By Department of Agricultural and Consumer Economics

University of Illinois

Brenna Ellison

Department of Agricultural Economics

Purdue University

As a part of the second quarter of the Gardner Food and Agricultural Policy Survey (farmdoc daily, August 18, 2022), we surveyed US consumers about their views of inflation. This article reviews the results of the survey, with a focus on views about the causes of inflation and government policies. The survey was conducted using Qualtrics Panels in August 2022 and included approximately 1,000 participants, recruited to match the US population in terms of gender, age, income, and geographic region.

What Consumers Think Is to Blame for Inflation

Before reviewing the survey responses from consumers, a brief review of the national discussion about what is causing inflation is informative. A review of the Bureau of Labor Statistics monthly consumer price index highlighted just how many different causes are behind the recent run of inflation, although energy costs appear to be the largest and most consistent driver (CBPP, August 2022; Fowers, July 26, 2022). The COVID-19 pandemic is much to blame, both for causing disruptions in supply chains but also because policy responses provided consumers with money to spend while the pandemic changed spending behavior, at least temporarily (compare, Bivens, February 7, 2022; Rubin and Chaney Cambon, August 10, 2022). Like the pandemic, inflation is currently a global problem and offers reasons against blaming US policies for inflation (Bivens, Banerjee, and Dzholos, August 4, 2022). There remains significant debate about the main drivers of inflation and how policymakers, including The Federal Reserve, should respond (see e.g., Kuhn, Ellis and Cohen, August 29, 2022; Agarwal & Kimball, April 7, 2022; McCausland, February 16, 2022; Bourne, February 1, 2022; Baker, January 29, 2022;).

With little agreement amongst experts, economists, and policymakers, it would not be surprising that consumers would also have a variety of causes for inflation; a premise we tested in this survey. We asked consumers, “In your opinion, what is MOST to blame for inflation?” Participants were able to choose either supply chain issues, the COVID-19 pandemic, energy prices, corporate profits, government policy, or consumers’ stockpiling. The options were presented in a random order for each participant. Participants were also able to select other as an option, where they were able to write their own answer. Table 1 presents these results. Government policy was the most commonly selected option (30.6%), followed by the COVID-19 pandemic (22.0%). More than 10% of consumers thought corporate profits (15.3%), supply chain issues (14.9%), or energy prices (10.7%) were most to blame. Few consumers thought consumer stockpiling was primarily to blame (2.7%).

Table 1. What US Consumers Think Is Most to Blame for Inflation

| | % of Respondents |

| Supply chain issues | 14.9% |

| COVID-19 pandemic | 22.0% |

| Energy prices | 10.7% |

| Corporate profits | 15.3% |

| Government policy | 30.6% |

| Consumers’ stockpiling | 2.7% |

| Other | 3.9% |

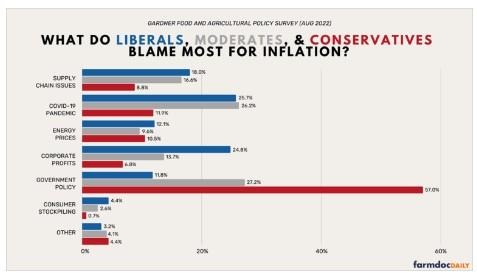

Consumers thoughts about the cause of inflation were quite different across political ideology. Figure 1 shows the proportion of liberals (n=339), moderates (n=416), and conservatives (n=295) that think each option is most to blame for inflation. We find that 57.0% of conservatives blamed government policy most, compared to 27.2% of moderates and 11.8% of liberals. Liberals and moderates were both more likely to blame supply chain issues or the COVID-19 pandemic than conservatives. Liberals were also more likely to blame corporate profits (24.8%) than moderates (13.7%) or conservatives (6.8%).

Figure 1. What US Consumers Think Is Most to Blame for Inflation across Political Ideology

Consumer Views about Government Support during Inflation

We also asked participants whether government assistance for certain groups should increase due to rising costs. In particular, we asked two questions – one about consumers and one about farmers: “Should government assistance for food programs (for example SNAP or WIC) increase due to rising costs of food?” and “Should government assistance for farmers increase due to rising costs of agricultural inputs?” The order of these policy questions was randomized for each participant (both policy questions were asked prior to the question looking at what was to blame for inflation, discussed above). We find that overall, over three quarters of consumers supported increasing funds for food programs (77.3%) and farmers (76.8%) due to rising costs. Responses to these questions differed by political ideology. Table 2 shows the proportion of liberal, moderate, and conservative consumers who supported increasing funds food programs and farmers.

