By Cory Walters

Managing uncertain yields and prices before planting is a primary concern to producers, especially when financial ruin is at stake. To manage uncertainty, producers are presented with a complex set of financial tools from both public sources (crop insurance and Farm Bill) and private sources (commodity futures markets). Over time, these tools and their relation have evolved. Prior to the mid-1990s, before crop insurance expanded, producers relied primarily on privately operated commodity futures markets and publicly funded government programs, such as the disaster assistance program and the loan deficiency program, to reduce income uncertainty. Since this time the U.S. government has dramatically enhanced the Federal Crop Insurance Program, making it the primary publicly funded government program available to producers.

The producer’s decision environment is further complicated by crop insurance covering not only yield uncertainty but also price uncertainty. Of all available insurance contract choices, revenue protection (RP), which adds price protection to the yield component, creates a direct link to futures markets.

The goal of pre-harvest price hedging (hereafter referred to as hedging) is to reduce exposure to price uncertainty. However, the resulting impact on net income uncertainty is not clear because the pre-sold crop is yet to be produced. Therefore, net income uncertainty from crop shortfalls could increase because selling more crop than is actually produced would require the producer to buy back pre-sold futures positions (McKinnon 1967). Production uncertainty and the strength of the farm yield-price correlation are two primary factors influencing the probability of buying back pre-sold futures price hedges, possibly at prices higher than were offered in the spring (McKinnon 1967). This negative relation between yields and prices is often referred to as the natural hedge and is relevant in decision making under uncertainty (Finger, 2012). If prices of pre-sold futures positions are higher than currently offered prices, then buying those positions back would be financially painful. Having the right crop insurance policy in place can substantially reduce this financial pain because crop insurance would pay when yield (or price for a revenue based policy) drops below a predetermined level. Consequently, crop insurance and hedging appear to complement each other. Crop insurance and hedging may also be substitutes. For example, producers may purchase an RP product with a higher coverage level and consequently reduce the level of pre-harvest hedging.

Investigating the relation between crop insurance, Farm Bill and hedging and their combined effect on farm net income risk provides challenges. The producer’s yield distribution, futures price distribution, and dependence between yield and price must be determined. Farm Bill payments depend upon a complicated set of conditions: program election (Agricultural Risk Coverage, County (ARC-Co) and Individual (ARC-Ic), Price Loss Coverage (PLC) and/or Supplemental Coverage Option (SCO)), the overall size of operation, percent base acres relative to planted, percent base acres per crop, percent bases acre per farm, crop insurance coverage level, PLC yield per farm and unknown random variables that change each year such as farm’s (and county) actual yield, the spring and fall price guarantee for his underlying crop insurance policy, the Marketing Year Average (MYA) price and inputs determining Farm Bill option expected revenues. We focus on net income, rather than revenue, because production costs vary with yields. The primary issue facing the modeler is how to represent the producer’s underlying joint distribution between yields and prices and MYA price, which comprehensively combines this information. Farm location influences the yield distribution, price distribution, and shape of the yield-price joint distribution, making it difficult to identify the efficient set of crop insurance contracts Farm Bill, and hedging levels. Additionally, wide-ranging opinions about what producers should do become irrelevant if producer yield uncertainty, price uncertainty, production costs, Farm Bill components (i.e., base acres), and yield-price joint distribution are ignored or misunderstood.

Producer Risk

Modern Portfolio Theory (MPT) uses information from the joint probability distribution function to rank each portfolio (Markowitz, 1952). MPT explores tradeoffs between mean and variance. We extend the concepts of MPT to explore trade-offs between the short-term objective of positive expected net income and the long-term objective of avoiding farm ruin (what we define as risk). Our objective of avoiding farm ruin focuses only on downside uncertainty, or the left-hand tail of the net income distribution, where bad net income outcomes with low probabilities occur.

Price and Yield Distributions

We investigate price uncertainty through the use of commodity market option prices within the framework of the Black-Scholes-Merton model of futures market behavior. This approach incorporates what the commodity market views as price uncertainty. One reason commodity markets exist is to provide the best information to help make spring predictions about fall prices. We use producer-level historical yields to capture farm yield uncertainty.

An Example

We motivate the risk management decision between Farm Bill, crop insurance, and hedging by analyzing data from a producer with a long yield history and production cost history for corn.

