By James Mintert

The Purdue/CME Group Ag Economy Barometer dropped 7 points in November, signaling a slump in U.S. agricultural producers’ confidence compared to a month earlier. At a reading of 128, the measure of producer optimism in November was the second weakest observed during 2017 and stood just 4 points above the 2017 low of 124, set in March (Figure 1). Based on a monthly phone survey of 400 agricultural producers from across the U.S., the latest results, although indicating producers were less confident about the agricultural economy than in October, still suggest agricultural producers remain more optimistic than they were prior to the fall 2016 election.

Figure 1. Purdue/CME Group Ag Economy Barometer, October 2015–November 2017.

Less Optimism About the Future Among Producers

The November slide in producer sentiment was driven by producers taking a less optimistic view of the future. The Index of Future Expectations declined 10 points compared to October as the index fell to 127. The decline in optimism about future economic conditions stands in contrast to producers’ assessment of current economic conditions, however, as the Index of Current Conditions reading of 129 in November was unchanged from October. (Figure 2).

Figure 2. Index of Current Conditions and Index of Future Expectations, October 2015–November 2017.

To provide insight into what’s driving changes in the barometer and its two sub-indices, Figure 3 shows producers’ responses since October 2015 to a question focused on the U.S. agricultural economy, looking ahead 12 months. The percentage of producers expecting “bad times” for the agricultural economy in the year ahead climbed to 62 percent on the November survey. The percentage of producers expecting bad times for the agricultural economy has been increasing since July, when it hit a summertime low of 50 percent. At the same time, the percentage of producers expecting good times for the agricultural economy in the upcoming year dipped to 28 percent in November, down from 35 percent in October.

Figure 3. Share of producers expecting “good times” and “bad times” financially in the U.S. agricultural economy during the upcoming 12 months, October 2015 – November 2017.

Producers see Farmland Values Stabilizing

On a regular basis, producers are asked about their expectations for farmland values. In November, a record low percentage (17 percent) of respondents indicated they expect farmland prices in their area to decline over the next 12 months (Figure 4). The decline in producers expecting lower farmland prices was accompanied by a small uptick in the share of respondents (21 percent) expecting farmland values to turn higher in the year ahead. Notably, for the first time in survey history, more producers expect farmland values to increase in the upcoming year than decline. Not included in Figure 4 is the share of respondents expecting farmland values to be “about the same,” over the upcoming 12 months. In November, the share of producers expecting no change in farmland values reached a life of survey high of 62 percent, nine percentage points above the previous peak of 53 percent, set in February 2017. So, the biggest change in attitudes in recent months has been a shift away from producers expecting farmland values to decline to an expectation that values are likely to stabilize.

Figure 4. Shares of agricultural producers reporting higher vs. lower expectations for farmland values, 12 months ahead, November 2015-November 2017.

Since farmland is a long-run investment, producers were also asked to provide their expectations for farmland values over the next five years. In November, 46 percent of producers said they expect farmland values in their area to be higher, whereas only 9 percent expect lower farmland values five years from now. Interestingly, the percentage of respondents expecting higher farmland values in five years was more than double the percentage of producers expecting higher values in 12 months. Responses to this question imply that there remains strong underlying support for farmland values among producers, even though margins in crop agriculture have been very narrow for several years in a row.

More on Agricultural Producers’ Perspectives on Trade

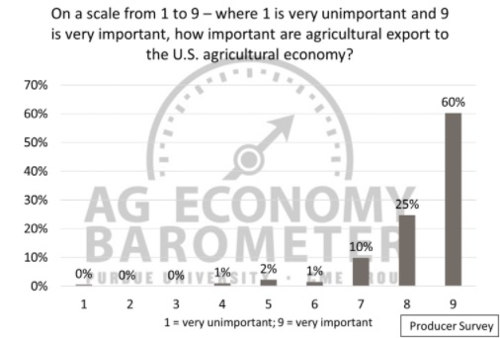

Throughout 2017 questions about agricultural trade have been posed to producers to gain insight into how proposed policy changes are affecting producer sentiment. On the November survey, producers were asked to rate the importance of agricultural exports to the U.S. agricultural economy (Figure 5) and, in a separate question, to rank the importance of the North American Free Trade Agreement (NAFTA) to the U.S. agricultural economy (Figure 6). When asked about agricultural exports specifically, 60 percent of producers said exports are “very important” (a rating of 9), and 96 percent said they were “important” (a rating of 6 or higher) to the ag economy. When probed specifically about NAFTA, producers were a bit less confident about the importance of the trade agreement to the U.S. ag economy. For example, 24 percent of producers rated NAFTA as “very important” (a rating of 9), and 70 percent rated it as “important” (rating of 6 or higher) (Figure 6). Perhaps the most glaring difference between producer perceptions about ag exports in an abstract sense and NAFTA, is the big difference in the percentage of respondents providing a neutral rating regarding NAFTA’s importance to the agricultural economy versus the percentage of producers providing a neutral response regarding export’s importance to the agricultural economy. Approximately 10 times as many producers provided a neutral rating (a rating of 5) to NAFTA’s importance to the agricultural economy as provided a neutral rating to the importance of exports to the agricultural economy.

Figure 5. Rating of the importance of agricultural exports to the U.S. agricultural economy (1= very unimportant, 9 = very important), November 2017.

Figure 6. Producers’ rating of the importance of NAFTA to the U.S. agricultural economy (1= very unimportant, 9 = very important), November 2017.

Concluding Comments

Agricultural producer sentiment turned lower in November, driven by a decline in optimism about future economic conditions in agriculture. Although the decline in sentiment pushed the Ag Economy Barometer reading to its second-lowest level of 2017, sentiment remains much more positive than it was prior to the fall 2016 election. Producer expectations regarding farmland values appear to have strengthened somewhat as more producers expect farmland values to increase than decline in the next 12 months, the first time this has happened since data collection began in October 2015. More broadly, however, the biggest shift in producer expectations regarding farmland values seems to be a movement away from an expectation of weaker values to an expectation that values are likely to remain unchanged over the next year. With respect to agricultural trade, producers continue to indicate that exports are very important to the U.S. agricultural economy. Producers also indicate that NAFTA is important to the agricultural economy, but producers are not as confident of NAFTA’s importance to agriculture as they are of exports in general.