By Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

By Nick Paulson and Jonathan Coppess et.al

Department of Agricultural and Consumer Economics

University of Illinois

The return of low prices and the impacts of trade conflict and the coronavirus pandemic have driven increased interest in land retirement or set aside policies and prompted this series, beginning with a historical review of such policy in the US (Coppess, Schnitkey, Paulson, Swanson, and Zulauf, June 26, 2020). This article is Part II of the series. Its central thesis is that a declining US role in world crop markets, combined with a shift to production outside the northern hemisphere, calls into question whether US land retirement programs can raise US prices even within a single crop year unless they are large and thus costly. They are also likely to lead to a loss in US market share.

Background

Economic reasoning and empirical studies consistently find land retirement programs to be less than 100% effective. Reducing plantings by 1 acre thus reduces output by less than 1 acre. This effect, where the reduction in output is less than the reduction in planted acreage, is commonly referred to as slippage. Frequently cited reasons for slippage are:

- Farms remove their least productive land due to its lower potential yield and thus profit potential.

- Farms increase the use of other inputs, such as fertilizer, on land that is planted. Given reason 1, more inputs are thus applied to the more productive land. More inputs are used per planted acre because the farm’s budget constraint on inputs is less binding since inputs do not need to be purchased for the retired land and because fewer planted acres increase the potential for a smaller supply and thus higher prices.

- Other countries increase production of the diverted crop in expectation of higher prices.

The US has historically retired farmland for two reasons: (1) to reduce supply and (2) for conservation purposes. Different versions of these two programs have been tried. Slippage is found in all cases, although the magnitude varies by study. One of the more recent studies, Dvoskin, 1988), citing existing literature, concluded that yield of diverted acres is approximately 80% of average crop yield. In addition, using historical US program data, Dvoskin estimated that each retired US acre resulted in a 0.66 reduction in US harvested acres. .

This article focuses on slippage resulting from actions by farmers in the rest of the world. They are not bound by US acreage retirement programs. Deepening concern that the US was ceding export market share to other counties was a key reason the Agriculture Improvement and Reform Act of 1996 eliminated annual acreage reduction programs (Orden, Paarlberg, and Roe. 1999; Coppess, 2018). Land retirement to reduce supply has thus been out of vogue in the US for over 20 years. Changes in the US role in world corn, cotton, soybean, and wheat markets since the 1996 Farm Bill are examined in the next two sections.

Declining US Role in World Crop Markets

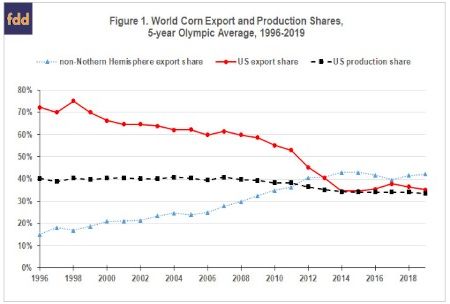

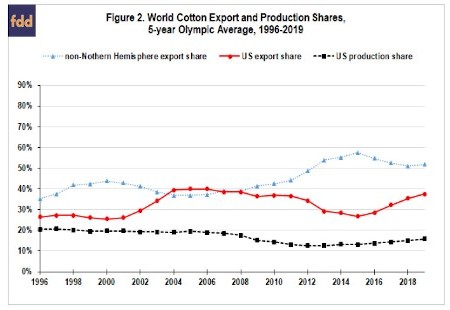

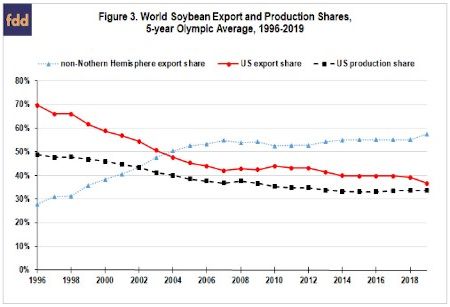

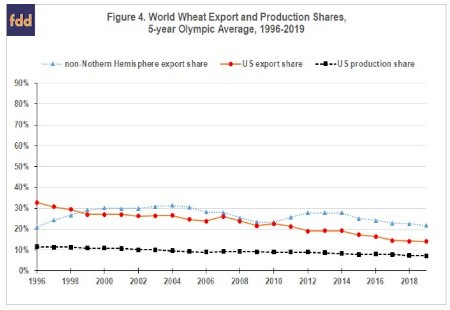

Using data from the US Department of Agriculture, Foreign Agricultural Service (USDA, FAS), US share of world corn, cotton, soybean, and wheat production has declined since the 1996 Farm Bill: from 40% in 1996 to 34% in 2019 for corn; 21% to 16% for cotton; 49% to 34% for soybeans, and 12% to 7% for wheat (see Figures 1-4). Although US share of world cotton exports increased from 26% to 38%, US share of world corn, soybean, and wheat exports declined by a startling amount: 72% to 35% for corn; 70% to 37% for soybeans, and 33% to 14% for wheat (see Figures 1-4). A 5 year Olympic average, which removes the high and low values, is used in Figures 1-4. .Averaging and removing high and low values dampen year-to-year variability resulting from shocks, such as weather, allowing a clearer picture of longer-term trends.

Rise in Exports from outside the Northern Hemisphere

Since the 1996 Farm Bill, share of world exports originating in non-northern hemisphere countries jumped from 15% to 42% for corn; 38% to 52% for cotton ; and 28% to 57% for soybeans (see Figures 1, 2, and 3 and data note 1). Only wheat’s share changed little: 21% to 22% (see Figure 4). In short, the world is much less dependent on northern hemisphere production and exports than 20 years ago.

Summary Observations

Declining world dependence on US production and exports and growth in off-US season production implies that retiring US land is likely to be less effective today than historically.

Rest of the world has a much greater capacity to respond to US land retirement programs today than during the mid-1990s, the last time the US retired land for the purpose of reducing production.

The jump in exports (and production) from outside the northern hemisphere means rest of the world can respond much more quickly to supply reductions in the US. The response is likely to occur within 6 months, or within the same US market year.

These three points suggest US retirement of corn, cotton, soybean, and wheat acres will likely lead to a quick loss in US share of world exports and production. Moreover, what may have been enacted as a temporary reduction in US output has the real potential to become a permanent reduction.

The three points also suggest only sizable US land retirement programs can increase prices in today’s market for corn, cotton, soybeans, and wheat. Thus, assuming normal weather and yields, Federal budgetary cost of land retirement programs that increase price are likely to be sizable and may even be more expensive than doing nothing.

Data Note

Areas of the world in the USDA, FAS data considered to be in the northern hemisphere are East Asia, European Union – 28, Former Soviet Union – 12, North America, and Other Europe.

Source : illinois.edu