On August 9 a fire broke out at one of the largest beef packing plants in the U.S., significantly impacting beef markets in the days and weeks that followed. The fire, at a plant in Holcomb, Kansas, owned by Tyson Fresh Meats, stressed an already sensitive balance between processing capacity and a growing fed cattle supply. Immediately after the fire, the Holcomb facility’s cattle were sent to other facilities in an industry already facing a relatively strained capacity. Among the many questions surrounding the fire are how is it impacting stakeholders who both sell to and buy from this increasingly concentrated industry, and when we can expect everything to get back to normal?

How Big is the Plant and What’s Going on There?

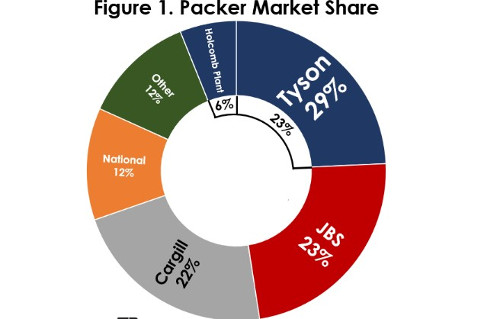

According to CattleFax, the Holcomb facility had a daily capacity of approximately 6,000 head, and accounted for about 6% of U.S. slaughter capacity, a not insignificant share for a single plant. Prior to the fire, Tyson held the nation’s largest market share of beef processing capacity at 29%, followed by JBS, Cargill and National at 23%, 22% and 12%, respectively. While the plant is out of commission, Tyson’s share could have dropped to 23%, however, due to reshuffling fed cattle to other facilities, Tyson will be able to keep the fire’s impact to its overall volume somewhat muted.

Nobody was hurt or injured during the fire, and first responders succeeded in putting it out before it spread to the rest of the plant. The majority of the damage was on the electrical system of the plant which is, as one would imagine, an extremely complex item to fix. Tyson still has not released an official timeline for plant repairs or set expectations for when it will be back on line. In the weeks following the fire, Tyson said the plant will be closed indefinitely until repairs can be made. However, in a recent investor call, representatives from Tyson said that it anticipates the plant to be fully back on line “in the course of the next couple of months,” and that they “expect the issue to be behind us and resume business as usual” by the new year. In the meantime, the company will continue to pay its hourly workers a full workweek wage.

What Would Economic Theory Tell Us Would Happen?

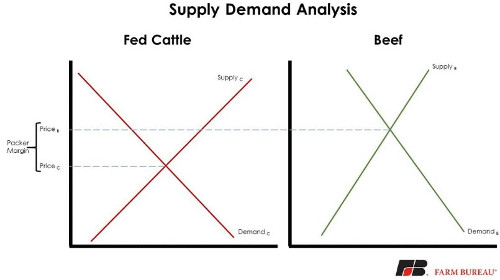

Immediately after the plant fire, we saw significant price movements in both the beef cutout, the product being produced by the packing plant, and in fed and feeder cattle, immediate and eventual inputs into the plant. The question is: is this what one would expect to happen under normal economic circumstances. The following graphic walks through a (very simplified) supply and demand response to the event, as well as the expected price response.

First, we should examine the situation before the fire, which is where the animation starts. On the right graph, we have a downward sloping demand curve (DemandB), which represents restaurant and grocery store demand for wholesale beef. On the same graph we have the upward sloping supply curve (SupplyB), which represents the beef that packers process and supply to the market. Where these two curves intersect results in the market equilibrium price of beef, denoted by PriceB. On the left side of the graph we have a similar set up for fed cattle, the major input for packers. Because packers require fed cattle to process into beef to supply their customers, we can develop a derived demand curve for fed cattle (DemandC). Feedlots and other cattle producers supply cattle to the market, resulting in the supply curve (SupplyC). Similar to the beef market, where these two curves intersect results in the market equilibrium price for fed cattle, PriceC. The difference between the price of beef and the price of cattle can be considered a (simplified) representation of the packer’s margin (not including processing costs, fixed costs, overhead, etc.).

The fire at the Holcomb facility was an exogenous shock to both the wholesale beef market and the fed cattle (and later down the supply chain, feeder cattle) market. In the beef market, this means the packing industry can supply less beef (assuming they were operating at capacity) to its customers, which is shown by shifting the supply curve inward and to the left (SupplyB-1). This shift results in a new higher equilibrium price (PriceB-1), as the supply has reduced while demand for beef has stayed the same (ceteris paribus). At the same time, since the packing industry has potentially lost 6% of its capacity, the industry is going to demand less of its input, fed cattle. This results in a leftward shift of the demand curve for cattle (DemandC-1), which in turn leads to a decrease in the equilibrium price for cattle (PriceC-1). With price for the input declining, and price for the output increasing, the remaining facilities that process cattle into beef would expect to see their gross margin increase, at least in the short run. Now that we have had some time to gather and process data, we can examine if what happened in the real world parallels economic theory.

Price Impact for beef

In the weeks following the fire, boxed beef values skyrocketed, moving from $216.04/cwt the week of the fire to $230.43/cwt the week after the fire and to $239.87/cwt the week after that. That’s a $23.83 jump in the two weeks after the fire. Downward pressure kicked in the third week after the fire and the cutout fell slightly to $234.35/cwt.

This pullback in prices has been mostly reflected across the primal values, but to differing degrees, as shown in Figure 2. Middle meats spiked immediately following the fire, and have since largely receded in value, with the rib dropping back down to pre-fire levels and the loin dropping to a 4% increase from its high of a 13% increase. End meats have managed to mostly sustain their higher levels since the fire, with the chuck and round remaining at or near a 10% increase from pre-fire levels. This is exactly the kind of market reaction one would have expected (at least directionally) from our basic analysis.

Price impact for cattle

While the price of the beef cutout moved significantly upward, the fed and feeder cattle markets went in the opposite direction. Figure 3 examines the immediate impact the fire had on futures markets for the nearby daily feeder cattle futures contract and the nearby daily live cattle futures contract. It shows all prices as a percentage of the prices the day of the fire. For the month leading up to the fire, both feeder and fed cattle futures were largely holding steady at or slightly above the value the day of the fire. Immediately following the fire, both futures markets exhibited significant bearish activity. Though both markets recovered a bit in the days following the fire, those gains have since been muted. This market has experienced significant volatility following the fire. However, the initial downward movement of prices is what we would have expected based on our simple modeling above.

Click here to see more...