By Andrew Frankenfield and David L. Swartz

If you’re still holding on to the remainder of your 2021 crop unpriced, I strongly suggest having a target price and target date to lock in a price.

Many factors are influencing the commodity markets; South American weather, expanding Chinese production, tension in the Black Sea Region, and inflation just to name a few. Grain prices may now move more in a day than they once did in months. With the cost of producing a bushel being higher than it ever has been, it's even more important to pay attention to your grain marketing plan.

Soybean futures for November 2022 were at contract highs last week. As of Monday, February 14th you could still price beans for fall delivery close to $14. The chart also shows the range of price movement within a given day, sometimes greater than 50 cents.

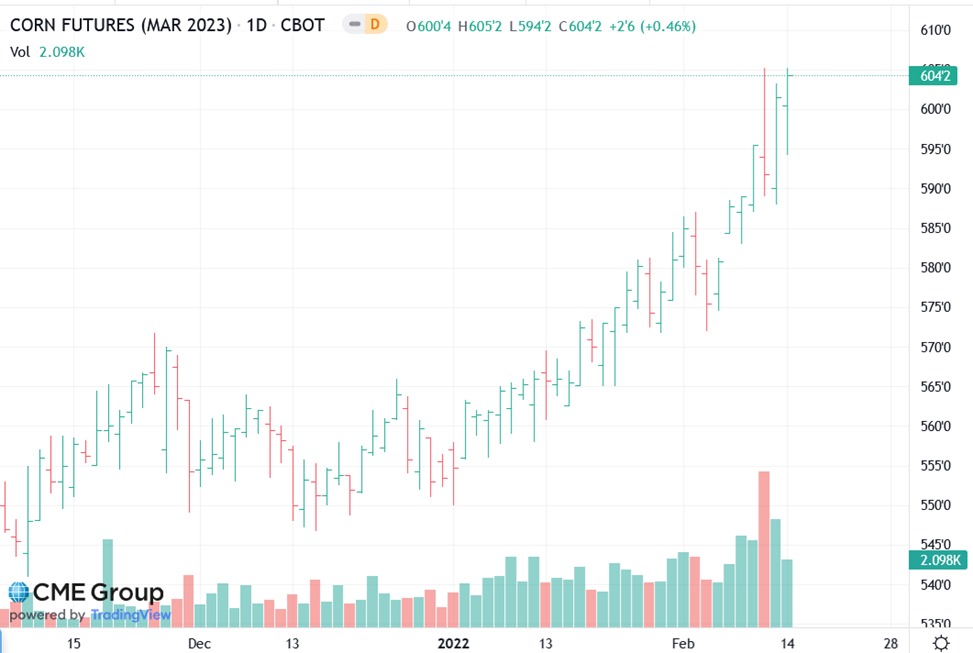

Corn Futures hit contract highs as March 2023 Futures pass the $6.00 mark recently. New crop corn (2022) delivered in January/February/March 2023 could be priced in the mid $6.00 range

Trying to guess the month with the highest price is not possible. Consider forward contracting a portion of your new crop over several months. Historically incremental sales during the first 7 months of the year (January through July) would tend to have a higher probability of high futures prices. Committing bushels to delivery could be complimented using crop insurance products, especially Revenue Protection (RP).

This chart from CME Group shows the November 2022 Soybean Futures in blue and the December 2022 Corn Futures in orange as a percentage change since February 2021. Corn is up over 36% and soybeans over 29% both near their contract highs.

Another marketing tool that could be a big benefit to producers is purchasing put options. Puts provide you the right to sell futures but not the obligation. Think of buying puts as insurance against lower prices, it gives you a price floor but allows you to take advantage of higher prices. I encourage you to have a discussion with a market advisor to determine the number of bushels, strike price (price floor), and cost appropriate for your operation.

Another very common strategy is harvesting the crop, storing it on-farm, and making incremental sales over the first half of the calendar year. Keep in mind this option does not provide any downside protection.

Farmers should have a new crop marketing plan written down and use discipline in order to implement this plan.

Remember, locking in a price for your crop is not any different than locking in your seed or fertilizer price six months before you even plant the crop. There is no marketing tool that will guarantee hitting the top of the market but having a goal of receiving a profitable average price year after year consistently should help you sleep better at night.

Source : psu.edu