As we kick off Quarter 4 of 2022, the end of the year is truly right around the corner. When we wrapped up 2021, Iowa had such a high quantity of auctions, along with historically high prices, that 2022’s uncertainty for land values seemed higher than usual: Would the inventory run dry? Did those that wanted to buy land already purchase farms in 2021? Or would investors continue to diversify, local farmers have strong enough balance sheets to continue to participate in local sales, and farms continue to change hands? With the first three quarters of 2022, we see that auction activity has stayed consistent – we’re still seeing many farms come to the auction block, and prices are generally staying strong.

Historical Auction Data

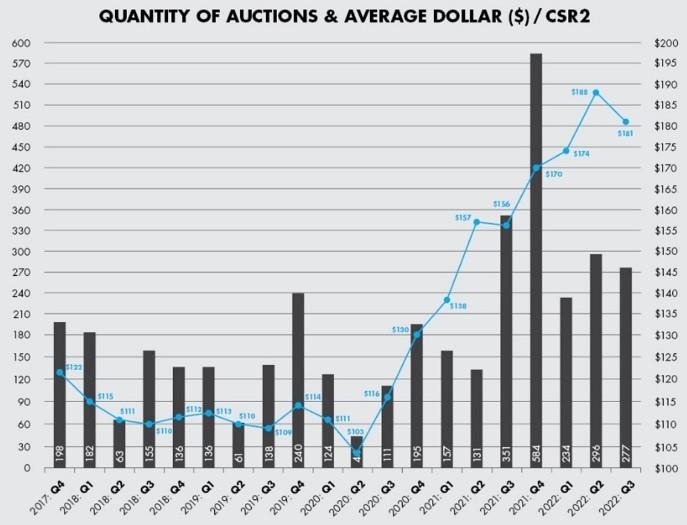

Over the past few quarters, we’ve seen that auctions are still going strong: Iowa saw an increase in average $/CSR2 from $170 in Q4 2021 to $174 in Q1 2022 (+2%) to $188 in Q2 2022 (+8%). The quantity of auctions has also increased: Over the past five years, Q1 and Q2 typically see between 120-180 tracts sell per quarter. In 2022, Q1 saw 234 tracts, and Q2 saw 296. In Q3 2022 we tracked 277 auction tracts that sold for an average dollar per CSR2 point of $181. That’s a 6% decrease in auction volume and 4% decrease in average value since last quarter.

Though we’ve seen a decrease in $/CSR2 in Quarter 3 as compared to Quarter 2, and a decrease in auction activity as compared to the previous few quarters, we’re still seeing higher prices than we were a year ago, and more auctions sold over the past few quarters than we’ve seen the past few years.

The Appraisal Department at Peoples Company provided the data for the chart below. They track sales for farms greater than 35 acres, with a highest and best use of agriculture, and at least 85% tillable ground (and no other contributory value such as commercial influence or buildings) sold at auction. The chart shows the change in $/CSR2 as well as auction volume for the past five years:

$/CSR2 Disparity

With all this data in mind, it’s important to remember that these prices are overall averages, and not an indicator of value for every farm. These figures (average $/acre, average $/CSR2) track trends across the market, but each pocket of the state is different, and each farm is individual. For instance, Iowa had several sales that sold for an average $/CSR2 under $110. The disparity in sale prices can be for several reasons: differences in farming ease and productivity, amount of advertising of the sale, interest/local competition in the market area, proximity to a grain facility, and how the overall auction is conducted can all be factors that can contribute to the way the farm sells on auction day. We have also seen an increase in no-sale activity over the past few months. This happens when the seller had a reserve price higher than what the market is willing to pay that day.

Wrapping up 2022 Agricultural Auctions

As we enter the last quarter of the year, those questions that brought us into 2022 still linger: Will the market run dry? Will increasing interest rates lower demand for ag land? Will rising input costs affect the farmer’s ability to purchase their neighboring farm? Those of us in the agricultural community have felt like we’ve been walking on eggshells these past few quarters, holding our breath while we wait for the drop. Though we can track the trends, these are all questions that we can only speculate over, and truly only time will tell.

About the American Society of Farm Managers and Rural Appraisers

Members of the Iowa Chapter of the American Society of Farm Managers and Rural Appraisers (ASFMRA) work with close to 2 million acres across Iowa. Its Farm Manager members are experts in helping landowners to achieve their objectives, while its Appraiser members are equipped with the tools necessary to tackle a wide spectrum of real estate valuation assignments. To locate a professional farm manager or appraiser in your area, visit ASFMRA.org.

Source : ASFMRA