Table 2. Proportion of Us Consumers across Political Ideologies Who Support Increases in Government Support for Farmers and Consumers Due to Rising Costs

| | Liberal | Moderate | Conservative |

| Percent of respondents who agreed government assistance for farmers should increase due to rising costs of agricultural inputs | 85.3% | 77.4% | 66.4% |

| Percent of respondents who agreed government assistance for food programs (for example SNAP or WIC) should increase due to rising costs of food | 90.2% | 76.0% | 64.4% |

We find over 60% of consumers – across political ideologies – supported increases in funding for both food programs and farmers. Liberals had the highest rates of support for both, with 90.2% supporting increased funding for food programs and 85.3% supporting increased funding for farmers. Conservatives had lower levels of support for both (although still, quite high), with 64.4% supporting increased funding for food programs and 66.4% supporting increased funding for farmers. Moderates were somewhere between liberals and conservatives, with 76.0% supporting increased funding for food programs and 77.4% supporting increased funding for farmers.

Discussion and Concluding Thoughts

We surveyed approximately 1,000 consumers about their views on inflation to better understand public perception of the causes of inflation and whether the government should increase support for farmers and consumers facing rising prices. Overall, we find that government policies (30.6%) and the COVID-19 pandemic (22.0%) receive the most blame for inflation. These responses differ considerably by political ideology (see Figure 1). 57.0% of conservatives and 27.2% of moderates blame government policy as the primary driver of inflation, compared with just 11.8% of liberals. There may be multiple reasons for this, beginning with the general understanding that the ideology (or political party) that is out of power is more likely to blame negative outcomes on the ideology or party in power. This could also be magnified by partisan media sources. Liberals and moderates were more likely to blame the COVID-19 pandemic. Liberals were also more likely to blame corporate profits.

We also found that most respondents think government assistance should increase in response to inflation for both farmers and food assistance. Although these responses differed by political ideology too, more than 60% of consumers across political ideologies supported both policies.

It appears somewhat contradictory that consumers would most frequently blame the government for inflation and support increased spending for two government programs. Digging deeper into the responses of consumers who blamed government policy most for inflation, we find that 71.0% of these respondents supported increasing payments for farmers and 64.8% supported increasing payments for food programs. This disconnect may be the result of multiple factors or combinations of factors. Consumers may blame government policy generally and not connect that blame to specific policies for helping farmers or food assistance. They could also attribute blame to specific government policies such as pandemic relief payments, paycheck protection loan program (see, USAspending.gov, Covid-19 Spending through July 31, 2022; Pandemic Oversight). That blame would likely not transfer to other government policies increasing payments for farmers and consumers using food programs.

In addition, the results could indicate a recognition that people need to buy food and farmers need to produce food, even under inflationary pressures. The public’s support of both policies could be a valuable insight for farm bill debates. It could be more valuable as the Federal Reserve undertakes important but painful efforts to combat inflation (see e.g., Cox, August 26, 2022; Horsley, August 26, 2022); Rugaber, August 26, 2022). Such pain is likely to hit consumers directly and harm the poor and least advantaged the most, just as the pain of inflation is concentrated among them (see e.g., Srikrishnan, July 8, 2022; Smialek, July 27, 2022; Stewart, July 28, 2022; Behsudi, August 3, 2022; Weber and Paul, August 7, 2022). In that view, consumers could view federal government policies and actions both to blame for inflation and necessary to support food insecure consumers and farmers facing rising prices.

The causes of inflation are varied and complex, and it appears unlikely that the issue of inflation will recede in the near future. Inflationary pressures continue to affect our food system – for farmers and consumers. Inflation will continue to impact politics and policy, driving the need for more perspectives on the views of voters and consumers. We will continue to evaluate the topic for future survey panels and questions.

Source : illinois.edu