By Gray Schnitkey and Nick Paulson et.al

Department of Agricultural and Consumer Economics

University of Illinois

Carl Zulauf

Department of Agricultural, Environmental and Development Economics

Ohio State University

We show payments for soybeans from Price Loss Coverage (PLC) and Agriculture Risk Coverage at the county level (ARC-CO) to aid in the deliberations over the next farm bill. Unlike all other major program crops, PLC did not trigger any payments for soybeans from 2014 to 2022, primarily because soybeans has a low statutory reference price relative to other crops. Raising soybeans’ statutory reference price of $8.40 to levels comparable to other crops will be difficult. More beneficial improvements likely come from changes to ARC-CO or the effective reference price mechanism. Eliminating the requirement to select PLC for acreage to be eligible for the Supplemental Coverage Option (SCO) insurance program also is warranted.

Background and Program Use

PLC and ARC-CO are two choices for receiving commodity title payments. The other alternative is ARC at the individual farm level (ARC-IC). Details of those three programs are provided in three farmdoc daily articles: ARC-CO (farmdoc daily, September 17, 2019), PLC (farmdoc daily, September 24, 2019), and ARC-IC (farmdoc daily, October 29, 2019).

Under the 2018 Farm Bill, farmers made commodity title choices for:

- The 2019 and 2020 crop years by March 15, 2020,

- The 2021 crop year by March 15, 2021,

- The 2022 crop year by March 15, 2022, and

- The 2023 crop year by March 15, 2023.

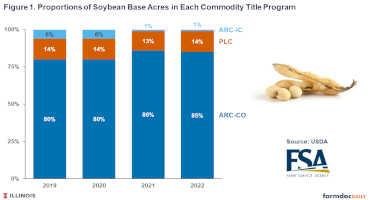

ARC-IC use of 6% was relatively high in 2019 and 2020 because of the prevalence of prevented planting associated with widespread flooding during the 2019 spring planting season (see Figure 1). Farms completely prevented from planting could receive large ARC-IC payments for the 2019 crop year, information which was known during the signup period (for more detailed discussion, see farmdoc daily, February 4, 2020, and April 18, 2023). ARC-IC returned to its more typical 1% enrollment level in 2021 and 2022.

ARC-CO accounts for 86% and 85% of soybean base acre enrollment in 2021 and 2022. These high percentages can be attributed to the fact that PLC made no payments on soybeans since its inception in 2014, and expectations for the marketing year average price to remain well above the reference price at the time of enrollment for both the 2021 and 2022 crop years.

PLC Payments for Soybeans

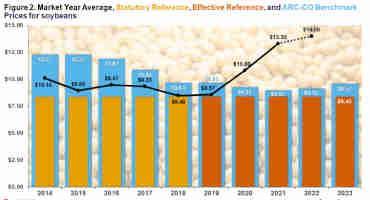

PLC was instituted in the 2014 Farm Bill, and triggers payments when the market year average (MYA) price is below the statutory reference price. For soybeans, the statutory reference price remains at $8.40 per bushel.

The 2018 Farm Bill added the effective reference price (see farmdoc daily, June 29, 2022). The effective reference price is the maximum of the statutory reference price ($8.40 per bushel for soybeans) and 85% of the five-year Olympic average of MYA prices, lagged one year. The effective reference price is capped at 115% of the statutory reference price or $9.66 for soybeans (8.40 x 1.15 = 9.66). Under the 2018 Farm Bill, PLC provides payments when the market year average (MYA) price is below the effective reference price, which can be above the statutory reference price. However, soybeans’ effective reference price did not increase above the statutory reference price during the life of the 2018 Farm Bill (2019 to 2023). As a result, the MYA had to be below the $8.40 statutory reference price for PLC to pay since its inception in 2014 through 2023.

From 2014 to 2023, the MYA price for soybeans has never been below $8.40 (see Figure 2). The lowest MYA prices of $8.48 in 2018 and $8.57 in 2019 occurred during the trade war with China. The lack of historical payment support, even during a trade war which significantly impacted soybeans, suggests that PLC has been relatively ineffective at providing price risk management for soybeans.

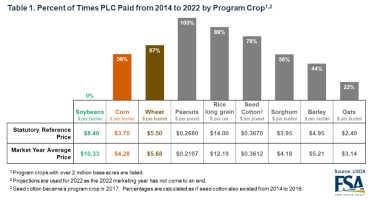

We calculated the number of times PLC triggered payments for the nine program crops with at least 2 million base acres. Percentages were calculated from PLC’s inception in 2014 to 2022. MYA price estimates for 2022 are used as the marketing year is not over. Except for soybeans, payments occurred on average in 64% of the years across all crops (see Table 1). Oats had the lowest percentage of 22% (2 out of nine years). Corn triggered in 56% of the years. Wheat triggered in 67% of the years. The three southern crops — peanuts, long-grain rice, and seed cotton— paid in the most years: peanuts at 100% of the time, long-grain rice at 89% of the time, and seed cotton at 78% of the time.

