By Kenny Burdine

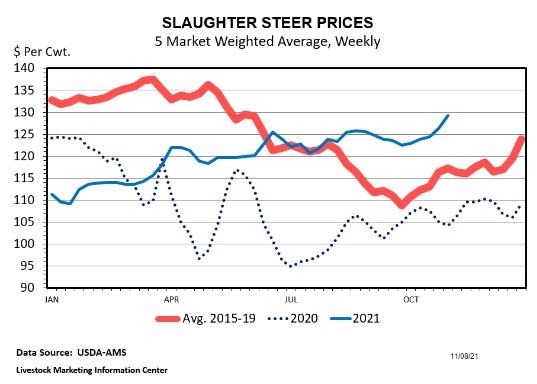

Fall is always a critical time for calf markets as so many spring born calves are sold. However, it has been very interesting to watch fed cattle prices this fall as well. I generally pay close attention any time a market moves counter to its normal seasonal pattern and that has been the case for fed cattle prices this year. The 5 Market Weighted Average weekly price chart is shown above and details what I am talking about. Note that a normal trend (red line) is for slaughter cattle prices to make their peak in the spring and move steadily downward through summer and early fall. Yet in 2021, fed cattle prices have trended upward since spring and did not put in a fall bottom at all. The last few weeks have been especially encouraging as prices have risen by more than $6 per cwt since the first week of October.

Several factors are behind this and are worth discussion. Last month, Josh discussed record beef export levels for the month of August. While export levels decreased from August to September, they remained over 20% above 2020 levels and kept the US on pace to exceed the annual record set in 2018. Growth is being seen in most of our major export markets and this continues to be a market driver.

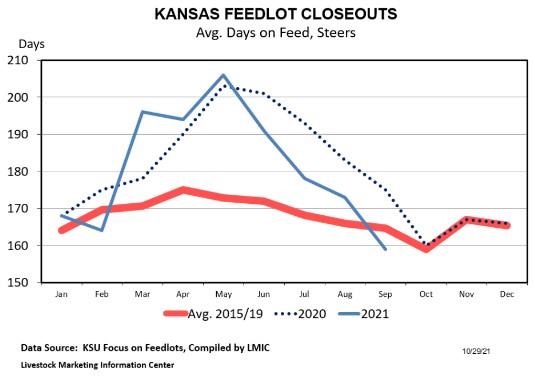

There are also dynamics related to fed cattle supply and marketings that are just as important to understand. We had previously talked about the pandemic pushing some 2020 cattle supplies into 2021 and how that had improved over the course of the current year. But, we are now seeing additional signs that feedlots are getting more current. The combination of fewer cattle on feed and much higher feed prices is leading to decreases in the number of days that cattle are on feed. Notice in the chart below how sharply “days on feed” has dropped since May in the Kansas State Focus on Feedlots data – this is way beyond what is seasonally normal. The more current feedlots are, the more leverage they have as they sell fed cattle into the packing industry, which explains some of the recent price improvement in slaughter cattle markets.

Fundamentally, current fed cattle prices should have little direct impact on feeder cattle values since feeder cattle are several months away from harvest. But a strong fall fed cattle market certainly creates optimism for spring, and the expectation of spring fed cattle prices is impacting feeder cattle prices now. On Friday November 5, CME© Live Cattle futures for April 2022 settled right at $140 per cwt. This was roughly $8 per cwt higher than the December contract, which is the current CME© live cattle contract being traded. Even contracts for the summer months are trading above that December price. Put simply, it appears that dynamics have shifted such that fed cattle prices should be much stronger in 2022 and that is welcome news for feeder cattle markets.

Source : osu.edu