Implications

According to USDA Production and Supply data the United States is the largest producer and the second largest exporter of broiler meat in the world. U.S. poultry exports may go to a lot more places than some other U.S. commodities, but the two customers next door, Mexico and Canada are the top two markets, accounting for nearly 1.5 of every 4 pounds exported.

The Story

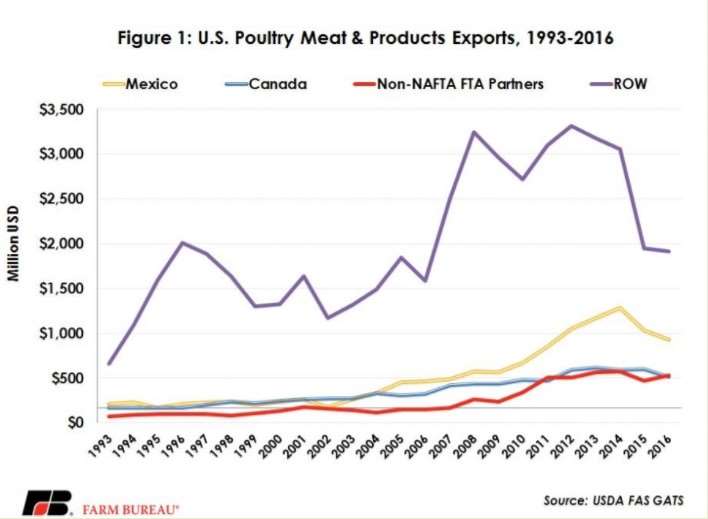

Mexico and Canada have long been important markets for U.S. poultry. In 1993, the year before NAFTA went into effect, 34 percent of the United States’ $1.1 billion in foreign poultry sales went to Mexico and Canada. By 2016, total U.S. poultry exports topped $3.8 billion, of which 37 percent were shipped to our NAFTA partners.

Mexico

Today with exports of $925 million, Mexico is far and away the top export destination for U.S. poultry, as was true in 1993. Russia slipped up to number one for several years in the mid-1990s through 2009. Trade barriers enacted by Russia over the last several years however have all but removed U.S. exports to Russia, returning the ever consistent customer, Mexico, to the top position. Sales to our southern neighbor have increased by more than 350 percent by value and by nearly 400 percent by volume since NAFTA were enacted.

Mexico itself has not been standing still. Their poultry industry has continued to thrive. In fact, production has grown by 148 percent since 1993.

Canada

Canada maintains a supply management system - more on that shortly - which limits the full potential of U.S. poultry exports, Canada is the United States second largest market for poultry meat. U.S. poultry meat sales by value and volume have grown by more than 200 percent and 180 percent, respectively, since NAFTA was signed.

Canada operates a supply management system in the broiler sector. Unlike in the United States, the industry is not vertically integrated. Canada has a multitude of independent chicken farmers, often operating family businesses, supplying live birds to processing companies. Where our integrators take on the role of deciding how much to produce, the government effectively tells producers up north how many birds they may or may not grow. Production is tightly controlled through a quota system. In order to maintain control of total poultry availability, imports of chicken meat are regulated under a tariff rate quota (TRQ) which is a function of the previous year's production level. Additional imports outside of the TRQ may be imported under re-export programs.

TRQ import access volumes into the Canadian market are equal to 7.5 percent of the previous year's domestic chicken production as reported by Statistics Canada. This access level is provided under NAFTA and is higher than Canada’s World Trade Organization commitment of 39,844 metric tons. USDA’s Foreign Agricultural Service forecasted the global permit allowance for 2017 to be 87,000 MT, based upon the estimated 2016 production. For 2016, the global chicken TRQ was 83,400 MT, based on the 2015 production level. The U.S. market share over the last decade has consistently been 85-90 percent.

FAS reports Canadian poultry companies have been increasingly utilizing various government-administered imports for re-export programs. Through these programs, Canadian chicken processors import chicken meat duty-free for use in processing, provided they re-export the associated processed products. Since 2007, imports for re-export have exceeded the TRQ volume, and therefore total chicken imports are more than double the TRQ volume.

Click here to see more...