We calculated the reference price needed for soybeans to match the same payment percentage for each of these program crops:

- Oats: For soybeans to have payments in 22% of the years like oats, the soybean statutory reference price would have to be above $8.57, the MYA price in 2019. Very low payments would be triggered if prices were just above $8.57. An $8.57 reference price is 6% higher than the current $8.40 statutory reference price. Given this reference price, PLC would have paid in 2018 and 2019, the height of the trade war.

- Corn: To trigger in 56% of the years, soybeans’ statutory reference price would have to be above $9.40, 16% higher than the current statutory reference price.

- Wheat: To trigger in 67% of the years, soybeans’ statutory reference price would have to be above $10.10, 20% higher than the current statutory reference price.

- Seed Cotton: To trigger in 78% of the years, soybeans’ statutory reference price would have to be above $10.80, a 36% increase over its current level.

- Long-Grain Rice: To trigger in 89% of the years, the statutory reference price would have to be above $13.00, a 50% increase over the current level.

- Peanuts: To trigger in 100% of the years, soybeans’ statutory reference price would have to be above $14.00, the current FSA projection for the 2022 MYA price. A $14 reference price would be 66% higher than the current reference price.

In summary, based on the existing history of the PLC program, significant increases in soybean’s reference price would likely need to occur before PLC performs similarly to other crops. To obtain a payment in 64% of the years, the average payment rate across all other crops, soybeans’ statutory reference price would have to be $10.10, 20% higher than the current level.

Given PLC’s performance, the 15% of soybean acres enrolled in PLC seems high. A hindrance to choosing ARC-CO is the requirement of being in PLC to purchase the Supplementary Coverage Option (SCO). SCO is a crop insurance product providing county coverage above farm-level coverage (see farmdoc daily, February 27, 2014).

ARC-CO Payments for Soybeans

ARC-CO is a revenue program that makes payments when county revenue is below 86% of benchmark revenue. Benchmark revenue equals benchmark price times benchmark yield, where both the benchmark yield and price are based on the five-previous values lagged one year (see farmdoc daily, September 17, 2019). From 2014 to 2019, MYA prices for soybeans were below the ARC-CO benchmark price (see Figure 1). ARC-CO payments are capped at 10% of benchmark revenue.

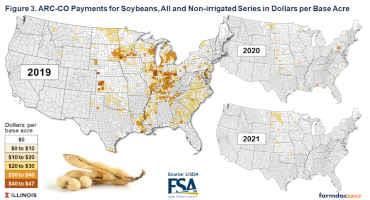

Figure 3 shows three maps reporting ARC-CO payments on a per base acre basis. Each county either has 1) one yield series for “All” of the crop or 2) two series for non-irrigated and irrigated yields. Figure 3 shows payments for the type “all” or “non-irrigated” series for each county with an ARC-CO benchmark.

2019: Wet weather impacted yields over much of the Midwest in 2019. Moreover, the $8.57 MYA price for 2019 was below the $9.63 benchmark price. As a result, ARC-CO payments occurred in many counties.

2020: In 2020, the MYA average price of $10.80 was above the 2020 ARC-CO benchmark price. A yield well below benchmark yields needed to occur before ARC-CO made payments. As shown in Figure 3, ARC-CO made payments in some counties nationwide.

2021: The 2021 MYA price was $13.30, well above the 2021 ARC-CO benchmark price of $8.95. Yields had to be well below benchmark yields before ARC-CO would make payments. As shown in Figure 3, ARC-CO made payments in the Great Plains, particularly in North and South Dakota. Drought in this area had a large negative impact on yields. Sporadic counties across the country also received payments.

Commentary

PLC has provided no payments for soybeans from 2014 through 2022. As a result, PLC has yet to be an effective risk management program for soybeans.

Arguments are being made to increase statutory reference prices. When compared to other crops, soybeans’ statutory reference price is low. To get to the average historical payment performance of the eight other large program crops, soybeans’ reference price would need to increase to $10.10, an increase of 20%. Raising soybeans’ reference price to this level would have large budgetary impacts for the next Farm Bill. Moreover, raising one crop’s reference price while keeping the other crops’ statutory references prices fixed could be politically problematic.

A proportional increase in all reference prices would be politically more feasible but likely not aid soybeans. For example, increasing all crop reference prices by 5% would benefit those crops already having a higher chance of receiving PLC payments at current reference price levels, exacerbating the budgetary impacts of such a change. However, a 5% increase would have little impact on soybeans, as the reference price would be only $8.82 per bushel.

The following modifications would provide more targeted benefits to soybean producers:

- Increasing the ARC-CO coverage level above 86% and/or the payment cap to over the current 10% of benchmark revenue.

- Improve the effective reference price mechanism by raising the factor on the Olympic moving average above 85% and/or increasing the limit on the payment factor above 115% of the statutory reference price.

Both modifications would result in benefits (larger or more likely program payments) when market prices move further above statutory reference price levels. This has been the situation for soybeans compared with other crops over the life of the ARC and PLC programs. These changes could also potentially benefit other crops if their market prices increase relative to their statutory reference prices in the future.

Another improvement would be eliminating the requirement to enroll in PLC to purchase SCO. Reasons for requiring PLC for the purchase of SCO are difficult to rationalize.

Source : illinois.edu