The year 2024 is rapidly coming to a close as we enter the holiday season and soon we’ll be entering 2025. This a great time to begin thinking about your 2025 crop marketing plans.

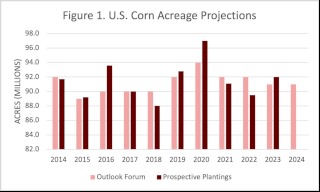

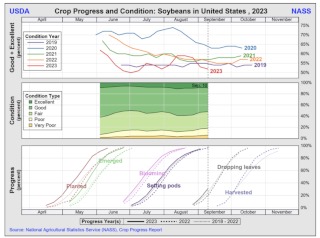

Where will grain and oilseed prices go in 2025? Who knows? While world corn ending stocks for the 2024/25 crop year are forecast down from both a year a ago and the five-year average, the U.S. share of world ending stocks have been growing for the last few years.

Couple this with the change in administration and the potential for a trade war looming, the price outlook is far from clear. For example:

- If U.S. tariffs result in retaliatory tariffs placed on U.S. grain and oilseed exports, and U.S. sales then weaken, grain stocks will rise further and prices will decline from where they are now. But,

- If much of the potential decline in sales is already “priced in” to the futures market, a more seasonal price outlook for 2025 could be in store, providing the normal spring and summer price rallies over today’s prices.

Maybe the place to start is by looking back and examining historical price action. Below is a 15-year seasonal index of the CME December Corn futures contract, beginning in January and running through the month of October. A few conclusions that can be drawn are:

- New Crop (DEC) corn futures seasonally rise as the crop year progresses, with a peak in April and early May, likely from uncertainty related to acreage and planting progress, and then again in June likely related to uncertainty regarding growing season heat, soil moisture and precipitation;

- Once those uncertainties become more clear, prices seasonly drift lower into harvest;

- Note though, the lesser, mid-July weather runup in price that does sometimes occur, providing a late marketing opportunity for those who may not have taken action earlier; and

- Finally, prices fall off significantly as the Kansas corn harvest is beginning (mid-September to early October), but by mid-harvest or later October, December futures seasonally rally.

Your 2025 Marketing Plans

Let’s focus on feedgrains. On average, we know we’ll likely see a couple of opportunities to price in 2025 at a level greater than what we’re seeing now or Jan. 1. But what is a “good price?”

First, a good rule of thumb is to not forward contract or price at a level below your cost of production, so get your calculators out. A great place to start is with Kansas State University’s 2025 Farm Budgets, where they have projections by crop, dryland versus irrigated and for each area of the state. Pulling this together and weighting them, we come up with an estimated direct (i.e., variable) corn cost of production for 2025 of $2.83 per bushel, up four cents from 2024’s $2.79 per bushel. A per bushel corn cost including both direct expenses and cash rent (more appropriate for those with greater cash rented acres) is $3.59 per bushel, up three cents from 2024, and total costs of corn production per bushel for corn this year is estimated at $4.32.

Comparable 2025 estimates for soybeans are $5.14 per bushel, for direct costs, $7.15 per bushel including both direct expenses and cash rent, and $9.12 as a total cost of production per bushel. Weighted average estimates for 2025 for wheat include $4.07, $5.54 and $6.91 per bushel, respectively.

What can be concluded from these tables? Holy mackeral! Twenty-seven percent of the time, December corn futures will rally $2 per bushel or more over the Jan. 1 price. Clearly, that might be a target price for that last increment of corn you might price before harvest, but don’t count on that kind of rally for most of your sales. With adequate world stocks and the potential for a trade war, the odds of more significant rallies might be lower in 2025.

Click here to see more...