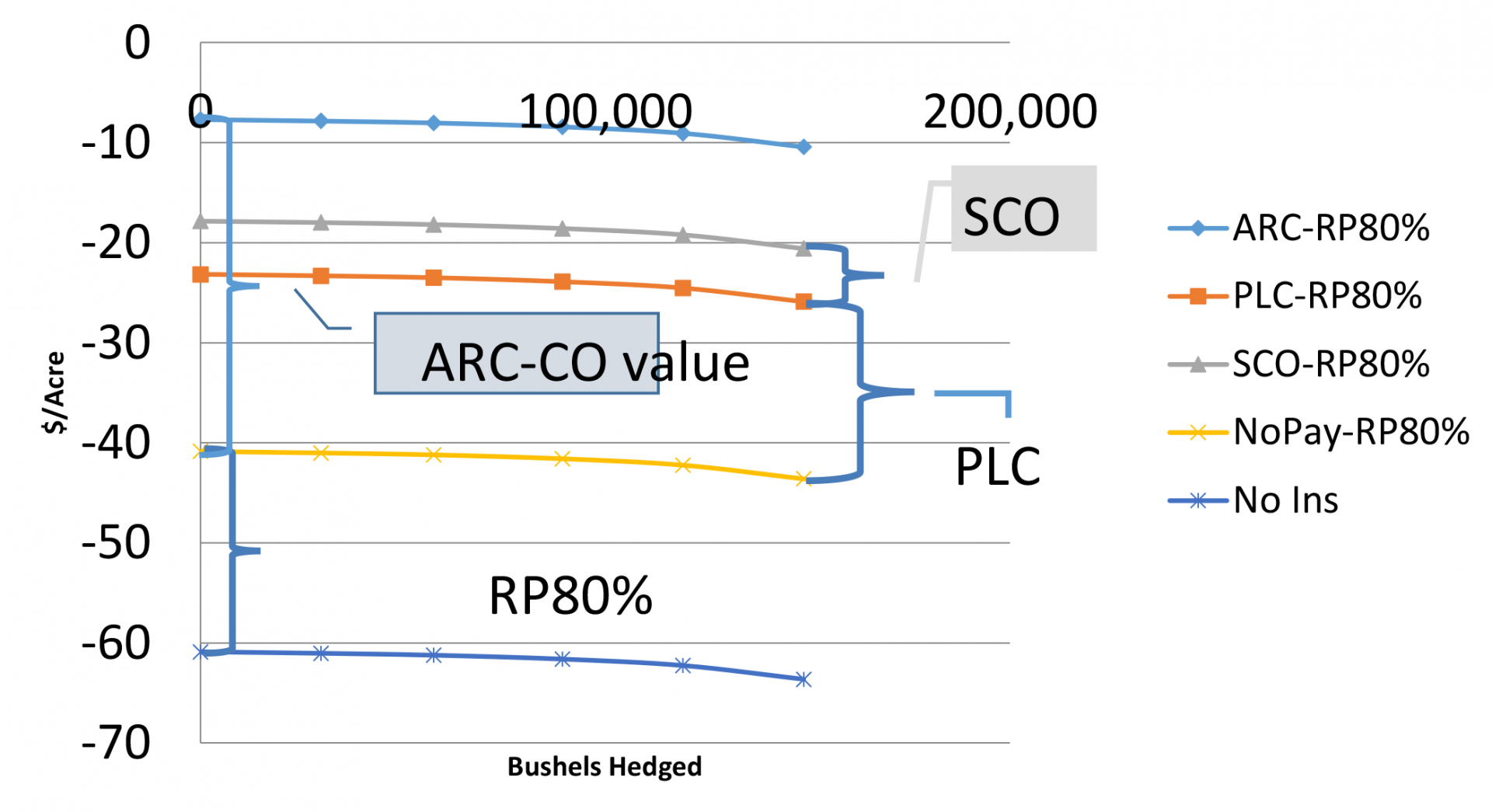

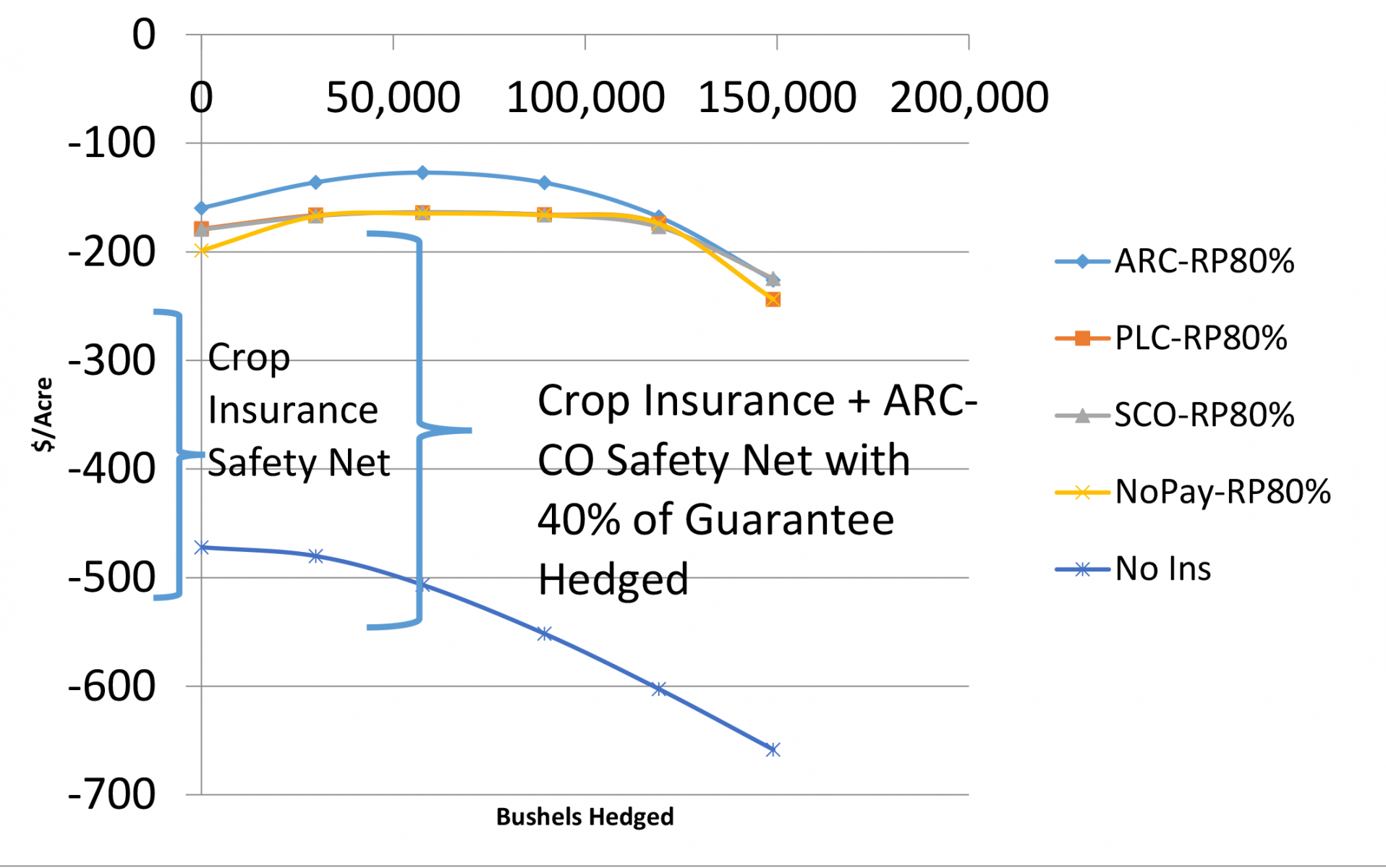

Results indicate that expected income is the highest when selecting an RP crop insurance policy and ARC-CO, and zero hedging (Figure 1). The next highest expected income occurs when selecting RP with PLC and SCO. In the presence of a subsidy, it is not surprising that government-provided risk management tools increase expected income. ARC-CO and PLC premiums are subsidized at 100% where SCO is subsidized at 65%. With a zero premium, the producer will always participate because they can never be worse off. Risk management results indicate farm ruin is minimized with RP-80% crop insurance policy, ARC-CO and 40% of expected production hedged (Figure 2). Results indicate that crop insurance is the foundation of the risk management platform. ARC-CO, PLC, and SCO provide additional risk management protection, but this protection is small (due to payment limits) in comparison to crop insurance. Crop insurance plus ARC-CO appear to complement hedging because Farm Ruin (1% Risk) declines as hedging increases. Farm Bill options appear to complement currently offered risk management choices, a result indicating the Farm Bill may be an efficient tool to reduce producer risk.

We examined how Farm Bill choices interact with other risk management programs, namely crop insurance and hedging, a privately provided tool through a portfolio approach. Our main contribution is that our model accounts for farm yield, county yield, and farm price correlation while connecting the fall futures market price to MYA price. The fall futures market price to MYA price connection allows us to evaluate Farm Bill choices while facing crop insurance and hedging choices. Our approach of incorporating uncertainty into the risk management decision-making process improves risk management decision making when the producer faces multiple programs each containing multiple choices.

Source:unl.edu