy assistance and patronage returns related to the dairy enterprise would add about 39 cents per 100 pounds of milk produced to returns in 2022.

While the price received increased, so did feed and nonfeed costs per 100 pounds of milk. Feed costs in 2022 averaged $14.68 per 100 pounds of milk produced as compared to $13.43 in 2021. In 2022, feed costs were at their highest level ever. The 2022 feed costs were $2.50 above the last five-year average of $12.18. Feed costs were about 55 percent of the total economic cost to produce milk. Nonfeed costs per 100 pounds of milk produced were $11.81 in 2022 compared to $10.24 in 2021. Total nonfeed costs were the highest recorded in 2022.

Increasing Profit Margins Projected for Dairy Producers, But Still Negative Economic Margins

The average milk price for 2023 is projected to be about 19 percent less or about $4.80 per hundredweight lower than the average for 2022 according to the United States Department of Agriculture (USDA), Economic Research Service (ERS), dairy forecast. Similar milk production, lower exports and lower prices for cheese and butter are leading to lower prices in 2023. United States milk production is expected to increase about 60 pounds per cow in 2023.

While milk prices decrease for 2023, feed costs for 2023 are expected to decrease due to lower corn and soybean prices. Feed costs per 100 pounds of milk produced are projected to average about $13.67 using prices of $5.80 per bushel for corn, 25 cents a pound for protein and $185 per ton for hay. This is based on annual feed consumption per cow, including replacement animals, of 96 bushels of corn, 5,376 pounds of protein, and 9.3 tons of hay or hay equivalents. If nonfeed costs per 100 pounds of milk produced averaged $11.50, total costs to produce 100 pounds of milk would be about $25. A 19 percent decrease in milk prices in 2023 for Illinois producers would result in an annual price of about $20.60 per 100 pounds. If total economic costs averaged $25 per 100 pounds of milk produced, the average Illinois producer would have returns below total economic costs by $4 per 100 pounds of milk produced.

2024 is projected to be better than 2023 even with lower USDA projected milk prices due to lower feed costs. However, economic costs are still projected to be below total returns in 2024.

The author would like to acknowledge that data used in this study comes from farms across the State of Illinois enrolled in Illinois Farm Business Farm Management (FBFM) Association. Without their cooperation, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,000 plus farmers and 70 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM field staff provide on-farm counsel with recordkeeping, farm financial management, business entity planning and income tax management.

Source : illinois.edu