By Alan Barrett

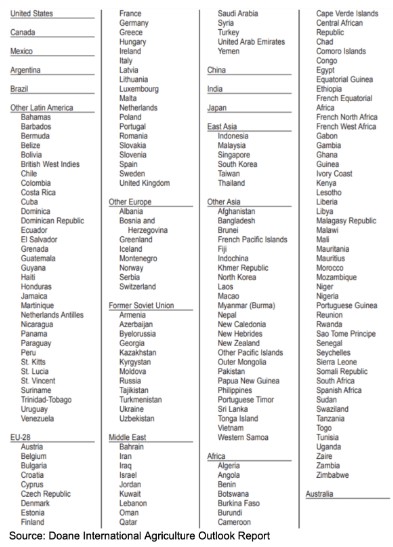

Doane’s economists recently updated the International Agriculture Outlook report, which includes ten-year forecasts of harvested area, yield, production, utilization, per capita consumption and net trade of coarse grains, corn, soybeans, wheat, cotton, and rice for 17 countries or major regions that encompass the world; the countries and regions are displayed in the table below. The report distills and conveys big-picture trends found in the global data on a semi-annual basis, and the following is focused on the world soybean market. The United States Department of Agriculture (USDA) Foreign Agricultural Service (FAS) provide the historical data.

In general, the international forecast is based on United Nations-sourced estimates of past yearly global censuses of population combined with long-term trends for per capita consumption to estimate world demand growth. Demand must be achieved by production from a combination of harvested area and yields with long-term trade netting the differences between demand and production. (A positive value for Net Trade in the tables represents a surplus of exports to imports. A negative value for Net Trade represents imports exceeding exports.)

Over the long term, world production comes into line with world consumption and world net imports approximate world net exports. In addition, the supply side (production plus net imports) of any country or region eventually comes into balance with the demand side (consumption + net exports). The projections are designed to provide a plausible scenario for the sectors covered, but not the actual outcomes in any particular year. China is handled differently because Chinese government officials are balancing domestic farmer needs, very large ending stocks, meeting tariff rate quotas (TRQ), and other political concerns. The baseline assumption is China’s rising consumption levels will allow it to simultaneously increase imports while reducing ending stocks or returning to a more normal stocks level.

Resting in the background of the analysis are the past estimates of global population growth, both for individual countries and accumulating to the global situation. The following chart clearly depicts that global population increases in a monotonous steady upward slope. As a starting point, world population is projected up 9% over the next decade, which will drive consumption increases.

The Asian Growth Center of China, India, Other Asia, and East Asia is experiencing great growth in food consumption, but has limited acreage available for cultivation. The current situation presents two key challenges. The first is how to meet the increase in food consumption? The second is how to deliver the food to the people?

The Asian Growth Center accounts for 52% of the world population. The area consists of extreme poverty that is enjoying economic growth, which is very important for commodity consumption, but especially for food products. As income increases, a wealthy person responds by switching to high-end food products, eating at restaurants and maybe even hiring a chef. Although they are spending more money on eating, the volume of coarse grains, wheat, and protein meals consumed might not increase. By comparison, as income increases a poor person responds by adding ingredients to a basic diet. Eating tastier food often requires vegetable oil, meat, fruits, and vegetables. Meat production requires feed rations of grains and protein meals that are converted into weight gain. For example, if 1.6 pounds of feed is required to add 1 pound of chicken, switching or just adding chicken to the dish results in an increase in per capita consumption of grains and protein meals.

As meat consumption increases, a natural evolution is from backyard operations to commercial operations to gain economies of scale. African Swine Fever (ASF) is accelerating the trend towards commercial pork production, which will increase use of commercial feed rations. Commercial operations are more efficient at converting feed rations into meat due to feed rations that are more scientific and precise. The feed ration requires exact nutritional requirements that come from grains and vegetable meal versus table scraps. Long-term, ASF should be positive for grain and vegetable meal consumption. World-class operations feeding precise diets will increase consumption of grains and vegetable meals. Also, the increase in commercial chicken production is forecast to continue to increase. The switch from backyard to commercial meat production is very beneficial to grain and vegetable meal consumption.

Meeting the Asian Growth Center’s increase in food consumption requires a world effort. Yields have continued to increase as the quality of machinery, seeds, and irrigation improves. Yields are expected to continue to increase, but additional acreage will have to be added. The additional marginal land will have lower yields than the average, which will pull the average yield gain down.

Total crop acreage in Asia, Australia, and Europe is expected to replace some hay and fallow land. South America and Africa have the most land available to enter crop production, but South America is best suited to add the quantity of land required to meet expanding world food consumption.

With food consumption growing faster than production in the Asian Growth Center, the area will continue to be grain and soybean deficit. As consumption increases over time, trade also increases. From 2009 to 2018, Asian Growth Center imports of soybeans increased 72% and over the next ten years, imports of soybeans are forecast to increase 48%.

A tremendous amount of infrastructure investment has occurred in the Asian Growth Center and Brazil. Examples of supply chain investment are new ports, deeper ports that can handle larger vessels, railroad tracks that service the ports, more sophisticate grain storage systems, and commercial animal operations.

One area of the supply chain that is often ignored occurs from marketplace to home. The expansion of commercial animal operations increases the amount of product flowing from one location, which requires more cold storage capacity and the development of the transportation cool chain. The cool chain requires dependable sources of power. In developed countries, the cool chain is fully developed and taken for granted. Marketplaces in developing and poor countries have wet markets. A wet market is when meat taken to a venue frozen and the meat thaws over the course of the day. All over Asia, marketplaces are converting from a wet market to a refrigerated store. Homeowners are investing in refrigeration, which allows them to buy more meat and produce on each trip to the market.

Click here to see more...